Regulating Foreign Commerce Through Multiple Pathways: A Case Study

abstract. This Essay looks at the regulation of foreign distilled spirits coming into the United States as a lens through which to understand how trade commitments become a part of U.S. law. The experience of distilled spirits in the last forty years demonstrates that trade agreements have the power to create new domestic rules, to lock in rules already on the books, and to be entirely powerless in the face of executive branch intransigence. But this story is just one illustration of competing authorities and unclear allegiances among the branches when it comes to issues of cross-border movement of goods and services. Contrary to the conventional wisdom, the commitments made in trade agreements seep into U.S. law in myriad undercounted ways, not just through implementing legislation or regulatory action. The Essay begins to peel back the layers of this complicated area at the intersection of foreign relations, trade, and administrative law.

introduction

Imagine you are the foreign minister of a U.S. trading partner country and you wish to ensure that the unique alcoholic product from your country is protected in the valuable U.S. market. You want the United States to guarantee that the name of your country’s unique product is used only for products that come from your country. U.S. law would suggest that you need to have your product added to the Code of Federal Regulations (CFR) list of protected distilled spirits.1 But U.S. practice over the last forty years would suggest you have at least four options. First, you could try to negotiate a major free trade agreement (FTA) with the United States and include in that FTA a commitment that the United States protect your product. Or, second, you could negotiate a smaller trade-related deal with the United States in which the United States agrees to protect your product and perhaps in exchange you could offer to protect a U.S. product in your market. Similarly, and perhaps if you have nothing to offer, you could conclude a letter exchange in which the United States promises to explore the possibility of protecting your product through its administrative process. Finally, and consistent with the legal provisions you identified in the CFR, you could file a petition or lobby the agency that makes the distilled-spirit regulations to motivate it to consider protecting your product and begin its administrative process toward a final rule that would add it to U.S. regulations.

All four of those approaches ultimately seek to achieve the same result: to guarantee that distinctive foreign alcoholic beverages cannot be sold on the U.S. market unless they have come from the country recognized by the United States and have been processed according to that country’s regulations. A U.S. trading partner can choose from this menu—each option of which features somewhat different legislative, bureaucratic, or public burdens. And all of these approaches have been used with some regularity, producing a mosaic of commitments to other governments and guidance to importers on just what the rules are.

Such an array of lawmaking processes creates questions about how U.S. trade agreements of different shapes and sizes complement and conflict with domestic regulatory process. Can the Executive negotiate through trade agreement what Congress has otherwise delegated to the Executive to do through notice-and-comment rulemaking? This Essay reviews these legal issues and their implications through the lens of the distilled-spirits regulations. I have chosen the distilled-spirits story because it illustrates starkly the range of international and domestic lawmaking possibilities in the management of foreign commerce. As seen through the distilled-spirits example, trade agreements have extraordinary rulemaking powers that affect agencies throughout the executive branch. The case study here is just the tip of the iceberg.

Moreover, most accounts of trade lawmaking focus on the congressional-executive relationship and see legislation as the primary means of converting our international commitments into U.S. law.2 The distilled-spirits experience reminds us that our international trade commitments trickle into U.S. law through multiple pathways.

I. the practice: a spirited case study

Returning to our hypothetical foreign minister of a U.S. trading partner, if that foreign minister were to choose to petition or lobby the agency that makes distilled-spirits regulations, that agency would be the Department of the Treasury’s Alcohol and Tobacco Tax and Trade Bureau (TTB), which regulates spirits.3 The TTB monitors and oversees the definitions, labeling, and movement through interstate and foreign commerce of wines and spirits. It regulates the kind, size and branding of the many types of alcoholic beverages on the U.S. market.4 “Standards of identity” is the term used to refer to mandatory requirements set by TTB to determine what these drinks must contain to be marketed under a certain name, such as brandy or gin.5

Following an extensive review of the regulatory scheme under the Federal Alcohol Administration Act,6 a 1969 regulation was the first to set out so-called “standards of identity” for a handful of foreign products including those originating from the United Kingdom (Scotch whisky), Ireland (Irish whisky), Canada (Canadian whisky), and France (cognac).7 According to the regulation, which is still in force today, those terms (e.g., Scotch whisky) may not be used commercially in the United States to describe any product not manufactured in those respective places in compliance with the applicable laws of those respective countries.8

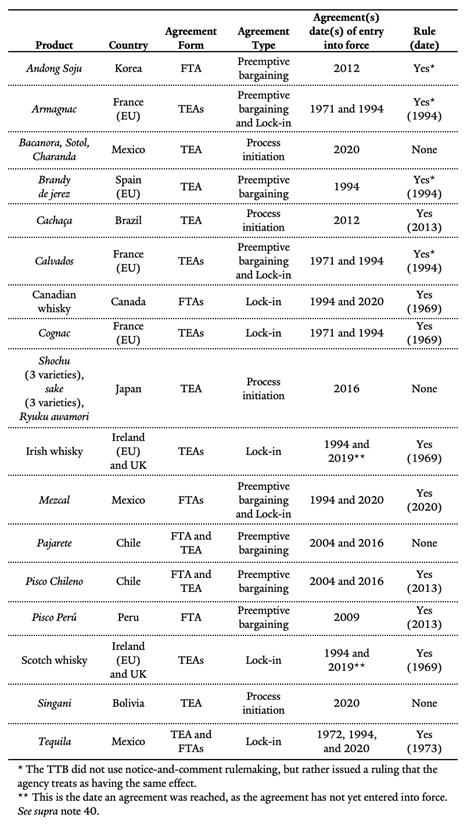

Today, the regulation’s list of geographically specific standards of identity includes also two different types of pisco—one from Chile and one from Peru—and Brazilian cachaça, and there may be more on the way.9 But those three more recently protected products were not added simply through the traditional U.S. rulemaking processes as was done in 1969. In practice, the United States has come to protect products not just through the regulatory process but also through the negotiation of two styles of trade agreements—large-scale FTAs and smaller agreements negotiated by the Executive alone that I call trade executive agreements (TEAs).10 More important than their size or structural shape, however, is their function. I consider three types of international agreements that surface in this story and complicate conventional depictions of administrative rulemaking. I refer to them according to their regulatory functions: preemptive-bargaining agreements, administrative process-initiation agreements, and lock-in agreements. A chart listing all the implicated products, agreements, and regulations is provided in the Appendix.11

A. Preemptive-Bargaining Agreements

From the early 1970s until 2006, the United States regularly entered into agreements with foreign partners committing the United States to recognizing certain types of “distinctive products” as only originating from a particular country. I call these agreements “preemptive bargaining agreements” because these trade agreements—whether in the form of an FTA or TEA—preempt the domestic administrative-law process described above and bargain to obtain favorable treatment of U.S. products in return for purported regulatory protection of foreign products. For the most part, the commitments made in this sort of agreement are then added to the existing regulations, although often after many years.

The first such instance of a preemptive-bargaining trade agreement concerning spirits on the record is a TEA with France in 1971 concerning cognac, Armagnac, and calvados, even though cognac was already protected under the 1969 regulation.12 In return for protection of these two additional products, France agreed that it would recognize bourbon whiskey as a distinctive product of the United States.13 The United States entered into a similar reciprocal TEA with Mexico in 1972-1973, prompted by a Mexican request for the United States to recognize tequila as a distinctive product of Mexico.14 Yet there was a striking difference between what happened after the French and Mexican deals each were signed, despite their temporal proximity. Both deals obligated the United States to protect the foreign products in the same way, but in the case of tequila, TTB15 carried out a rulemaking exercise immediately thereafter that incorporated tequila into its existing regulations as a recognized standard of identity.16 By contrast, with respect to Armagnac and calvados, TTB did not take any domestic legal action for more than twenty years, leaving their legally protected status uncertain.17

More than thirty years after these short TEAs were completed, the United States agreed to recognize certain types of pisco as originating in Chile and Peru. These commitments were among hundreds made by the Office of the U.S. Trade Representative (USTR) in two separate large-scale FTAs entering into force in 2004 and 2009. The U.S.-Chile FTA provides that the United States “shall recognize Pisco Chileno(Chilean Pisco), Pajarete and Vino Asoleado” as distinctive products of Chile.18 Likewise, the U.S.-Peru Trade Promotion Agreement provides that “[t]he United States shall recognize ‘Pisco Perú’ as a distinctive product of Peru.”19 In these instances, nine and four years, respectively, passed before the two varieties of pisco were added to the U.S. regulations through a single notice-and-comment rulemaking.20

An even longer delay occurred after the entry into force in 1994 of the North American Free Trade Agreement (NAFTA). The NAFTA provides that the United States shall recognize mezcal as a distinctive product of Mexico.21 The language of the agreement indicates that the U.S. obligation would not take effect immediately; Mexico had to complete an internal process concerning its own regulations about mezcal.22 Thereafter, however, the United States committed to recognize the product. What happened for the next several years is not publicly reported, but TTB issued a final rule adding mezcal to the list in 2020.23

Finally, in 2007, the United States and Korea negotiated an FTA with reciprocal protections for U.S. products and a Korean spirit called Andong Soju.24 In January 2012, the TTB issued a ruling—which the agency intended to have the same legal force as a rule—announcing that it would protect Andong Soju as a recognized standard of identity consistent with 22 C.F.R. § 5.22.25

B. Process-Initiation Agreements

Since 2012, the United States has not entered into any international commitments guaranteeing recognition of standards of identity on distilled spirits like those in the 1990s and early 2000s described above. Rather, it has taken a decidedly different approach—one in which it does not commit to recognition, but instead commits to beginning its own regulatory process with a possible outcome of recognition.26 For example, in April 2012, the United States agreed with Brazil in a TEA negotiated by USTR, which is the agency with the lead on U.S. trade negotiations, that if the United States were to publish a final rule that provides that cachaça is a distinctive product of Brazil, then Brazil would recognize bourbon whiskey and Tennessee whisky as distinct products of the United States within thirty days.27 Brazil had asked TTB for more than a decade to begin such a process, but it was not until this exchange of letters that action was taken.28 Three weeks after the conclusion of the agreement, TTB promulgated a proposed rule and less than a year later, a final rule recognizing cachaça came into effect.29

Similar TEAs were concluded with Japan, Mexico, and most recently Bolivia: agreements obligating the United States to initiate the administrative process of recognition or protection of distilled spirits from those countries.30 However, despite these commitments to those trading partners in 2016, 2018, and 2020, respectively, not one of these agreements has precipitated a notice of proposed rulemaking or other action from TTB.

C. Lock-In Agreements

Curiously, the products that have been named in the U.S. regulation since 1969 have also been subject to trade agreements in recent years. Long after those protections were written into U.S. law, those trading partners sought to conclude agreements to the same result. For example, apart from its guarantee on mezcal, the NAFTA also provided that the United States shall recognize Canadian whisky as a distinctive product of Canada (which it already had since at least 1969) and tequila as a distinctive product of Mexico (which it already had since 1973). In effect, the NAFTA locked in existing regulatory protections at the supranational level.31 The new NAFTA—the United States-Mexico-Canada Agreement (USMCA) which entered into force on July 1, 2020—repeats the same commitments for all three products (tequila, Canadian whisky, and mezcal).32

Also, in 1994, the United States entered into a TEA with the European Union on the recognition of certain distilled spirits.33 The agreement provides for the recognition of Scotch whisky, Irish whisky, cognac, Armagnac, calvados, and brandy de jerez. Of those, Scotch whisky, Irish whisky, and cognac were already in the regulation when the European Union sought the agreement. Armagnac and calvados had been subject to a 1971 agreement with France34 but TTB had never added them to the regulation—nor would it this time either. Instead, TTB issued an administrative ruling expressing its recognition of Armagnac, calvados, and brandy de jerez. The result is that these products are considered protected by the agency through the ruling, even if the enforceability of such a measure is contested.35 At the least, that ruling and the TEA must be located separately from the regulation.36 A government official who was present at the 1994 negotiation reported that that TEA was concluded only because the two trading partners had been in negotiations regarding trade in wine products for six years without making sufficient progress. Officials felt they “needed to show something [i.e., negotiate the TEA on spirits]”—that it was “not a waste of six years.”37 The agency published a notice38 in the Federal Register regarding the ruling “for optics”; according to the official, it gave the European Commission “a greater level of comfort in [the ruling’s] legality.”39

In the same way, in 2019, the United States entered into a further agreement with the United Kingdom, prompted by the latter’s intent to depart from the European Union, that seeks to ensure that the United States will honor its 1994 commitment to the European Union regarding Scotch whisky and Irish whisky.40

II. putting practice into law

While there is much to be mined from this case study on distilled spirits, which is just one area among many where trade agreements and regulatory processes intersect, as a preliminary matter, I will focus on some of the legal questions that the data precipitate. The law is ambiguous at best on these matters. Until now we barely had a sense of just what types of obligations the Executive has been making and how those obligations might intersect with regulatory space.

Let us begin with the simplest scenario for a distilled spirit: the ordinary regulatory process. An interested party or government may petition the TTB to commence the notice-and-comment process and, through that process, advocate for a final rule that recognizes and protects the product in question. Once a product is listed in the regulation, it is protected under U.S. law. Working through the rulemaking system has the advantages of clarity, some degree of transparency, and certainty once completed. A final rule is publicized for the business and international community. It is clear to U.S. Customs and Border Protection officials. It has the disadvantage of potential failure, especially if other stakeholders are strongly opposed. Still, the regulatory path subject to ordinary administrative law rules is the securest for protecting distinctive distilled spirits.

What to make, however, of the trade agreements that purport to do the same? What legal effect do the preemptive-bargaining agreements have? As a matter of international law, there is no doubt that the United States, acting through the USTR, has an obligation to protect those products in its market. But as a matter of domestic law, the answer is less clear—and some piece of that turns on the difference between FTAs and TEAs and their implementation.

FTAs are usually implemented through legislation. The USMCA, the NAFTA, the U.S.-Korea FTA, the U.S.-Peru FTA, and the U.S.-Chile FTA generally were approved by Congress prior to their respective entries into force.41 That legislation provides the Executive with authority to implement through regulation, proclamation, or other executive authorities, regulatory changes as required by the agreement. But how executive-branch agencies ought to carry out this administrative implementation is not clear from the legislative package.

Here again we come to somewhat of a fork in the road for the executive branch which applies equally to TEAs: proceed with ordinary notice-and-comment rulemaking or use some other executive branch tool, like a presidential proclamation or agency ruling, to put these obligations into effect. Ordinary rulemaking is authorized by law, but, in this case, the result is heavily predetermined, making the administrative lawmaking process moot and possibly violating the Administrative Procedure Act (APA).42 Indeed, although it is possible that TTB would reject protection of such a product in the rulemaking process, there are no examples of this occurring following a preemptive-bargaining agreement. TTB nevertheless went through the motions for pisco. TTB acknowledged in its final rule the language of the two trade agreements and in its finding commented:

After careful review of the comments . . . , and after consideration of the obligations incurred in the international agreements, TTB has determined that it is appropriate to adopt the proposed regulatory amendments . . . [which, among other things] will revoke by operation of regulation any [Certificates of Label Approval] that specify ‘Pisco’ as the class and type or, brand name, or fanciful name of distilled spirits products that are not products of Peru or Chile.43

The difficulty with using another method of implementation, however, is the absence of any delegation to the president or relevant agencies to do so. TTB has used “rulings” and its beverage “manual” to achieve the same result, but it is uncertain whether those are appropriate uses of those devices.44

A third possibility is that that these agreement provisions are self-executing.45 The conventional view in U.S. trade law is that FTAs are not self-executing.46 Moreover, most foreign relations and constitutional law scholars would likely object to any suggestion that an international agreement entered into by one administrative agency concerning a subject that had been delegated to another administrative agency on a topic that falls within the exclusive purview of Congress could be self-executing. Were that so, it would make these preemptive-bargaining trade agreements powerful tools that could trump ordinary rulemaking.

In fact, that is precisely what has occurred as a matter of practice, according to government officials interviewed for purposes of this project. For example, although not all the Chilean products noted in the U.S.-Chile FTA have been implemented into the CFR or into statute, TTB treats those products as protected under U.S. law.47 Similarly, even though mezcal did not make it into the regulations until 2020, TTB has considered it protected since 1994.48 Thus, for both the Chilean products and for mezcal, the TTB has provided protection to those spirits by issuing appropriate customs documentation to qualifying imports. Likewise, although Korean Andong Soju mentioned in the U.S.-Korea FTA and Armagnac, brandy de jerez, and calvados mentioned in the 1974 TEA with the European Union have only been addressed in administrative rulings rather than notice-and-comment rulemaking, TTB has treated them as protected.

Courts have not (yet) confronted these thorny questions of self-execution and implementation. If a trading partner did encounter any treatment contrary to the provisions of an FTA, that government could activate the dispute-settlement system under the agreement to prompt U.S. corrective action.49 For those commitments in TEAs, which lack dispute-settlement provisions, it is an open question whether a foreign government or other actor could raise a challenge at all, such as in the U.S. domestic courts.50

As for the process-initiation agreements, the practical results for the products are far less certain, but the agreements are more legally sound. The agreements concluded since 2012, which promise only process, not result, clearly comport with U.S. law. The main issue that arises under those agreements is that the U.S. obligations to begin the rulemaking process are rarely carried out in any timely way. There, however, because they are all conducted through TEAs rather than FTAs, U.S. trading partners do not have recourse to any international dispute settlement. Because of that, while binding, those commitments are not internationally enforceable. It is likewise unlikely they could be enforced domestically in the U.S. courts on ripeness grounds, among others.

Finally, the lock-in agreements create hypothetical legal difficulties. What if the TTB decides to change its rules and remove a product that was subject to a lock-in agreement? Under TTB’s unpublished approach, the agreement is the law. If it is self-executing, an agreement could have the force of a treaty, overriding any regulation that the agency would seek to make.51 What if Congress or the USTR wishes to change course? Lock-ins create the potential for disputes at the domestic and international levels.

III. trade’s regulations revisited

Seeing how trade agreements and domestic regulations interact illuminates a broader research agenda beyond the issues highlighted in Part II. This functional account of regulatory trade agreements has important implications for multiple constituencies: for business, for foreign governments, for the U.S. executive, for Congress, and for scholars. Across all interested parties, three overarching lessons stand out.

First, this study demonstrates that there are multiple ways to approach modifying our regulations related to foreign commerce—rather than a one-size-fits-all approach. It is not just that agreements become law, but rather regulations prompt agreements, agreements prompt regulations, and agreements themselves carry the force of law in the eyes of U.S. agency officials. Using trade agreements to try to create regulatory change has the benefit of reciprocal arrangements, but it struggles on other dimensions. For one, it changes the stakes in the administrative process. Agency calculus could be affected by the fact that U.S. products intended to be protected in the reciprocal market could suffer as a result. Writing regulation through agreements has far less transparency and redirects access to lawmaking by interest groups and members of the public.52 Given the tendency to a singular, preordained outcome, it may also harm the legitimacy of the agency’s ordinary process.

Second, this study shows that implementing trade agreements is not as simple as the traditional academic understanding would suggest. Implementation of trade agreement commitments, whether through FTAs or through TEAs, is blurry and seemingly ad hoc, running the risk that an agency commits to a set of rules that the other refuses to execute—with concomitant questions as to what trade law trumps at the border.53 For example, do U.S. Customs officials apply a commitment negotiated by USTR or a regulation promulgated by TTB? As this study shows, in some instances, the United States has even doubled down internationally while not formally implementing the law domestically. Put simply, the experience of distilled spirits in the last forty years demonstrates that trade agreements have the power to create new rules, to lock in domestic rules already on the books, and to be entirely powerless.

Another lesson, especially for U.S. government actors, is that there are understudied inconsistencies and loopholes that could lead to U.S. liability if not addressed. That this is so does not make trade law unique, nor is this subset unique within trade, but it is one of many areas in which Congress may be underinformed about the effects and applications of its delegations. Both branches may wish to clarify the state of the law in future lawmaking exercises and to undertake a review of other regulatory areas where similar phenomena may be found.

Broadening the aperture to situate this study in the trade-law literature more squarely, it also illustrates the variation in what I will call differential commitments in trade agreements. When seen in light of trade lawmaking in other areas, the distilled-spirits story suggests that there are degrees of trade-agreement implementation and variation in what actually changes in domestic law. That certain issue areas get more or less attention or are more or less important to a government should come as no surprise. But what is interesting is that not only are they given different treatment in the news or in the agreement text, they are also subject to differentiated implementation—and that differentiation is not captured in any easily measurable way.

Relatedly, none of the officials with whom I spoke could provide a precise explanation as to why the process-initiation TEAs had not been acted upon. TTB noted that whether the agency moves forward depends on factors such as whether it decides that rulemaking is the best course, the workload burden, and public or industry interest.54 That response confirms that, at least in some cases, these markets are so small that their neglect reflects the same unspoken truth on differentiated commitments: not all agreement obligations are created equal. They enter U.S. law differently, creating the possibility for further discrepancies in their application and, ultimately, in their enforcement and the availability of judicial review. USTR and TTB are in close contact, but these rulemakings are low on the priority list for action, especially because TTB takes the position that it can independently facilitate these imports through undertaking the necessary paperwork and approvals for Customs and Border Protection in the absence of any regulation or ruling.55

For scholars, this project carries corrections, cautionary notes, and promise for future research. Contrary to the conventional wisdom, trade agreements serve regulatory functions in unexpected ways including directly, possibly through self-executing mechanisms. Ideas such as “self-execution” and “implementation” are well theorized in foreign-relations law but may not have clear application or be subject to the same principles and constraints in trade. Trade agreements cover a wide array of areas nearly all of which have some overlap with domestic rules. Where the law goes from there has yet to be determined. And, while one case study does not indicate a trend, there are hundreds of similar types of small trade agreements and unnoticed provisions in larger trade agreements with an impact on the administrative state.56 Many questions remain unresolved in this story that are ripe for further study.57

Finally, there is a critical normative question as to how these types of market-access permissions ought to be granted—through regulation, through agreement, through both, or through neither. What should happen here? What should go first? Is it desirable for USTR to commit to something that is otherwise delegated to rulemaking governed by administrative law? One could see this as an opportunity for hybrid lawmaking through which federal agencies solicit views from the public or other agencies before entering into commitments similar to public comment on FTAs. Revising the present approaches to address these democratic deficits would go a long way to creating a stable and legitimate trade and regulatory landscape.

Conclusion

The distilled-spirits story is just one illustration of competing authorities and unclear allegiances among the branches of government when it comes to issues of cross-border movement of goods and services and transnational regulation. The commitments made in TEAs and in traditional FTAs seep into the law of the United States in myriad undercounted ways, not just through implementing legislation or approved regulatory action. This Essay has looked at a subset of that permeation: how trade agreement commitments can be and have been interwoven with administrative law processes. As can be seen here, much work remains in trying to navigate the intersection among these areas of law. At least in one area, trade agreements may be more powerful than previously considered.

Associate Professor, University of Miami School of Law. My thanks to Sarah Bashadi of the Yale Law Journal and to Oona Hathaway for the generous invitation to contribute. I am grateful to Elena Chachko, John Coyle, Jason Yackee, and David Zaring for their comments on earlier versions of this Essay. Special thanks to the several current and former government officials and practitioners interviewed for this project for their willingness to engage with me on the trade regulatory agreements discussed here. Mackenzie Garrity and the Miami Law librarians provided excellent research assistance.

Appendix

TABLE 1. OVERVIEW OF DISTILLED SPIRITS AND THEIR MODES OF IMPLEMENTATION58

See, e.g., Cory Adkins & David Singh Grewal, Two Views of International Trade in the Constitutional Order, 94 Tex. L. Rev. 1495, 1499 (2016); Kathleen Claussen, Separation of Trade Law Powers, 43 Yale J. Int’l L. 315, 318 (2018); Timothy Meyer & Ganesh Sitaraman, Trade and the Separation of Powers, 107 Calif. L. Rev. 583, 636-37 (2019); Hal Shapiro & Lael Brainard, Trade Promotion Authority Formerly Known as Fast Track: Building Common Ground on Trade Demands More than a Name Change, 35 Geo. Wash. Int’l L. Rev. 1, 9-10 (2003).

Pub. L. No. 74-401, ch. 814, 49 Stat. 977 (1935) (codified at 27 U.S.C. §§ 201-219a (2018)). This statute and related legislation created overlapping jurisdiction across multiple agencies from the early part of the twentieth century. The Treasury Department has, since the 1970s, maintained primary responsibility for the regulation of spirits. See 27 C.F.R. § 5.4 (delegating those authorities to the Alcohol and Tobacco Tax and Trade Bureau (TTB)). The statutory language authorizes the Secretary to “prescribe[] regulations.” 27 U.S.C. § 205(e) (2018).

Free trade agreements (FTAs) are approved by Congress before they enter into force; trade executive agreements (TEAs) are not approved by either house of Congress after their negotiation. See generally Kathleen Claussen, Trade Executive Agreements (Aug. 1, 2020) (unpublished manuscript) (on file with author) (discussing and analyzing TEAs).

Agreement Providing for the Recognition and Protection by France of the Appellation of Origin of United States Bourbon Whiskey and Continued Protection by the United States of Appellations of Origin of the French Brandies Cognac, Armagnac, and Calvados, U.S.-Fr., Dec. 2, 1970-Jan. 18, 1971, 22 U.S.T. 36 (entered into force Mar. 20, 1971).

United States-Chile Free Trade Agreement, U.S.-Chile, art. 3.15, ¶ 2, June 6, 2003, State Dep’t No. 04-35, https://ustr.gov/trade-agreements/free-trade-agreements/chile-fta/final-text [https://perma.cc/26MH-RNMH] (entered into force Jan. 1, 2004).

Modernization of the Labeling and Advertising Regulations for Wine, Distilled Spirits, and Malt Beverages, 85 Fed. Reg. 18,704, 18,723 (Apr. 2, 2020) (corrected version Modernization of the Labeling and Advertising Regulations for Wine, Distilled Spirits, and Malt Beverages, 85 Fed. Reg. 20,423 (Apr. 13, 2020)). Curiously, this addition was embedded in a broader “modernization” regulation which largely repeats old products but adds mezcal as if it were a correction. TTB explained that mezcal’s protection has been noted in TTB’s “Distilled Spirits Beverage Alcohol Manual,” even though it had not been added to the regulation. Email from Karen B. Welch, Dir. of Int’l Affairs, Alcohol & Tobacco Tax & Trade Bureau, U.S. Dep’t of the Treasury, to Kathleen E. Claussen, Assoc. Professor of Law, Univ. of Miami Sch. of Law (July 9, 2020, 10:44 AM EDT) (on file with author).

See TTB Ruling 2012-1, U.S. Dep’t Treasury (Jan. 11, 2012), superseded by TTB Ruling 2012-3, U.S. Dep’t Treasury (Oct. 11, 2012), https://www.ttb.gov/images/pdfs/rulings/2012-3.pdf [https://perma.cc/P5SW-9TSM]; Telephone Interview with former U.S. Treasury official (June 24, 2020).

Government officials with whom I spoke for this project could not explain the change. Email from former official of the Office of the U.S. Trade Representative to Kathleen Claussen, Assoc. Professor of Law, Univ. of Miami Sch. of Law (June 14, 2020, 9:51 PM EDT) (on file with author); Email from Karen E. Welch, supra note 23.

Letter from Michael B. G. Froman, Ambassador, U.S. Trade Representative, to Shuichi Takatori, State Minister of Japan (Feb. 4, 2016), https://ustr.gov/sites/default/files/TPP-Final-Text-JP-Exchange-of-Letters-on-Distinctive-Products.pdf [https://perma.cc/6XM2-RTHC]; Letter from Robert E. Lighthizer, Ambassador, U.S. Trade Representative, to Karen Longaric, Ministry of Foreign Affairs of Bol. (Jan. 6, 2020) (on file with author); Letter from Robert E. Lighthizer, Ambassador, U.S. Trade Representative, to Ildefonso Guajardo Villarreal, Sec’y of Econ. of Mex. (Nov. 30, 2018), https://ustr.gov/sites/default/files/files/agreements/FTA/USMCA/Text/MX-US_Side_Letter_on_Distilled_Spirits.pdf [https://perma.cc/3URR-BMHV].

To be sure, this concept is not new to international law, even if used somewhat differently. See generally Rachel Brewster, The Domestic Origins of International Agreements, 44 Va. J. Int’l L. 501 (2004) (describing how international law creates commitments at the domestic level); Tom Ginsburg, Locking in Democracy: Constitutions, Commitment, and International Law, 38 N.Y.U. J. Int’l L. & Pol. 707 (2006) (same). Most trade and investment agreements create some lock-in effect (express and implicit), and limit what states can do as a result, but those are usually prospective, unlike these.

Agreement Between the United States of America, the United Mexican States, and Canada, Can.-Mex.-U.S., art. 3.C.2, Nov. 30, 2018, https://ustr.gov/trade-agreements/free-trade-agreements/united-states-mexico-canada-agreement/agreement-between [https://perma.cc/JEP9-ZSCE ]; NAFTA, supra note 21, annex 313.

Commentators and courts have viewed such rulings, and their weight as a matter of law, differently in the few cases that have arisen. See, e.g., In re Anheuser-Busch Beer Labeling Mktg. & Sales Practices Litig., 644 F. App’x 515, 524 (6th Cir. 2016) (discussing a ruling in terms of its regulatory impact); Cruz v. Anheuser-Busch, LLC, No. CV 14-09670 AB ASX, 2015 WL 3561536, at *4 (C.D. Cal. June 3, 2015), aff’d sub nom. Cruz v. Anheuser-Busch Companies, LLC, 682 F. App’x 583 (9th Cir. 2017) (concluding that a TTB ruling that expressly called itself “interim policy” “pending rulemaking” was a policy not a rule); United States v. Evans, 712 F. Supp. 1435, 1444 (D. Mont. 1989), aff’d, 928 F.2d 858 (9th Cir. 1991) (discussing a contemplated ruling as an interpretive instrument); Alcohol & Tobacco Tax & Trade Bureau, TTB Rulings, U.S. Dep’t Treasury, https://www.ttb.gov/rulings [https://perma.cc/23P8-N5GW] (“TTB Rulings state our official position on the interpretation or application of a statute or of TTB’s regulations. A ruling might also clarify existing guidance.”); Telephone Interview with former U.S. Treasury official, supra note 25 (describing how TTB treats them as equivalent to regulations for internal purposes).

Consequently, individual companies would not be aware that their products were protected unless they somehow located the ruling which was provided to me by a former official when I inquired. See ATF Ruling 94-5, U.S. Dep’t Treasury (June 9, 1994), https://www.ttb.gov/images/pdfs/rulings/94-5.htm [https://perma.cc/K2G9-62CR]; Telephone Interview with former U.S. Treasury official, supra note 25.

Agreement Between the United States of America and the United Kingdom of Great Britain and Northern Ireland on the Mutual Recognition of Certain Distilled Spirits/Spirit Drinks, Gr. Brit.-U.S., Jan. 31, 2019, https://ustr.gov/sites/default/files/US-UK_Agreement_on_Distilled_Spirits_signed_Jan_31_2019.pdf [https://perma.cc/9PSW-LE25]. This agreement had not yet entered into force as of February 2020. See Office of the U.S. Trade Representative, 2020 Trade Policy Agenda and 2019 Annual Report of the President of the United States on the Trade Agreements Program annex II, pt. II (2020), https://ustr.gov/sites/default/files/2020_Trade_Policy_Agenda_and_2019_Annual_Report.pdf [https://perma.cc/K5M7-4KH9].

See Pub. L. No. 79-404, 60 Stat. 237 (1946) (codified as amended in scattered sections of 5 U.S.C.). The two bodies of law appear to clash. Congress does not provide a workaround, for example, to reconcile the implementation of trade agreement commitments with the delegation to an agency to prescribe regulations to achieve the same.

Telephone Interview with former U.S. Treasury official, supra note 25 (commenting that rulings usually interpret existing regulations not add to them). The simpler way to implement at least FTA commitments is to add them to each FTA’s implementing legislation rather than leave it to the executive to navigate conflicting delegations.

Telephone Interview with TTB official, supra note 29. Pajarete and vino asoleado have never been added to the regulations despite the Statement of Administrative Action accompanying the U.S.-Chile FTA Implementation Act providing that TTB will implement the protection for all three beverages. See Statement of Administrative Action, United States-Chile Free Trade Agreement Implementation Act, Pub. L. No. 108-77, 117 Stat. 909 (2003), at 13 (July 15, 2003), https://www.cbp.gov/sites/default/files/documents/chili_trade_3.pdf [https://perma.cc/HF6D-C5VY]. Unsurprisingly, Chile entered into a further lock-in agreement in 2016 to ensure those products’ protection given that they had been left out of the regulations. Letter from Michael B. G. Froman, Ambassador, U.S. Trade Representative, to Hon. Andres Rebolledo, Vice Minister for Trade, Chilean Ministry of Foreign Affairs (Feb. 4, 2016), https://ustr.gov/sites/default/files/TPP-Final-Text-US-CL-Letter-Exchange-on-Distinctive-Products.pdf [https://perma.cc/NTE9-ENL5]. Peru concluded a similar letter. Letter from Michael B. G. Froman, Ambassador, U.S. Trade Representative, to Hon. Magali Silva Velarde-Álvarez, Minister of Foreign Trade & Tourism, Peruvian Ministry of Foreign Trade & Tourism (Feb. 4, 2016), https://ustr.gov/sites/default/files/TPP-Final-Text-US-PE-Letter-Exchange-on-Distinctive-Products.pdf [https://perma.cc/D66X-XVS5].

For instance, given that the Office of the U.S. Trade Representative (USTR) negotiates on behalf of the United States, individuals or entities interested in influencing trade-commitment outcomes as represented in agreements ought to lobby USTR rather than participate in any notice-and-comment process that TTB would administer.

See, e.g., Email from Karen Welch, supra note 23 (noting that factors include “the benefits of engaging in a particular rulemaking weighed against the workload burden to the Bureau . . . , and whether the rulemaking is expected to impact a significant number of industry members and/or members of the public”).

For instance, there is a historical and factual question as to why the United States switched its practice to process-initiation agreements in 2012. Email from former official of the Office of the U.S. Trade Representative, supra note 26; Email from Karen Welch, supra note 23 (deferring to USTR but noting that “the rulemaking process can be a time consuming and labor intensive effort, and it is often difficult to put a timeline on or determine the outcome of rulemaking”).