Probate Lending

abstract. One of the most controversial trends in American civil justice is litigation lending: corporations paying plaintiffs a lump sum in return for a stake in a pending lawsuit. Although causes of action were once inalienable, many jurisdictions have abandoned this bright-line prohibition, opening the door for businesses to invest in other parties’ claims. Some courts, lawmakers, and scholars applaud litigation lenders for helping wronged individuals obtain relief, but others accuse them of exploiting low-income plaintiffs and increasing court congestion.

This Article reveals that a similar phenomenon has quietly emerged in the probate system. Recently, companies have started to make “probate loans”: advancing funds to heirs or beneficiaries to be repaid from their interest in a court-supervised estate. The Article sheds light on this shadowy practice by analyzing 594 probate administrations from a major California county. It finds that probate lending is a lucrative business. It also concludes that some of the strongest rationales for banning the sale of causes of action—concerns about abusive transactions and the corrosive effect of outsiders on the judicial processes—apply to transfers of inheritance rights. The Article thus suggests several ways to regulate this nascent industry.

author. David Horton is a Professor of Law, University of California, Davis, School of Law. Andrea Cann Chandrasekher is an Acting Professor of Law, University of California, Davis, of Law. The authors thank Chris Elmendorf, Adam J. Hirsch, Reid Kress Weisbord, participants at the East Bay junior faculty workshop and the Tulane faculty workshop series, and Alex Saslaw and the editors of the Yale Law Journal for helpful comments.

Introduction

On December 28,2007, Eva Bell died in Alameda County, California.1 She did not create a trust, which meant that her assets should have passed through the court-supervised probate system to her children and grandchildren.2 But shortly after the probate matter began, something happened that transformed the succession process. Eva’s son assigned $26,100 of his expected payout from the estate to a company, Advance Inheritance, in return for $15,000.3 In turn, by purchasing heirship rights, Advance Inheritance acquired standing as an “interested person” in Eva’s probate case.4 It capitalized on this privilege by successfully petitioning to become Eva’s personal representative (the party responsible for managing her possessions).5 It then evicted tenants from an apartment that Eva had owned, sold the building, and paid itself thousands of dollars in fees from the estate.6

Meanwhile, another firm, Inheritance Funding, entered into several contracts with Eva’s other relatives, buying a $57,200 cut of the estate for a total of $39,000.7 The final such deal—in which one of Eva’s children sold $7,600 in inheritance rights for $5,000—came just three weeks before the probate ended, and was the equivalent of a loan with an annualized interest rate of almost 1,000%.8

Firms like Advance Inheritance and Inheritance Funding lurk on the peripheries of one of the most divisive issues in American civil justice. For the last two decades, there has been a contentious debate over whether third parties should be allowed to purchase, invest in, or control legal claims.9 The ancient doctrine of champerty once barred strangers from obtaining an interest in pending cases.10 Likewise, although most rights are assignable—transferrable to others—medieval English judges refused to enforce assignments of complaints.11 Nevertheless, these rules have eroded over the centuries, blurring the line between causes of action and other forms of property, which can be freely divided, alienated, and pledged as collateral.12 Recently, venerable enterprises such as Credit Suisse and Allianz have poured money into other parties’ lawsuits, and sophisticated litigation-investment boutiques have emerged.13 These companies typically pay the lawyers’ fees “on an interim basis” in exchange for a share of any future verdict or settlement.14 In dozens of articles in newspapers and law journals, this business model has been praised for opening the courthouse doors to low-income plaintiffs15 and condemned as a predatory lending practice16 that subsidizes vexatious litigation.17

Yet despite the attention lavished on the litigation-finance industry, inheritance-purchasing companies have flown beneath the radar. No law review article has even mentioned the issue,18 and only one state statute expressly regulates the practice.19 To be sure, there are meaningful differences between assigning a pending civil claim and transferring inheritance rights. The former invites strangers into bare-knuckled adversarial proceedings, whereas the latter merely opens the door to the bureaucratic and normally non-contentious world of probate.20 But as Eva Bell’s estate illustrates, both transactions raise concerns about consumer exploitation and the disruptive effect of outsiders on the judicial process. And, in any event, the chasm in our knowledge about probate lending is glaring. Because the death of the baby boom generation will funnel $59 trillion through the succession process in the next half-century—the largest wealth transfer in history21—probate lenders will only become more entrenched and powerful.

This Article brings the probate lending industry into sharp relief. It does so by analyzing every estate administration stemming from deaths that occurred during a year in a major California county. This originally collected dataset, which spans 594 cases, capitalizes on a state law that requires probate lenders to lodge their contracts with the court.22 Thus, it offers insight into a variety of issues that would normally be private, such as the frequency of loans, their terms, their effective interest rates, and whether estates with loans are more likely to degenerate into litigation than their counterparts.

This trove of empirical evidence yields three main conclusions. First, probate loans are more common than one might expect. There are seventy-seven such deals in the files. Although probate lending may be more prevalent in California than elsewhere,23 there are millions of probate matters throughout the nation each year, which suggests that there is a robust market for inheritance rights.Second, these transactions raise serious fairness concerns. Companies handed out a meager $808,500 in exchange for $1,378,786 in decedents’ property.24 Because these advances occurred, on average, 373 days before the lenders were repaid, the mean markup on the principal was a whopping sixty-nine percent per year.25 Third, probate lenders are active litigants. They filed petitions or objections in nearly one-third of the matters in which they appeared. Thus, at least in this context, opening the courthouse door to third parties increases the volume of claims.

The Article then discusses the policy implications of these findings. It starts by considering whether probate loans are usurious. Usury statutes, the oldest form of consumer protection, prohibit creditors from charging excessive interest rates.26 Yet usury laws only govern advances that are “absolutely repayable.”27 Thus, most courts have exempted litigation loans from usury regulation, reasoning that firms will lose the money they have fronted if the plaintiff neither settles nor prevails at trial.28 We prove that probate loans involve no such contingency. Indeed, the probate lenders in our dataset recouped the principal ninety-six percent of the time. Even more remarkably, all the probate loans in our dataset that were repaid surpass California’s usury limit. Accordingly, these companies are violating the usury laws on a massive scale.

Next, the Article turns its attention to the Truth in Lending Act (TILA).29 TILA, a federal statute, imposes strict liability upon creditors who violate its intricate disclosure mandates.30 In the sole case involving probate loans, a federal court dismissed allegations that TILA applied to an assignment of inheritance rights, reasoning that the statute does not cover “non-recourse advance[s].”31 But our data reveal that probate loans are not truly non-recourse. Indeed, lenders recover both the principal and interest in all but the most extraordinary circumstances. On top of this, we show that their disclosures routinely flout TILA’s commands.

Finally, the Article analyzes whether probate loans violate the champerty doctrine. To be sure, unlike litigation loans, which often seek to facilitate claiming, probate loans are not usually made for the purpose of funding a lawsuit. Indeed, most estate administrations glide along without the heirs or beneficiaries filing a pleading or setting foot in court. Thus, at first blush, the presence of a third party among their ranks seems unlikely to affect the probate process. But when we excavate deeper, we find a surprisingly strong connection between loans and conflict. Our linear probability regression confirms that loans increase the odds of a contest far more than any other variable, including intestacies, holographic wills, and testators who disinherit family members. Nevertheless, we also uncover evidence that litigation filed by lenders may sometimes be in the best interests of the estate. We therefore recommend that courts and policymakers police probate loans through mechanisms other than the champerty doctrine.

The Article contains three Parts. Part I surveys the rules that govern the sale of rights that are rooted in the legal system. It shows that the expansion in the market for civil claims has spilled over into the realm of decedents’ estates. Part II explains how we gathered our data and offers an overview of the probate lending industry. Part III uses insights from our study to outline ways in which courts and lawmakers can regulate probate lenders.

i. borrowing against claims and estates

Plaintiffs with civil claims and individuals who expect to inherit from a probate estate possess property rights that depend on the outcome of a matter in court. Thus, it is not surprising that the rules that govern the transfer of these entitlements have developed in tandem. This Part describes this progression, focusing first on the divisive issue of litigation lending and then telling the neglected story of its probate counterpart.

A. Litigation Lending

Pending lawsuits were once inalienable: a plaintiff could neither borrow against her anticipated winnings nor sell the right to prosecute the complaint to a third party. Nevertheless, as this Section explains, these prohibitions have waned, spawning the litigation-lending industry and generating heated debate.

The common law frowned upon outsiders who injected themselves into cases. Maintenance, the act of “intermeddling in a [law]suit,” was both a crime and a tort.32 Medieval judges were particularly unkind to a species of maintenance known as champerty, which occurs when a third party provides financial support to a plaintiff in return for a share of her ultimate recovery.33 In addition, courts refused to enforce attempted assignments of “choses in action,” which are intangible property rights, such as pending claims.34

This hardline stance against the alienation of legal grievances reflected several concerns. First, claim sales had a checkered history. In Rome, where a market for lawsuits first developed, buyers repeatedly convinced plaintiffs to “part with their claims for sums far below their value.”35 Claim sales were so strongly associated with sharp practices that the word “champerty” derives from “champart,” an arrangement that allowed wealthy landowners to exploit tenants without violating the usury laws.36 Second, claim sales were thought to encourage litigation.37 During the Middle Ages, invoking the judicial system—even for righteous reasons—was seen as manifesting “a quarrelsome and un-Christian spirit.”38 Permitting strangers to invest in cases seemed to incentivize an activity that was only grudgingly tolerated.39 Third, society saw lawsuits as intrinsically personal and thus not capable of changing hands. As Max Radin puts it, the transfer of a complaint did violence to “the feeling always present in most communities that a controversy properly concerned only the persons actually involved in the original transaction.”40

Gradually, however, the champerty and non-assignability rules began to decay. In the seventeenth century, courts became more receptive to the transfer of choses in action.41 When sitting in equity, they began to enforce assignments of pending lawsuits for breach of contract and property damage, so long as the terms were fair.42 Conversely, they continued to ban the sale of grievances that were “personal”—tied to an individual plaintiff—such as torts that cause physical or mental harm.43

The philosophy or policy underlying this distinction was never clear. To be sure, unlike a broken promise or a smashed heirloom, a bodily injury is subjective, idiosyncratic, and harder to value.44 Nevertheless, even “personal” torts often lead to demonstrable economic damages, such as medical bills and lost wages.45 Likewise, courts sometimes opined that a third party, who had not experienced the allegations in the complaint firsthand, could not “urge them with any force.”46 But if this were true, it suggested that “personal” claims were a perilous investment, not that they should be inalienable. Finally, judges recoiled at the specter of “a profitable traffic in human pain and suffering.”47 Yet this fissure in the free market also had the undesirable consequence of roping off a potential path to relief for plaintiffs who could not afford to pursue the cases themselves.

Given this uncertainty about the normative underpinnings of the champerty and non-assignability rules, it is not surprising that several exceptions emerged over the course of the twentieth century. Courts and policymakers opened the door for contingent-fee lawyers to represent clients in return for a share of their winnings48 and for insurers to engage in subrogation (suing a tortfeasor to recover sums that the company had previously paid to an injured policyholder).49 Some states also began to allow plaintiffs to assign the proceeds of “personal” claims.50 As the North Carolina Supreme Court opined, selling the fruits of a lawsuit—rather than the lawsuit itself—was tolerable because it preserved the plaintiff’s stewardship of the case:

The assignment of a claim gives the assignee control of the claim and promotes champerty. Such a contract is against public policy and void. The assignment of the proceeds of a claim does not give the assignee control of the case and there is no reason it should not be valid.51

Then, near the dawn of the new millennium, skepticism about champerty reached a fever pitch. In 1997, the Massachusetts Supreme Court abolished the rule in Saladini v. Righellis.52 To finance a lawsuit, Righellis borrowed about $19,000 from Saladini in exchange for half of the recovery.53 Righellis settled the complaint for $130,000 but refused to pay Saladini.54 In the ensuing legal dispute, a judge raised the issue of champerty, leading Righellis to oppose payment on the grounds that the contract was champertous.55 The state justices agreed that the agreement was the very definition of champerty.56 Nevertheless, they declined to apply the doctrine, reasoning that ethical regulation of lawyers and case-specific contract defenses such as unconscionability did a better job of preventing “frivolous lawsuits[] or financial overreaching by a party of superior bargaining position.”57 Saladini sparked a rash of decisions that cited similar grounds to abolish champerty.58 However, it did not persuade everyone. Courts in Arizona, Minnesota, Ohio, and Pennsylvania rejected Saladini’s analysis, predicting that claim sales would lead to a spike in litigation and “pervert[] the remedial process of the law into an engine of oppression.”59

As the non-assignment and champerty principles receded, entrepreneurs saw an opportunity. They began to make litigation loans: immediate cash payments to injured plaintiffs in exchange for a percentage of any future judgment or settlement.60 Despite their name, these arrangements were not technically “loans,” because they did not always require the litigant to repay the company.61 If the plaintiff lost, she kept the advancement, and the firm took nothing.62 Because funders bore so much risk, they often insisted on taking an enormous slice of the plaintiff’s ultimate recovery.63 In addition, the non-recourse nature of these advancements helped shield them from regulation. Although the law is slightly ambiguous, state usury statutes and TILA64 arguably do not apply when repayment of a sum is contingent on future events.65 Thus, as the rise of the internet made it easier for plaintiffs to find lenders and major financial institutions began to test the waters, litigation finance blossomed into a billion-dollar industry.66 Today, many funders not only buy a stake in a pending case, but try to maximize the value of their investment by acquiring the power to select counsel and make strategic decisions.67

To put it mildly, these developments have been polarizing. Over the course of the last two decades, a chorus of voices has risen in opposition to litigation funding. These commentators accuse lenders of obscuring the terms of their agreements, including their skyscraping interest rates.68 In addition, they assert that claim sales encourage baseless lawsuits and exacerbate the burden on the judiciary.69 Conversely, many scholars support litigation funding. This group consists of an odd alliance of law-and-economics disciples, who are skeptical of limitations on the free market,70 and pro-plaintiff tort scholars, who are eager to arm injured parties with new ammunition.71 Members of this cohort see litigation loans as “merely one of a variety of subprime financial arrangements, such as home mortgages, payday loans, car-title loans and rent-to-own transactions, which can empower people without access to more traditional credit sources.”72 Moreover, they argue that abolishing the champerty and non-assignability rules helps poor plaintiffs obtain the cash they need to resist the siren song of low-ballttlement offers.73

These dueling views hinge on complex empirical questions about which we have little evidence. Only one study has attempted to gauge the effect of allowing third parties to acquire an interest in pending lawsuits.74 David Abrams and Daniel Chen examined information from Australia, which, like the United States, consists of a patchwork of states that disagree about whether to retain the champerty rule.75 Abrams and Chen collected data from each Australian jurisdiction’s courts as well as from a major litigation funder known as IMF.76 They used the volume of loans that IMF issued within a region as a proxy for the degree to which that region had relaxed the prohibition on champerty.77 They determined that courts in states where IMF did the most business experienced several negative consequences, including “slower case processing, larger backlogs, and increased spending.”78 Yet they also found no statistically significant relationship between IMF’s activity and filing rates.79 Thus, although their work is an important first step, it hardly provides definitive answers.

In addition, this fierce debate is incomplete in one respect: it has not addressed the related issue of assignments of inheritance rights. The next Section fills this void.

B. Probate Lending

Like civil plaintiffs with potential judgments, heirs and beneficiaries have also tried to trade their future inheritance rights for cash. When a decedent makes a will or dies intestate, any such assignment brings an outsider into the judicially-supervised probate system. Although the permissibility of this practice has long been unclear, third parties have become increasingly emboldened in their efforts to buy shares in an estate.

Traditionally, a person could not convey her interest in the estate of someone who was still alive. Courts cited the fact that the not-yet-deceased property owner was free to create a new will, or destroy or amend her existing will, and held that a naked expectancy was not even a form of property.80 Accordingly, they nullified purported transfers of anticipated legacies or bequests under the maxim qui non habet, ille non dat: “he who has not, gives not.”81 Likewise, judges also observed that sales of future inheritances were especially prone to abuse.82 Because these contracts featured a toxic cocktail of impetuous sellers and opportunistic buyers, they earned the nickname “catching bargains.”83 Finally, auctioning off shares in the estate to the highest bidder undermined a testator’s wish to provide for her loved ones.84 In the words of the Indiana Supreme Court, inheritance sales “operate[] as a fraud upon the ancestor, and divest[] h[er] bounty from the kin to a stranger.”85

Eventually, these rules fell into disarray. As noted above, by the twentieth century, most states permitted the assignment of non-“personal” civil complaints.86 This new rubric should have paved the way for sales of potential inheritances. Unlike claims for defamation or pain and suffering, which vindicate “wrongs done to the person, the reputation, or the feelings of the injured party,”87 the privilege of receiving money from a decedent is external, economic, and easy to quantify. But this expansion in the market for claims did not dispel the cloud that hung over “catching bargains.” Some jurisdictions clung to their tradition of refusing to honor these agreements.88 Others presumed that these contracts were fraudulent unless the purchaser could “show that the transaction was a bona fide one, and based upon a full consideration.”89 And still others distinguished between transfers between family members (which were valid)90 and those featuring third parties (which were “not favored”).91 These conflicting approaches prompted the Ohio Supreme Court to observe in 1929 that “authority can be found supporting almost every conceivable angle of the subject.”92

Compounding this uncertainty, courts were much more tolerant of assignments consummated after the decedent had passed away. Even jurisdictions that barred pre-death inheritance sales relaxed this restriction once the probate case had begun.93 Judges in this camp observed that when the original owner dies, title vests immediately in her successors, subject only to the estate’s debts, taxes, and legal fees.94 Thus, the reasoning continued, the property being administered belonged to the heirs and beneficiaries, who were free to dispose of it as they wished.95

This formalistic logic ignored several problems with the alienability of pending estates. For one, these courts never explained why the dangers that animated their hostility to “catching bargains”—reckless sellers, ruthless buyers, and flouting the decedent’s intent—vanished the instant the decedent’s heart stopped beating.96 In addition, they did not try to square their holdings with the champerty doctrine. Probate rules confer standing upon “interested person[s]”: those whose rights might be affected by a judicial ruling.97 As a result, when an outside party purchases a portion of the decedent’s assets, she also obtains the power to file petitions and objections, to seek to remove the personal representative, and to sue for breach of fiduciary duty.98 This result—which, as one court cautioned, allows third parties to “literally[] buy[] a law suit”99—seems incompatible with the idea that outsiders should not be able to commandeer a judicial proceeding.

In the early twentieth century, the practice of “heir hunting” exposed these simmering tensions. Heir hunters sift through probate records, which, like all court files, are available to the public, looking for wealthy intestate decedents who have no close family members.100 They then trace the decedent’s family tree, identify her next of kin, and sell them information about the probate matter in return for a generous cut of their inheritance.101

Initially, these opportunists received a cold reception. Courts in the District of Columbia, Kentucky, New Jersey, New York, Ohio, and Pennsylvania held that heir hunters were guilty of champerty.102 According to these opinions, heir hunters usurp the personal representative’s duty to locate the decedent’s relatives:

This Court is its own Clerk and has custody and jurisdiction over its files, papers, cases and records, and as such, does not intend to permit any self[-]appointed person or organization to operate in open competition with duly appointed fiduciaries. Such activity is against public policy and borders on ‘ambulance chasing’ when not solicited by the Administratrix or authorized by the Court.103

Similarly, in 1935, the New York legislature passed a statute giving probate courts broad authority to “fix and determine the validity and reasonableness of [an heir hunter’s] compensation” and requiring assignments of interests in estates to be in writing.104 Six years later, California lawmakers followed suit, empowering probate judges to strike down or rewrite heir-hunting contracts “upon such terms as [they] deem[] just and equitable.”105

But these interventions did not stem the tide of heir hunting. For one, despite the spate of opinions that invoked the champerty doctrine, it was not clear that heir hunters actually “foment[] unnecessary litigation.”106 Heir hunting does not create lawsuits out of whole cloth; rather, it merely identifies the proper parties in a matter that has already been filed. This disconnect leaps to the fore when one reads the first wave of heir hunting decisions closely. In most of them, an individual or entity had secured an assignment from a distant but known relative of the decedent—usually one who resided overseas—mere days before the official notice of death arrived in the mail from the probate court.107 Thus, because discovery of the rightful heirs “was inevitable,” these heir hunters were blatant intermeddlers.108 Yet not all heir hunters fit this mold. Sometimes, a decedent’s line of consanguinity was tangled or her relatives had vanished, and an heir hunter solved these mysteries.109 In these situations, heir hunting spared the personal representative an expensive and time-consuming search.

Near the dawn of the twenty-first century, judges became more attuned to these nuances, and heir hunting achieved a degree of legitimacy. Courts in Rhode Island, Texas, and Washington honored heir-hunting agreements, observing that they “may be beneficial rather than harmful in some cases.”110 Likewise, a Wisconsin appellate panel rejected the link between heir hunting and champerty, reasoning that routine probate proceedings are non-adversarial and therefore not “litigation”:

Heirship determination[s] . . . do[] not assume the spectre of a contest or litigation until an interested party, by way of counter-proof or motion, controverts the proof filed by the personal representative. Here, no heirship litigation ever pended in the trial court, none was contemplated, and the conclusiveness of the proof filed with the probate court makes it unlikely that any litigation will ever occur . . . . The proceeding would have followed the same course through probate, irrespective of [the heir hunter’s] involvement.111

Finally, the New York and California legislation, which was animated by suspicion of heir hunting,112 had the unintended consequence of normalizing it. Because these laws assumed that heir-hunting agreements were valid, and placed the burden on the decedent’s relatives to prove otherwise, judges saw the laws as a tacit seal of approval.113 Thus, in 2001, a California appellate court not only upheld an heir-hunting contract, but went so far as to opine that “it is not our province to regulate the business.”114

Then, in 2004, articles in the San Francisco Chronicle described a new twist on heir hunting.115 Thousands of people who were grieving the recent loss of loved ones had been approached by corporations offering to buy their interest in the estate.116 These “probate lenders” were a hybrid of heir hunters and litigation financiers.117 They harvested names of decedents’ kin from unresolved probate cases and promised them cash in exchange for an assignment of their eventual inheritances.118 Ostensibly, these transactions were non-recourse: at least on paper, recipients had no obligation to repay the company if the estate became mired in the courts or depleted by creditors or mismanagement.119 In turn, because probate lenders were not certain to recoup the money they fronted, they charged high markups and argued that their contracts were too contingent to fall under federal and state consumer-protection statutes.120 Representatives of these firms defended their methods, noting that probate can be agonizingly slow and that a decedent’s relatives often cannot wait for bequests or legacies to trickle through the court system.121 Yet the public reacted viscerally to the Chronicle stories, dubbing probate lenders “hearse chasers” (a riff on “ambulance chasers”) and urging public officials to investigate the industry.122

California lawmakers soon began to debate regulating probate lenders. Rather than adopting a far-reaching measure that “treat[ed] a cash advance to a beneficiary of an estate as a consumer loan” and therefore triggered the usury statutes and TILA, they chose a softer tactic.123 They enacted Probate Code section 11604.5, which requires probate lenders to file their contracts in the probate record within thirty days after they are signed,124 and permits judges to refuse to honor these deals if they “[a]re grossly unreasonable.”125

Yet section 11604.5 has made little difference in the decade since it kicked in. Despite the statute’s disclosure requirements, we know virtually nothing about probate lenders. Policymakers have ignored the fledgling industry, and no article in a newspaper or law journal has even mentioned it in passing. Likewise, despite section 11604.5’s invitation for judges to scrutinize the terms of probate loans, only one reported case has addressed the topic. In Reed v. Val-Chris Investments, Inc., the plaintiff received $35,000 in exchange for assigning $50,000 of his father’s estate to a company called Advance Inheritance (AI).126 He then sought to rescind the deal on the grounds that AI had violated TILA’s disclosure mandates.127 A federal district court dismissed the complaint, reasoning that the contract between AI and the plaintiff was non-recourse and thus was not subject to TILA:

As evident by both parties’ lack of citation to authority on this issue, the Court acknowledges the absence of case law addressing whether such a transaction is subject to TILA. However, the Court finds that the transaction between Plaintiff and AI was not a loan because Plaintiff had no obligation to pay AI anything if the Estate did not satisfy the amount Plaintiff assigned to AI.128

Meanwhile, probate lending appears to have blossomed into a thriving business. More than two dozen of these firms maintain active web presences, including AI,129 A.I.C.,130 Approved Cash Advance,131 Cash Flow Investment Partners,132 Crutcher Loan Company,133 First Probate Loans134 HBS Finance,135 Heir Advance Company,136 Inheritance Advance,137 Inheritance Funding Company,138 Inheritance Loan Company, LLC,139 Inheritance Now,140 J.G. Wentworth,141 Key National Funding,142 PB Financial Group Corporation,143 Probate and Estate Financing,144 ProbateLoan.com,145 ProbateLoan.net,146 The Suburban Group,147 Texas Cash Advance Loans,148 Westar Lending Group,149 Worldmine Financial Associates, LLC,150 and VET Worldwide Solutions.151 These companies run the gamut from one-person shops152 to organizations that have handled over $100 million in transactions.153 Although most were founded in the mid-2000s,154 a healthy plurality of these companies have opened their doors within the last five years.155

Admittedly, probate lending appears to be more established in California than elsewhere. This may be because it originated there. Alternatively, it could stem from section 11604.5, which, like the heir-hunting legislation before it, may have inadvertently legitimized the practice it sought to regulate.156 Indeed, section 11604.5 can be seen as creating a safe harbor for firms that wish to engage in these transactions: as long as they jump through the statute’s hoops, they seem to have the legislature’s blessing. Finally, lenders may have been emboldened by the fact that California is one of a handful of jurisdictions that have never recognized the champerty doctrine.157 Perhaps for these reasons, most probate lenders are headquartered in the Golden State.158

Yet there is also evidence that the business is expanding. Probate lenders have emerged in Florida,159 Kentucky,160 and Texas.161 Some of the larger California firms trumpet their ability to “[o]perate in all 50 states.”162 They maintain unique web pages for each jurisdiction163 and feature testimonials from far-flung clients throughout the nation.164 Finally, some litigation lenders have apparently started to test the probate waters by offering “inheritance advances”165—a trend that could cause probate lending to grow along with the market for civil claims.

***

Rights that are bound up in the legal system have gradually become easier to transfer. One product of this movement, litigation lending, has received sustained scholarly attention. In sharp contrast, the related topic of probate lending remains shrouded in mystery. Thus, in the next Part, we report the results of an empirical study that fills this gap.

ii. Empirically Assessing Probate Loans

This Part reports the Article’s empirical findings about probate loans. It begins by describing the data collection and cleaning process, and then discusses the empirical analysis and results.

A. Data Description

Recall that California Probate Code section 11604.5 requires probate lenders to file their contracts in the judicial record.166 As a result, these agreements, which would normally be private, are included in the state’s court files.

To assess this burgeoning industry, we turned to a survey that one of us had previously conducted of every probate matter stemming from deaths that occurred in Alameda County, California, during 2007.167 Alameda County, which sits just east of San Francisco, is a racially and economically diverse region with a population of about 1.6 million.168 It includes wealthy enclaves near the University of California, Berkeley campus, industrial suburbs such as San Leandro, and urban sections of Oakland. The dataset was culled from the county’s online case filing system, DomainWeb, and includes every probate estate that appeared on the calendar between January 1, 2008, and March 1, 2009.169 It consists of 668 testate and intestate administrations that arose from individuals who had passed away in 2007.170

From this sample, we cut 74 cases in which a decedent left property primarily to a trust.171 These administrations featured what are known as “pour over” wills, which are unlikely to involve assignments of inheritance rights.172

For the remaining 594 cases, we pulled the following variables from the case record: the date of any will, the date of decedent’s death, the dates that the probate case opened and closed, the gross value of the estate, the identities of any creditors who sought to collect debts from the estate, information on personal representative and attorneys’ fees, and whether litigation occurred. For matters that involved probate loans, we additionally captured the following variables: the date of the loan, the amount of the loan, whether the lender was repaid, the repayment date (if the loan was repaid), the value of the lender’s interest, the effective annual interest rate,173 and whether the lender initiated litigation.

B. Results

1. Overview

Loans are a visible part of the probate landscape. To be sure, only 30 of the 594 cases (5%) feature loans. But these contracts cluster together.174 Because nineteen estates involve multiple loans—including one that contained ten separate transactions175—there is a grand total of seventy-seven loans in the data.176

It is hard to know whether this ratio is representative of the national market.177 On the one hand, as noted, California appears to be the epicenter of probate lending. That suggests that borrowing against an estate may be less common in other regions. Yet our research may also understate the current incidence of probate loans. Only six lenders were named in the Alameda County files.178 Because many inheritance-purchasing firms have opened their doors recently,179 the market may have expanded since 2009, when our sample period ends.

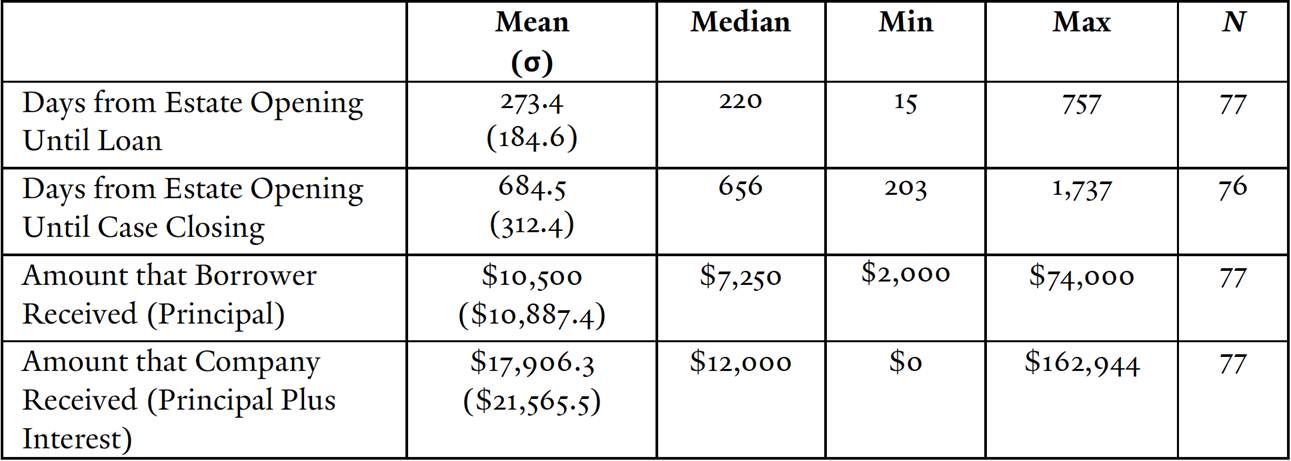

Creditors paid $808,500 and collected $1,378,786 in inheritance rights. As Table 1 reveals, the amount borrowed per agreement ranged from $2,000 to $74,000, and repayment amounts were anywhere between $0 and $162,944.180

table 1.

probate loan descriptive statistics

Note. σ = standard deviation. One estate was still open at the time that our data collection ended, and thus had no close date.

Lenders follow the same basic template. They usually enter the picture about halfway through the administrative process, after the personal representative has submitted the Inventory and Appraisal (I&A). The I&A is a mandatory filing that sets forth the value of all of the decedent’s assets. Once the I&A has been lodged, lenders can calculate the dollar value of each party’s eventual inheritance and thus confirm that they are likely to be repaid. Nevertheless, every contract we uncovered takes pains to declare that it is non-recourse.181 Rather than using the term “loan,”182 these arrangements are stylized as “[a]ssignment[s],”183 “money advanced . . . on [a] beneficial interest,”184 and sales of “the right to receive a distribution of a fixed amount of . . . [an] estate.”185

Firms regularly try to recoup their investment as soon as possible. The California Probate Code permits preliminary distributions of up to half of the decedent’s assets under certain circumstances.186 Lenders invoked this procedure in seven of the thirty-three estates (21%), cashing out an average of eight months before the case terminated with the final disbursement of the decedent’s property.

2. Correlates of Loans

What motivates people to borrow against their inheritances? To investigate this question, we ran a linear probability regression where the dependent variable was whether an estate contained one or more loans.187 We controlled for several factors in the regression: the length of the probate case, whether a bank or credit card company sought to be reimbursed for a debt incurred by the decedent, the gross value of the estate, whether the decedent made a will (and if so, when), the number of times attorneys were hailed before the probate court, and the decedent’s marital status.

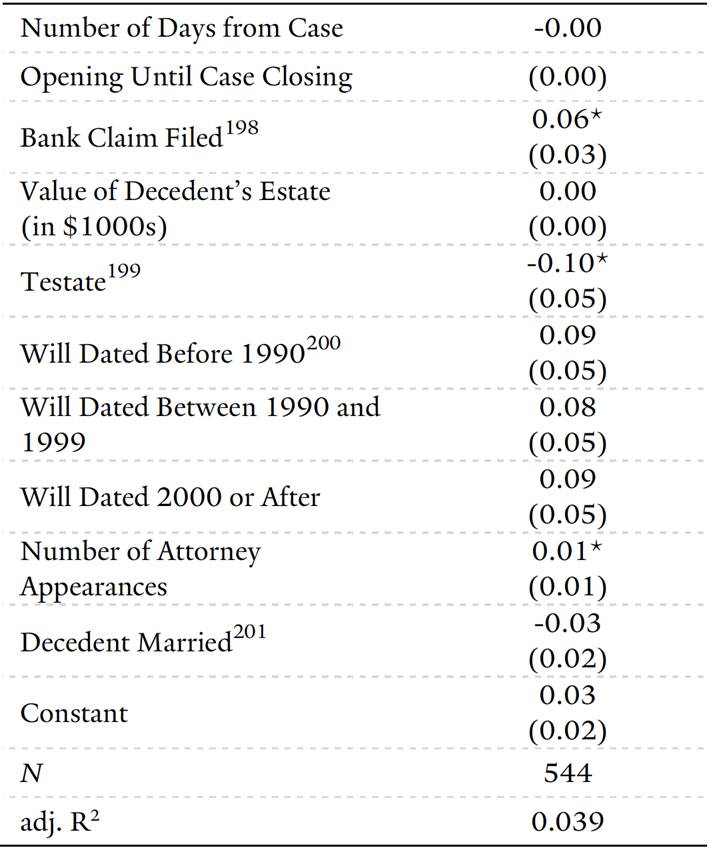

We first evaluated probate lenders’ argument that their services are beneficial because their customers cannot afford to wait for the snail-like probate process to conclude.188 We did not discover strong support for this assertion. Indeed, as Table 2 demonstrates, we found that probate loans were not more likely to occur in estates with longer disposition times. Thus, it does not seem that heirs and beneficiaries assign their inheritance rights out of frustration with probate’s notorious delays.189

In addition, the evidence is mixed on whether individuals enter into loans due to financial necessity. Unfortunately, we are not privy to the economic status of any heir or beneficiary. Yet the size of the estate could be a relevant proxy, on the theory that less affluent decedents have heirs who are also lower on the income ladder. If probate lenders truly bridge a gap for clients who are “hard-pressed for money,”190 we would expect to see that higher loan probabilities were associated with lower estate values. Nevertheless, we unearthed no such connection. On the other hand, the likelihood of an assignment is six percentage points higher, on average, for heirs of people who owed money to a bank or a commercial lender (p<0.05). This might hint at a “[c]ulture of [d]ebt,” in which people who borrow have friends and relatives who also do so.191 In addition, because the poor are more likely to accumulate credit card liability,192 it could suggest a tie between pecuniary need and probate lending—although additional research would be required to substantiate it.193

Finally, the probability of a loan was ten percentage points lower in testacies than in intestacies (p<0.05). Recall that courts once viewed “catching bargain[s]” as a kind of “deceit” that subverts a property owner’s desire to provide for her loved ones.194 Testate beneficiaries, who have been singled out in the decedent’s will, may share this sentiment and feel that a loan is a betrayal of the bequest.195 But intestate heirs have not been honored in the same way. They may see their interests as fungible—not expressions of a decedent’s affection, but merely another income stream at their disposal.196

table 2.

correlates of probate loans

linear probability model197

(robust standard errors in parentheses)

|

3. Judicial Intervention

Recall that California Probate Code section 11604.5 allows judges to strike down “grossly unreasonable” probate loans or “order distribution on any terms that [they] . . . consider[] equitable.”198 We did not unearth a single instance of a court exercising this prerogative. Instead, the norm—at least in Alameda County, during the period under study—appears to have been to rubber stamp probate loans. As we explain next, courts and policymakers should recognize that these transactions are, in fact, quite problematic for borrowers and the legal system.

iii. Policy Implications

This Part prescribes policy based on our empirical findings. It first explains why most probate loans violate the usury statutes and TILA. It then considers the more difficult issue of whether assignments of inheritance rights to firms are consistent with the champerty doctrine.

A. Usury

In the San Francisco Chronicle’s stories on probate lenders, experts opined that these firms seem to be an ingenious effort to evade the usury laws.199 Although this accusation has also been levied against litigation lenders, most courts have held that litigation loans are immune from usury regulation. But in this Section, we explain why the result should be different for probate loans.

Usury statutes limit the amount of interest that creditors can charge on a loan.200 These laws are notoriously complex: they vary wildly between states and are riddled with exceptions and idiosyncratic rules for particular institutions and transactions.201 There is also no uniform maximum rate, although the ceiling for consumer loans202 in most jurisdictions is around ten percent annual simple interest.203 In California, Florida, Michigan, Ohio, Pennsylvania, New Jersey, New York, and Texas—which have large elderly populations and are potential hubs for probate loans204—caps range from six to eighteen percent.205 Sanctions for usury violations can be severe, and include disgorgement of profits, punitive damages, and even criminal liability.206

However, usury laws only govern advances that saddle the borrower with “an absolute obligation to repay the principal.”207 As a result, usury statutes do not apply to transactions where the creditor’s recovery of the fronted money hinges “upon a bona fide contingency.”208 As the Arizona Supreme Court put it, “An example of a debt ‘contingently repayable’ is posed by this situation: Borrower says to lender: Lend me $10 to bet on a horse race, and if the horse wins, I promise to pay you $15 tomorrow; if the horse loses, you get nothing.”209 This logic has spurred many courts to exempt litigation loans from usury regulation.210 Litigation lenders forfeit their investment if the plaintiff does not settle or prevail on the merits; thus, they face the realistic possibility of coming away empty-handed.211

Anglo-Dutch Petroleum International, Inc. v. Haskell illustrates this line of authority.212 Anglo-Dutch, an oil company, sued two rivals for misappropriating trade secrets and breaching a confidentiality agreement.213 Because Anglo-Dutch needed cash to stay afloat, it sold $560,000 of its potential damages to a variety of litigation funders.214 But when a jury issued a verdict of $81 million, Anglo-Dutch refused to honor these assignments, contending that they were not enforceable on the grounds of usury.215 Anglo-Dutch supported this theory with evidence that some of the litigation funders had admitted that “success in the . . . lawsuit was certain” and there was “no risk whatsoever.”216 A Texas appellate court rejected this argument, reasoning that mere optimism about the trial did not prove that the money was going to be repaid.217 Instead, the court explained, Anglo-Dutch needed to demonstrate that, at the time it signed the deals, it had “obtained ‘incontrovertible evidence’ of its claims.”218

Critically, though, not all contingencies are the same. As the Restatement (First) of Contracts provides, lenders cannot shield usurious transactions by predicating their recovery on conditions that are unlikely to occur:

A creditor who takes the chance of losing all or part of the sum to which he would be entitled if he bargained for the return of his money with the highest permissible rate of interest is allowed to contract for greater profit. On the other hand it is not permissible to use this form of contract as a device for obtaining usurious profit. If the probability of the occurrence of the contingency on which diminished payment is promised is remote, . . . the transaction is presumably usurious.219

Courts apply this test functionally rather than formally, considering all the facts and circumstances “to determine whether the lender’s profits are exposed to the requisite risk.”220 The odds that the lender will get burned “must be substantial, . . . for a mere colorable hazard will not prevent the charge from being usurious.”221

A corollary of this principle is that litigation loans fall under the usury laws if unusual circumstances suggest that the plaintiff—and thus the lender—will likely be made whole. For instance, in Echeverria v. Estate of Lindner, a day laborer fell from a scaffold on a jobsite and filed a worker’s compensation claim against his employer.222 A company called LawCash advanced him $25,000 to be repaid from his damages, with interest compounding every month at 3.85%.223 A New York trial court held that the agreement was usurious.224 The court noted that because the legal standard in the underlying tort matter was strict liability, “there was a very low probability that judgment would not be in favor of the plaintiff.”225

Likewise, in Lawsuit Financial, LLC v. Curry, a Michigan appellate court held that several litigation loans were usurious.226 Mary Curry brought a tort claim after being injured in a car crash.227 At trial, the defendants in Curry’s personal injury lawsuit admitted that they were at fault, and the jury—tasked only with calculating damages—awarded Curry $27 million.228 The defendants challenged this verdict with a salvo of post-trial motions.229 Before the judge ruled on these motions, Curry signed three agreements with a litigation lender, one of which pledged the greater of $887,500 or ten percent of her winnings, in return for $177,500.230 The appellate judges noted that Curry was clearly destined to recover something from her tort lawsuit at the time the agreements were consummated:

[B]efore the advances were made, the defendants in the personal injury lawsuit had already admitted liability, the jury had already returned a $27 million verdict in [Curry]’s favor, an order of judgment had already been entered, and the only remaining issue was the amount of recovery . . . . Because liability had already been admitted when plaintiff advanced the funds, the fact that . . . Curry would recover some damages for her injuries was already known.231

Like the litigation loans in these cases, probate loans are “absolutely repayable.”232 Seventy-four of the seventy-seven advances (96%) in our dataset were fully reimbursed. The remaining three loans resulted in lender losses: one lender recovered $13,229 of a $20,000 payment,233 and another took home just $9,800 from an outlay of $16,800.234 Even more starkly, one company lost its entire investment when the personal representative stole the decedent’s assets and then disappeared.235 Yet these matters were highly unusual. In the first two, the lenders unwisely entered into assignments before the I&A was filed, thus exposing themselves to the danger that the estate would be worth less than assumed.236 In the third, the company had advanced funds even though the personal representative had not taken out a surety bond to insure all stakeholders against fraud and embezzlement.237 The fact that firms can easily take steps to avoid repeating these kinds of mistakes suggests that they are not likely to recur. Thus, like litigation financiers who bought a stake in Echeverria’s strict liability claim or Curry’s unopposed negligence allegations, probate lenders are “almost guaranteed to recover” and face “low, if any risk.”238

But even if the usury statutes apply, it does not necessarily follow that probate lenders are defying them. Unlike traditional loans, these transactions neither have a set rate nor a fixed term.239 In fact, the annual percentage of a firm’s markup depends on a fact that is unknown at the time of contracting: the number of days until the estate closes. Thus, the status of probate loans under the usury statutes depends on a second contingency: not whether the creditor will be repaid, but when. Theoretically, a case could persist for so long in the system that the company’s rate of return would be minimal.

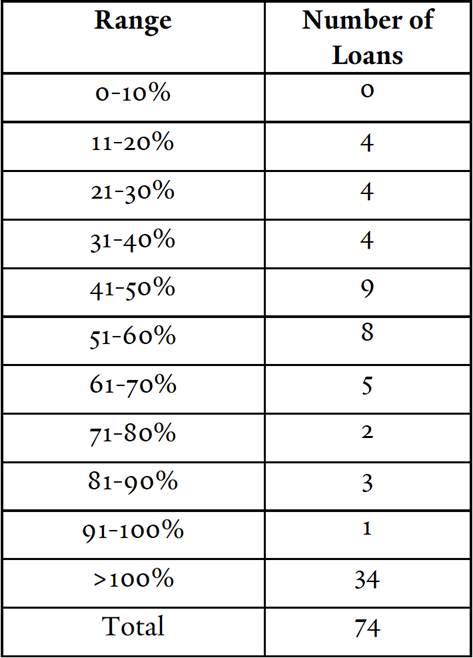

Again, though, this turns out to be a phantom condition. We were able to determine the effective annual simple interest rates for the seventy-four loans that were fully repaid.240 Strikingly, allof them exceeded California’s usury threshold of 10%.241 In fact, as Table 3 reveals, fifty-three (72%) featured rates of more than 50%, and thirty-four (46%) topped 100%.242 Thus, probate lenders are all but assured of usurious returns.243

table 3.

effective interest rates

To conform to the usury statutes, probate lenders could experiment with “usury savings clauses,” which resurrect invalid loans by reducing the interest rate to the maximum permissible amount. Admittedly, some courts refuse to enforce these provisions, reasoning that they encourage lenders to charge all their customers astronomical rates and then merely “refund . . . the usurious amounts” to “the few debtors who complain.”244 Yet judges are more hospitable to usury savings clauses when they seem less like attempts to launder patently illegal transactions and more like the product of genuine uncertainty about whether a loan will be usurious. Indeed, as the Florida Court of Appeals explained, a savings clause may be appropriate “where the transaction is not clearly usurious at the outset but only becomes usurious upon the happening of a future contingency.”245 Given the fact that the returns on a probate loan depend on when the estate closes—and is thus impossible to predict ex ante—courts might be willing to enforce savings clauses in this context. In turn, this ceiling on interest rates would go a long way in ameliorating the seeming unfairness of these contracts.

In sum, reaping a usurious profit from a probate loan is “not a gamble, but a ‘sure thing.’”246 In addition, as we discuss next, the fact that probate loans are “absolutely repayable” subjects them to federal consumer protection efforts.247

B. The Truth in Lending Act

Because probate lenders are virtually guaranteed to recover their advances, they also must comply with the Truth in Lending Act. As this section explains, their current efforts are insufficient.

Congress enacted TILA in 1968 to standardize the information that lenders furnish and thereby allow potential customers “to compare more readily the various credit terms available.”248 The statute penalizes companies that fail to follow its byzantine provisions, “even if the violation is technical and unintended.”249 It applies to “credit transaction[s],”250 which occur when a borrower incurs “debt.”251 Although TILA does not define “debt,” it is generally understood as the transfer of value “to someone who is obligated to pay it back.”252 Thus, as with the usury statutes, scholars have assumed TILA does not govern litigation loans.253 Moreover, recall that in Reed v. Val-Chris Investments, Inc., a federal district court exempted a probate loan from TILA because the company “had no recourse against [the beneficiary] if his potential inheritance was not sufficient to cover his assignment.”254

This analysis would be persuasive if probate loans truly were non-recourse. However, TILA requires courts to “focus on the substance, not the form, of credit-extending transactions.”255 In reality, probate loans seem to be consistently repaid. Thus, no matter what these contracts say about being contingent on the outcome of the probate matter, they involve no authentic risk for lenders, and thus create “debt.”

TILA also exempts certain loans for more than a specified sum. During the period covered by our study, the statute did not apply to “[c]redit transactions, other than those in which a security interest is or will be acquired in real property . . . in which the total amount financed exceeds $25,000.”256 In 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act, which broadened TILA’s scope by raising the cap to $50,000 and indexing it to inflation.257 However, we unearthed just four contracts in which the borrowers received more than $25,000, and just one that was north of $50,000. Thus, this carve-out is unlikely to affect more than a slender minority of probate loans.

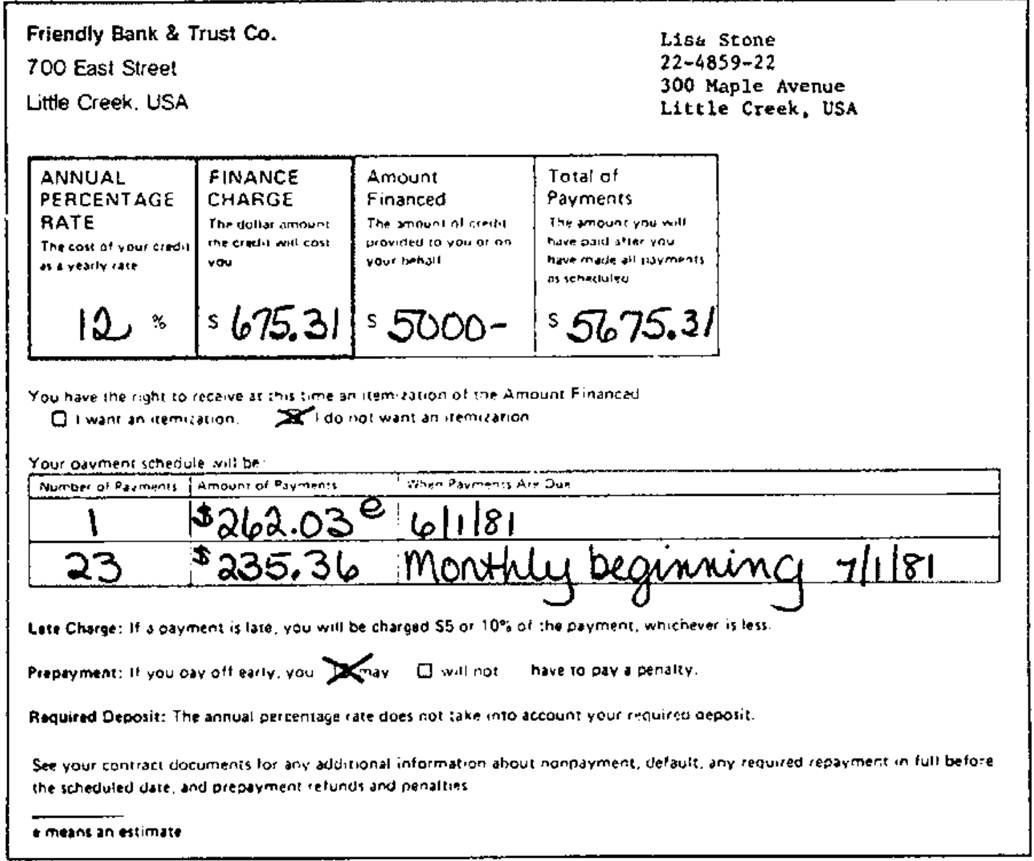

TILA classifies consumer loans that require a single payment, such as probate loans, as “closed-end” loans.258 TILA’s rules for “closed-end” credit plans such as probate loans fall into two categories. First, section 1638(a) governsthe content of disclosures. It instructs lenders to inform borrowers of “[t]he ‘amount financed’, using that term,”259 “[t]he ‘finance charge’, . . . using that term,”260 and “[t]he finance charge expressed as an ‘annual percentage rate’, using that term.”261 Second, section 1632(a) controls the formof disclosures. The statute and Regulation Z task companies with highlighting “[t]he terms ‘annual percentage rate’ and ‘finance charge’ . . . more conspicuously than other terms,”262 segregating disclosures from other paperwork,263 and ensuring that disclosures do not contain extraneous text.264

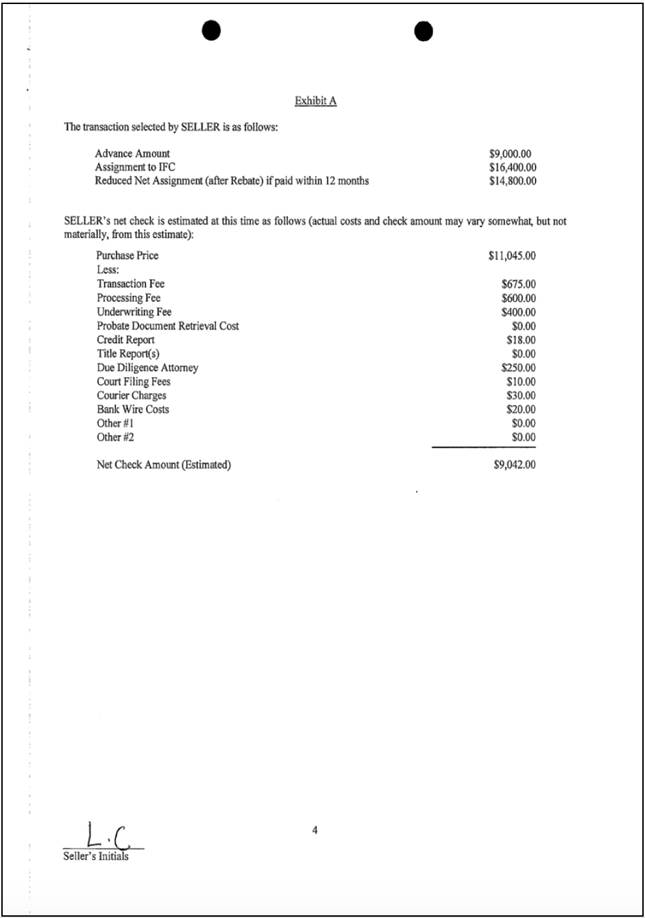

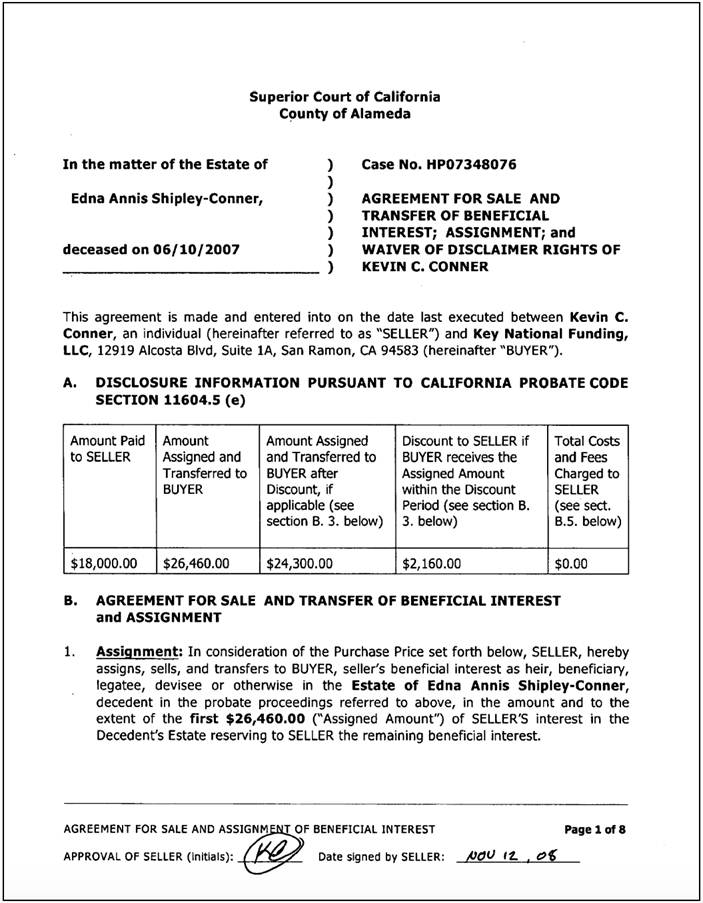

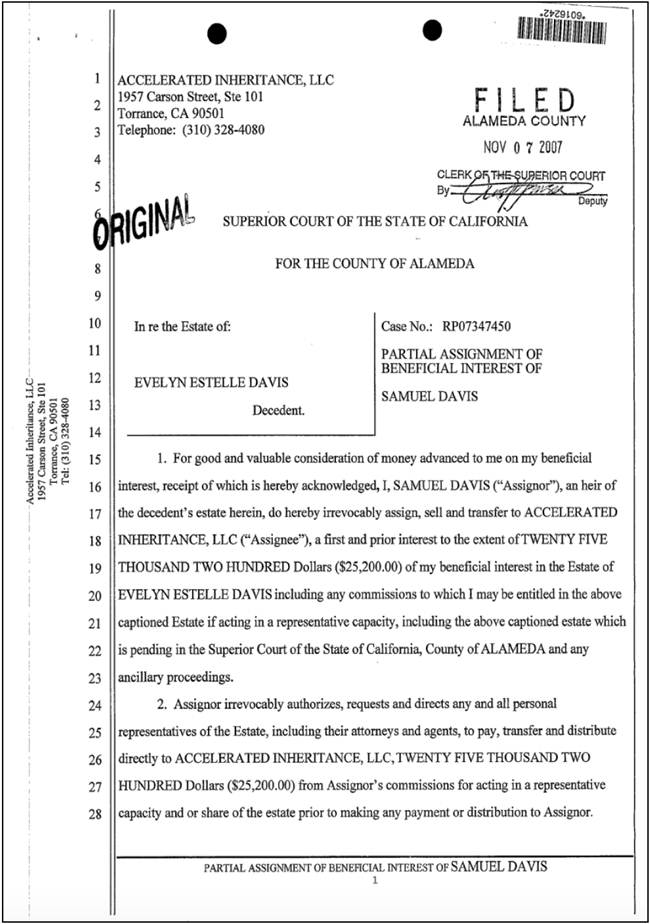

The probate lenders in our dataset do not satisfy these “hypertechnical” mandates.265 As Figures 1 through 4 reveal, these firms violate section 1638(a)(2)(A) by failing to use the magic words “amount financed” (although they do list the “[a]dvance [a]mount” or “[a]mount [p]aid” to the borrower). Even more starkly, they contravene sections 1638(a)(3), 1638(a)(4), and 1632(a) by failing to mention—let alone estimate or highlight—the “finance charge” and the “annual percentage rate.” Likewise, a surefire way to violate section 1632(a) is to convey contradictory or inaccurate information.266 Some probate lenders, such as Inheritance Funding (Figure 2), have internally inconsistent documents that state one sum ($9,000 in Figure 2) as the “[a]dvance [a]mount” and a slightly different calculation ($9,042 in Figure 2) as the “[n]et [c]heck [a]mount.” Finally, rather than separating their disclosures from the terms of the loan, most probate lenders, like Key National Funding (Figure 3) and Accelerated Inheritance (Figure 4), shoehorn the entire transaction into a single document.267

figure 1.

model tila consumer credit disclosure268

figure 2.

inheritance funding disclosure269

figure 3.

p class="Document">letter from lord halifax to mr. wilkes270

figure 4.

accelerated inheritance disclosure271

One might wonder how companies could communicate the “finance charge” and “annual percentage rate” when those variables are unknown at the time of contracting. The answer is that Regulation Z allows creditors to deal with uncertainty about the terms of a loan by disclosing “the best information reasonably available” provided that they “state clearly that the disclosure is an estimate.”272 Lenders likely have a vast reservoir of historical information from which they could derive educated guesses about what any particular loan’s effective interest rate is likely to be. Indeed, although they cannot know for certain how many days will pass between the time of the agreement and the conclusion of the case, their own promotional materials reveal that the process follows certain patterns.273

For these reasons, unless probate lenders have revised their disclosures since our study, they could face a wave of TILA claims.274 Congress has sweetened the pot for TILA plaintiffs in two important ways. First, in class actions, section 1640 allows damages in “such [an] amount as the court may allow,” up to the lesser of $1,000,000 or 1% of the defendant’s net worth.275 Second, borrowers who prevail on any TILA theory may recoup their attorneys’ fees and costs.276 These incentives could make probate lenders tempting targets for the plaintiffs’ bar.277

In addition, when an individual litigant (rather than a class member) prevails in a lawsuit for violations of the subsections of Section 1638 we have mentioned above, section 1640 entitles her to statutory damages of twice the amount of the finance charge, up to $2,000.278 Because no probate loan in our dataset had a finance charge of less than $1,000, each one would have triggered the maximum amount of liability.

Finally, creditors that violate section 1632(a) are liable for actual damages for “proven injury or loss.”279 To obtain relief, a plaintiff must demonstrate that “(1) [s]he read the TILA disclosure statement; (2) [s]he understood the charges being disclosed; (3) had the disclosure statement been accurate, [s]he would have sought a lower price; and (4) [s]he would have obtained a lower price.”280 Admittedly, debtors are often unable to link a company’s inadequate disclosures under section 1632(a) to concrete harm.281 Nevertheless, these cases usually involve trivial deviations from the statute’s blueprint, which makes it hard for a borrower to prove that she noticed the flaw—let alone that it prompted her to forgo a better deal.282 Because the deficiencies in probate lenders’ disclosures are so flagrant, it may be easier for heirs and beneficiaries to demonstrate causation. For example, in our research, the markups on a $10,000 advance ranged from $5,200 to $8,600. But the fact that lenders do not spotlight these charges makes it difficult for prospective clients to shop among competing firms.

Accordingly, probate lenders routinely violate TILA. In addition, as we discuss next, their transactions may suffer from an even greater infirmity: champerty.

C. Champerty

The champerty doctrine has been a formidable obstacle for litigation financiers and heir hunters. Similarly, in jurisdictions that continue to follow the ancient rule,283 champerty is a bet-the-company issue for probate lenders. Unlike the usury statutes, which force creditors to lower their interest rates, or TILA, which impacts how lenders convey information to prospective customers, champerty has the potential to ban certain transactions entirely. This Section explains that, although there is a colorable argument that probate lending is champterous, courts and policymakers should police the industry through other means.

At first blush, probate lending seems manifestly different than litigation lending and heir hunting. The contrast with litigation lending is particularly acute. Litigation loans are associated with conflict for a simple reason: they seek to enable a lawsuit. But probate loans do not. Heirs and beneficiaries rarely, if ever, funnel the money they receive from probate lenders back into an adversarial proceeding.

Similarly, probate lending seems less like champerty than heir hunting. In the typical heir hunting scenario, someone dies without an estate plan or any known family. Because the decedent’s closest relatives will be “laughing heirs”—far-flung and distant kin—the heir hunter must substantiate their inheritance rights by filing an heirship petition.284 Even if this pleading is not contested, the court must adjudicate it, and, as a result, there is at least some systematic connection between heir hunting and burdens on the judiciary.285 Yet there is no reason to expect probate lending to have a similar effect. When probate functions smoothly, the heirs and beneficiaries sit on the sidelines, waiting for title to be cleared and the decedent’s debts to be paid. The fact that one of these individuals has assigned a cut of the estate to a company should merely add another passive party to the case, changing nothing. Therefore, we did not expect to find any correlation between probate lending and probate litigation.

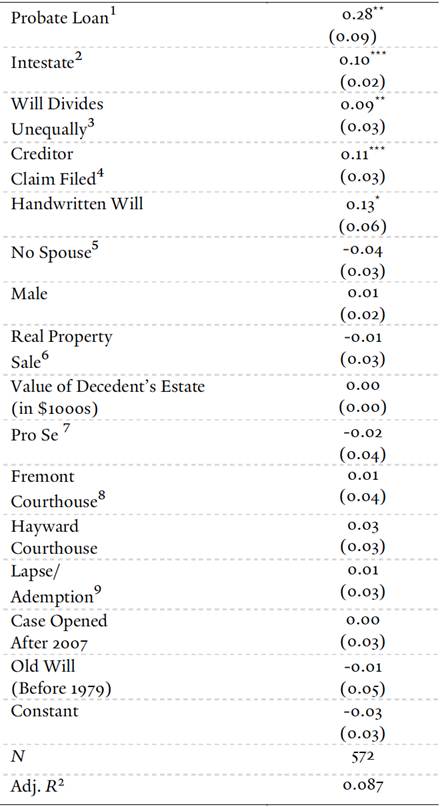

To test this intuition, we ran a linear probability regression using “litigation”—defined as a request for relief that sparks an objection from an adverse party—as the dependent variable.286 Our marquee independent variable was whether or not an estate contained a probate loan. Our other independent variables were factors that have long been suspected to cause conflict during estate administration: whether or not the case involved a decedent who (1) died intestate,287 (2) executed handwritten wills,288 (3) divided property unequally among similarly situated relatives, (4) named personal representatives who served pro se (rather than hiring a lawyer),289 (5) owned real property that needed to be sold during the probate matter, and (6) experienced a major change of circumstances after executing the will, such as leaving assets to beneficiaries who passed away (triggering the doctrine of lapse)290 or making specific bequests of items they did not own at death (raising issues of ademption).291 Finally, we added dummy variables to control for other, less obvious sources of friction, including the decedent’s gender and marital status, the courthouse where the case was lodged, the fact that creditors emerged from the woodwork, and the value of the estate.

Surprisingly, we discovered that probate loans are more strongly correlated with disputes than any other characteristic. Indeed, as Table 4 elucidates, a lender’s involvement increased the odds of conflict by twenty-eight percentage points.292 Thus, there is a statistically significant relationship between probate loans and full-fledged litigation.

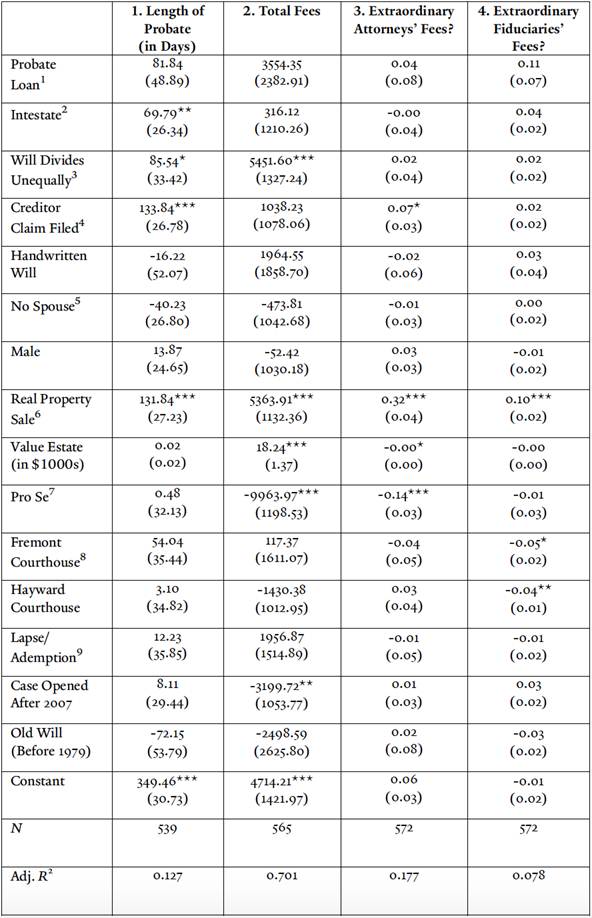

table 4.

correlates of probate litigation

linear probability model293

(robust standard errors in parentheses)

Note. * p < 0.05, ** p < 0.01, *** p < 0.001.

Of course, these results only prove so much. Rather than establishing that loans lead to litigation, they could point in the other direction: that litigation causes loans. Perhaps heirs and beneficiaries engage the services of a lender because a lawsuit has already derailed the probate process. Similarly, because we defined “litigation” so broadly—as any contested petition—we have swept up claims that may be only tenuously related to the presence of a lender. For instance, as mentioned, firms usually do not invest in an estate until after the personal representative has filed the I&A.294 Some disputes, such as challenges to a will’s validity and heirship petitions, occur at the beginning of the probate process, and thus likely occur before any loan.

Nevertheless, when we investigated further, we found little mystery about the link between loans and claims. In two-thirds of these cases, the petition or objection was initiated by the lender itself. Probate lending thus introduces litigious third parties into the court system.

Ultimately, though, we are not persuaded that the practice is champterous. Courts generally do not apply the doctrine to parties who first acquire an interest in property and then bring a cause of action related to that property.295 This is an apt description of probate lenders, who buy inheritance rights and subsequently (sometimes) sue. In fact, even when a purchaser knew that litigation involving an asset “would be inevitable,” judges only deem the sale to be champterous when “‘stirring up litigation’ was [its] sole or primary purpose.”296 As far as we can tell, probate lenders do not buy shares of a decedent’s estate in order to file claims. Instead, they litigate when necessary to further their prime directive of turning a profit.

In addition, our other proposals diminish the need for champerty. Indeed, champerty’s policy foundations partially overlap with those that underlie the usury laws and TILA. One of champerty’s core purposes is to preclude “financial overreaching by a party of superior bargaining position.”297 Requiring probate loans to comply with state and federal consumer protection statutes would address this concern directly by capping interest rates, compelling enhanced disclosures, and facilitating consumer choice. These measures are better tailored to the problem than the blunderbuss champerty doctrine.

And although champerty also serves the discrete objective of preventing “useless litigation,”298 it is not clear that extending the rule to probate lending would accomplish this goal. It is tempting to see lawsuits filed by faceless entities in a grim light, but the truth is more nuanced. Most of the probate lenders’ petitions or objections sought either to remove the personal representative or recover for the personal representative’s breach of fiduciary duty. Notably, if these allegations were well-founded, then they would benefit not only the company, but the heirs and beneficiaries. After all, a personal representative who is lazy or has exhibited poor judgment may imperil the value of the estate.299 When a probate lender sues to protect its investment, it also vindicates the rights of the other recipients of the decedent’s bounty. Thus, applying champerty to probate lending would ignore the fact that claiming can be socially valuable.300

We acknowledge that there are defensible counterarguments. First, some courts and scholars argue that champerty seeks to “categorically deter even meritorious litigation.”301 This broader understanding is captured in the expression that the law should not encourage parties “to enforce those rights which others are not disposed to enforce.”302 Seen this way, it is irrelevant that there may be a silver lining to some lawsuits initiated by firms. The glowing thing is that they litigate when no one else wishes to do so, and therefore engage in inefficient hypervigilance. Second, not every pleading filed by a probate lender furthers the interests of the heirs and beneficiaries. Some, such as petitions to be appointed as a personal representative, to obtain a preliminary distribution, or to force the personal representative to sell real property, stem from rank self-interest.303 Third, even if probate lending does not meet the technical elements of champerty, courts have traditionally not shied away from extending the doctrine “by analogy.”304

Yet two other factors militate against an inexorable bar on probate loans. For one, lawsuits filed by lenders seem to be less damaging than other species of litigation. We ran additional regressions designed to detect whether the incidence of probate loans is correlated with factors that are commonly believed to burden the court or harm the other parties. We started with case length, which we report in the first column of Table 5. We discovered no statistically significant relationship between the fact that an estate contained a loan and the number of days of the probate matter.305 Conversely, four other variables did increase disposition times in a meaningful way: intestacies; wills that divide property unequally among similarly situated relatives; the fact that a creditor asserted a claim against the decedent; and a real property sale. Notably, as the first column of Table 4 reports, three of these variables—intestacies, lopsided wills, and creditors’ claims—alsoraise the likelihood of litigation.306 The fact that probate loans increase the probability of conflict but do notenlarge disposition times suggests that petitions filed by lenders are resolved more quickly than other allegations.307

Also, although probate litigation is notorious for allowing attorneys and personal representatives to bleed the estate dry,308 we did not uncover evidence of this propensity in connection with probate loans. At the outset, we acknowledge that this result may be specific to the way that California compensates attorneys and personal representatives. Unlike other jurisdictions, which give the court discretion to award “reasonable” fees,309 California provides lawyers and fiduciaries with a fixed percentage of the gross value of the estate,310 with the chance to earn more through an award of “extraordinary” fees.311 Subject to this caveat, Table 5 shows no statistically significant tie between probate loans and increased administrative costs. Indeed, loans are neither associated with (1) higher amounts of attorneys’ and personal representatives’ fees (column 2) nor (2) whether or not the court exercised its discretion to supplement the baseline fee award with extraordinary fees (columns 3 and 4). Gauged by these criteria, then, litigation filed by probate lenders is comparatively benign.312

table 5.

correlates of probate litigation313

(robust standard errors in parentheses)

Note. * p < 0.05, ** p < 0.01, *** p < 0.001.

Finally, rather than the nuclear option of the champerty doctrine, modest steps could contain litigation filed by probate lenders. For starters, probate judges might keep companies in check by liberally exercising their discretion to resolve disputes on the pleadings. In many states, the rules of civil procedure only govern probate matters if they are consistent with the probate code.314 One difference between the two spheres is the status of dispositive motions. In civil practice, the parties must wade through discovery before seeking summary judgment.315 However, probate judges enjoy wide leeway to rule on the papers.316Thus, if a petition or objection brought by a firm is not in the best interests of the estate, the probate court can abruptly reject it, sparing the other participants the cost and hassle of responding.

Meanwhile, testators

could insert anti-assignment provisions in their wills. Trusts frequently

contain similar devices, which are called “spendthrift clauses.”317 Owners use trusts rather than outright

gifts to create a pool of assets that provides their loved ones with a

guaranteed stream of income for many years. Spendthrift clauses facilitate this

goal by preventing irresponsible, cash-hungry beneficiaries from selling their

rights to these regular distributions.318 Yet because wills involve a one-time transfer

of property, rather than an enduring corpus, they do not usually include

spendthrift language. The growth of probate lending should cause estate

planners and their clients—particularly those who are conflict-adverse—to

rethink this conventional wisdom. In turn, allowing testators to forbid

assignments would be an elegant solution to the problems we have described

This Article has identified the phenomenon of probate

lending: the practice whereby firms buy interests in a pending estate. Like

litigation lending, probate lending takes place against a backdrop of festering

uncertainty about the alienability of rights that are tied to the court system.

So far, the few judges and policymakers who have encountered probate lending

have been forced to guess about its contours and key characteristics. This

Article has attempted to use an empirical analysis of a unique dataset to bring

these issues into the light. It concludes that probate loans often violate

usury statutes and TILA, and are hard to square with the champerty

doctrine. The time has arrived to regulate the “catching bargains” of the

twenty-first century.Conclusion

See Third Assignment of Beneficial Interest in Decedent’s Estate at 1, Estate of Bell, No. RP08389640 (Cal. Super. Ct. Sept. 8, 2008); Second Assignment of Beneficial Interest in Decedent’s Estate at 1, Estate of Bell, No. RP08389640 (Cal. Super. Ct. Aug. 27, 2008); Assignment of Beneficial Interest in Decedent’s Estate at 1, Estate of Bell, No. RP08389640 (Cal. Super. Ct. July 1, 2008).

See Cal. Prob. Code § 48(a)(1) (West 2016) (defining “interested person” to include “[a]n heir, . . . creditor, beneficiary, and any other person having a property right in or claim against . . . the estate of a decedent”). The Uniform Probate Code is identical. See Unif. Probate Code § 1-201(23) (amended 2010), 8 pt. 1 U.L.A. 48 (2013).

See Assignment Agreement, Sale & Transfer of Beneficial Interest in Decedent’s Estate/Waiver of Disclaimer Rights at 4, Estate of Bell, No. RP08389640 (Cal. Super. Ct. Mar. 18, 2010) [hereinafter March 18 Assignment]; Assignment Agreement, Sale & Transfer of Beneficial Interest in Decedent’s Estate/Waiver of Disclaimer Rights at 4, Estate of Bell, No. RP08389640 (Cal. Super. Ct. Jan. 22, 2010); Assignment Agreement, Sale & Transfer of Beneficial Interest in Decedent’s Estate/Waiver of Disclaimer Rights at 1, Estate of Bell, No. RP08389640 (Cal. Super. Ct. Jan. 8, 2010); Assignment Agreement, Sale & Transfer of Beneficial Interest in Decedent’s Estate/Waiver of Disclaimer Rights at 4, Estate of Bell, No. RP08389640 (Cal. Super. Ct. Dec. 17, 2009); Assignment Agreement, Sale & Transfer of Beneficial Interest in Decedent’s Estate/Waiver of Disclaimer Rights at 1, Estate of Bell, No. RP08389640 (Cal. Super. Ct. Nov. 19, 2009); Assignment Agreement, Sale & Transfer of Beneficial Interest in Decedent’s Estate/Waiver of Disclaimer Rights at 1, Estate of Bell, No. RP08389640 (Cal. Super. Ct. Nov. 13, 2009); Assignment Agreement, Sale & Transfer of Beneficial Interest in Decedent’s Estate/Waiver of Disclaimer Rights at 1, Estate of Bell, No. RP08389640 (Cal. Super. Ct. June 22, 2009).

For overviews of the birth and evolution of the litigation-finance industry, see Maya Steinitz, Whose Claim Is This Anyway? Third-Party Litigation Funding, 95 Minn. L. Rev. 1268, 1275-86 (2011); Jason Lyon, Comment, Revolution in Progress: Third-Party Funding of American Litigation, 58 UCLA L. Rev. 571, 572-79 (2010); Mariel Rodak, Comment, It’s About Time: A Systems Thinking Analysis of the Litigation Finance Industry and Its Effect on Settlement, 155 U. Pa. L. Rev. 503, 504-08 (2006); Mattathias Schwartz, Should You Be Allowed To Invest in a Lawsuit?, N.Y. Times Mag. (Oct. 22, 2015), http://www.nytimes.com/2015/10/25/magazine/should-you-be-allowed-to-invest-in-a-lawsuit.html [http://perma.cc/XEE7-BMVA]. Commentary on the topic falls into two rough camps. One grapples with the overarching policy question of whether to allow plaintiffs to sell causes of action. See, e.g., U.S. Chamber Inst. for Legal Reform, Selling Lawsuits, Buying Trouble: Third Party Litigation Funding in the United States (2009), http:// www.instituteforlegalreform.com/uploads/sites/1/thirdpartylitigationfinancing.pdf [http://perma.cc/9JQM-JRTN] (offering a skeptical view of claim sales); Michael Abramowicz, On the Alienability of Legal Claims, 114 Yale L.J. 697, 702 (2005) (arguing that a market in lawsuits is more problematic from an economic perspective than a deontological view); Anthony J. Sebok, The Inauthentic Claim, 64 Vand. L. Rev. 61, 120-33 (2011) (challenging the conventional rationales for barring the assignment of pending causes of action); Marc J. Shukaitis, A Market in Personal Injury Tort Claims, 16 J. Legal Stud. 329, 334-41 (1987) (arguing that tort claims should be alienable); Teal E. Luthy, Comment, Assigning Common Law Claims for Fraud, 65 U. Chi. L. Rev. 1001, 1021 (1998) (contending that fraud claims should be alienable). A second strand of scholarship focuses more tightly on the litigation-finance industry’s ethical, legal, and pragmatic dimensions. See, e.g., Julia H. McLaughlin, Litigation Funding: Charting a Legal and Ethical Course, 31 Vt. L. Rev. 615, 634-46 (2007) (considering whether litigation-finance contracts are valid); Victoria A. Shannon, Harmonizing Third-Party Litigation Funding Regulation, 36 Cardozo L. Rev. 861, 883-906 (2015) (engaging in a similar analysis); Maya Steinitz & Abigail C. Field, A Model Litigation Finance Contract, 99 Iowa L. Rev. 711, 749-72 (2014) (presenting a model contract for litigation-finance companies to use); Paul Bond, Comment, Making Champerty Work: An Invitation to State Action, 150 U. Pa. L. Rev. 1297, 1319-28 (2002) (proposing that states supervise the sale of lawsuits and establish “courts of champerty” for claim buyers); Ari Dobner, Comment, Litigation for Sale, 144 U. Pa. L. Rev. 1529, 1551-90 (1996) (explaining how lawsuit-purchasing companies can use choice-of-law and forum-selection clauses to their advantage).

See, e.g., Saladini v. Righellis, 687 N.E.2d 1224, 1226 (Mass. 1997) (describing the decline of champerty); Sebok, supra note 9, at 120 (noting that “the law concerning third-party investment in litigation has changed since the early common law, and that this change, while generally in a direction of liberalization, has been inconsistent”).

See, e.g., Steinitz, supra note 9, at 1277 (calling the surge in interest in buying claims “second-wave litigation funding”); Dobner, supra note 9, at 1529-30 (describing the rise of litigation-finance companies); William Alden, Litigation Finance Firm Raises $260 Million for New Fund, N.Y. Times: DealBook (Jan. 12, 2014, 10:33 PM), http://dealbook.nytimes.com/2014/01/12/litigation-finance-firm-raises-260 -million-for-new-fund [http://perma.cc/G9QF-CHKX].