Ineffective in Any Form: How Confirmation Bias and Distractions Undermine Improved Home-Loan Disclosures

Introduction

For several decades, Congress has attempted to help consumers make prudent home-loan decisions, primarily by mandating the use of home-loan disclosure forms that disclose the key terms of the loan, including interest rates, fees, and closing costs.1 Consumers must receive such forms at two stages: (i) within three days after they apply for a loan (containing estimated figures) and (ii) just before closing (containing final figures). In theory, the disclosures are intended to ensure that consumers have a chance to review, understand, and approve the terms of the loan. Congress has continued to rely on this method to prevent predatory lending, even as home-loan products have become increasingly complex, risky, and divergent in pricing over time.2

In 2008, in response to the residential mortgage crisis—in which many consumers took out overpriced and unaffordable home loans3—the Department of Housing and Urban Development (HUD) created a revised Good Faith Estimate disclosure form (GFE disclosure), one of the disclosures that borrowers receive within three days of applying for the home loan. HUD also created a revised HUD-1 Settlement Statement (HUD-1 form), one of the disclosures that borrowers receive at the closing of the loan, to better disclose the terms of loans to consumers.4

The 2008 revisions, which became effective on January 1, 2010, attempted to address a key problem: many consumers were taking out loans mistakenly thinking that they were receiving fixed-rate loans when they were actually getting much riskier, floating-rate loans. For the latter, the initial interest rate and monthly payments were low, but later increased to levels that many borrowers could not afford.5 The pre-2010 HUD-1 form did not require lenders to disclose the interest rate or monthly payment or explain how such rates and payments could increase.

At the time, the rules on disclosing adjustable-rate features under the Truth in Lending Act (TILA) resulted in misleading disclosures. Specifically, the Act permitted lenders to calculate a borrower’s potential monthly payment after a rate change based on an index and margin at the time the lender made the loan, rather than how high the rate could actually rise over the term of the loan.6

HUD designed the 2010 HUD-1 form to more clearly disclose this information. Moreover, in 2012, the Consumer Financial Protection Bureau (CFPB) proposed new, consolidated forms—combining the GFE disclosure with the TILA disclosure provided when an applicant applies for a loan, and consolidating the HUD-1 form with the TILA disclosure required at closing—to help consumers understand the terms of the loan being offered.7

This Essay describes the results of three eye-tracking experiments testing whether even improved loan-disclosure forms provide an effective strategy for adequately protecting consumers. These experiments tracked participants’ eye fixations as they reviewed the pre-2010 HUD-1 and TILA disclosures or the 2010 HUD-1 disclosure form. The experiments also tested participants’ recall of key loan terms and their evaluations of the presented loan. We specifically tested for “confirmation biases,” i.e., cognitive biases wherein individuals skim through documents seeking to confirm the truth of what they are told (e.g., “Your loan is at 4%”) and fail to skim for evidence that a statement is false (e.g., that the loan may start at 4%, but can increase to a rate as high as 8%).8 These confirmation biases are of particular interest because, if they produce the hypothesized effects, they would cause consumers to miss the critical information that disclosure forms were designed to communicate, thereby undermining Congress’s intentions in mandating the use of disclosure forms.

Part I of this Essay describes our methodology in further detail, and Part II presents our results. We found that consumers do demonstrate confirmation biases. Our results further suggest that the 2010 change in disclosure forms was beneficial for consumers, as fewer study participants failed to see that the interest rate could rise with the 2010 HUD-1 form than with pre-2010 HUD-1 and TILA forms. We also investigated the effect of “dual tasking.” Dual tasking may occur when, for example, a mortgage broker engages borrowers in conversation while they are attempting to read a form, and it may increase confirmation biases and cause more consumers to miss important disclosed terms. We found that dual tasking considerably decreased the effectiveness of the 2010 disclosure form.

In light of our findings and other psychological phenomena, we argue in Part III that relying primarily on disclosure forms, even improved ones, is inadequate. To better protect consumers and address the limited effectiveness of such forms, we recommend that Congress amend the Dodd-Frank Act9 to expand the limited mortgage-counseling services that the law currently requires for extremely high-cost loans to cover all home loans for which the borrower fails to pass a “financial literacy test.” Part III also recommends more robust counseling and other improvements to the counseling provisions and procedures proposed by the CFPB in July 2012.10

I. Methodology

A. Eye-Tracking

We ran three experiments that tracked consumers’ eyes as they reviewed home-loan disclosure forms. Experiment 1 investigated confirmation biases on the pre-2010 HUD-1 and TILA forms. To test whether the revised forms reduce confirmation biases and improve recall and loan evaluation, Experiment 2 investigated confirmation biases on the 2010 HUD-1 form. Experiment 3 investigated the impact of conversation on confirmation biases, recall of loan terms, and loan evaluation under the 2010 HUD-1 form.

B. Participants

We excluded data from five participants because of data-recording failures, leaving the following totals. In Experiment 1, fifty undergraduate students reviewed the pre-2010 HUD-1 and TILA disclosure forms. Twenty-five were in the “monthly payment condition,” in which experimenters told them the initial monthly payment but not how it might adjust. Twenty-five were in the “interest rate condition,” in which the experimenter told them the initial interest rate. In Experiment 2, forty-eight undergraduate students (twenty-four in the monthly payment condition and twenty-four in the interest rate condition) reviewed the 2010 HUD-1 disclosure form. In Experiment 3, forty-two undergraduate students (twenty-two in the monthly payment condition and twenty in the interest rate condition) reviewed the 2010 HUD-1 disclosure form while the experimenter attempted to engage them in conversation. In exchange for their participation, students received credit in an introductory psychology course and one dollar for every correctly recalled term.11

C. Procedure, Materials, and Equipment

We tested all participants individually in approximately twenty-minute sessions. An EyeLink 1000 eye tracker (made by SR Research, Ltd.) recorded participants’ eye movements.

Upon arrival, the experimenter informed participants that the purpose of the study was to assess how mortgage consumers review home-loan disclosure forms. Participants sat down and placed their heads in the chin rest of the eye tracker. To allow participants to acclimate to the eye-tracking apparatus, participants read through a short article unrelated to the study. After participants completed the article, the experimenter described the disclosure forms and their purpose. The experimenter explained to participants that their task was to read through the forms as if they were the consumers taking out the loans, and that, after they finished reading, they would answer questions about the contents of the forms they reviewed. The experimenter told them that they would be paid one dollar for every loan term that they correctly recalled, and that they could not reference the forms while answering the questions.

Once participants confirmed that they fully understood the task, the experimenter gave participants information that could create confirmation biases. Specifically, participants were randomly told either that (1) “the interest rate for your loan is 3.875%” (the interest rate condition); or (2) “the monthly payment for your loan is $1,960.00” (the monthly payment condition). In neither condition did the experimenter disclose that the quoted rate would apply only for a limited period of time. In contrast to Experiments 1 and 2, the experimenter in Experiment 3 attempted to engage the participants in conversation from a set of six predetermined topics while participants reviewed the forms.

After reviewing the disclosure forms, participants in all three experiments recalled loan terms and answered questions about the loan, including participants’ thoughts on the quality of the loan. The specific questions asked, as well as participants’ responses, are discussed below. After these questions were completed, the experimenter paid participants one dollar for every loan attribute they correctly recalled and thanked them for their time.

II. Results

A. Eye Fixations

We first investigated whether presenting misleading information—such as stating the initial interest rate or monthly payment without qualifying the term as temporary—would create confirmation biases. If a confirmation bias existed, participants would tend to locate information confirming the stated interest rate or monthly payment and fail to search for information that could disconfirm it. Specifically, they would fail to look for evidence that the loan adjusts.

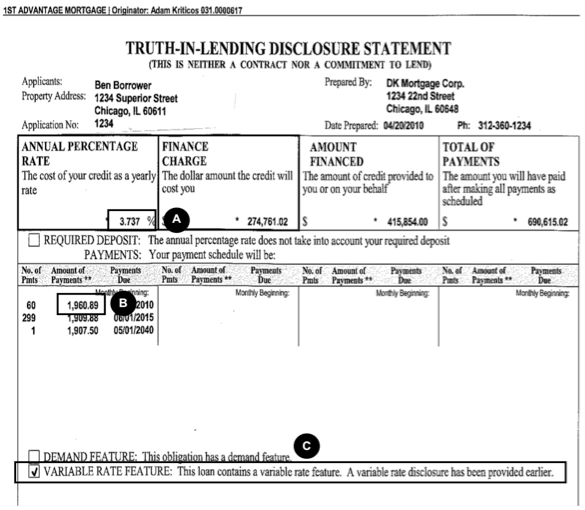

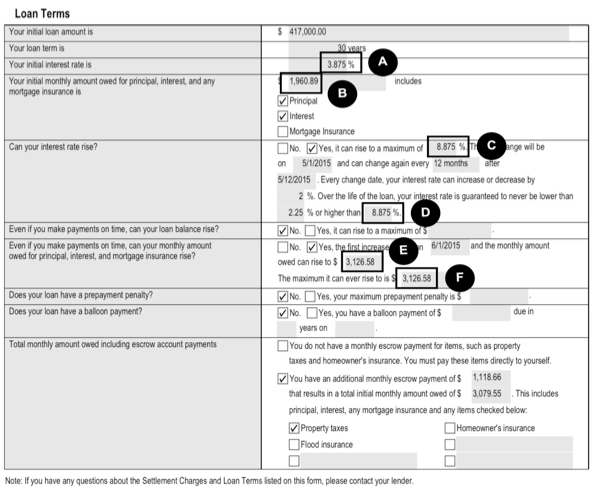

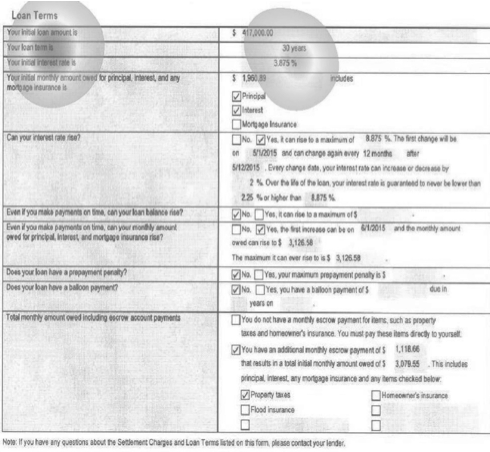

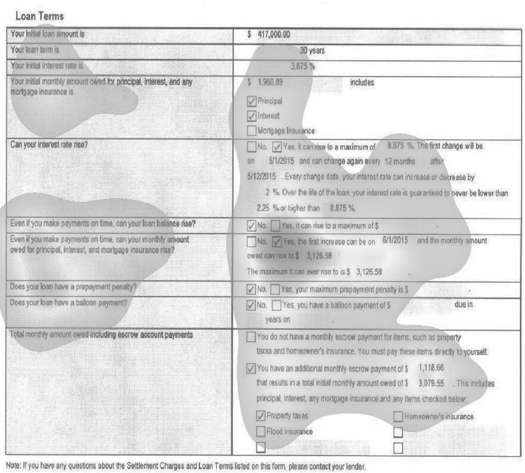

To investigate this question and track where the participants looked on the forms, we defined non-overlapping, rectangular Areas of Interest (AOIs) around the initial interest rate, initial monthly payment, and areas of the form that would make it clear that these terms were not permanent. AOIs are used to define areas of a display that are under consideration for tracking purposes. Eye movements—namely, fixations—that land on or within these areas can be analyzed and compared.12 We analyzed the number of fixations that landed on or within these AOIs, where a fixation was defined as an event in which the eyes stayed relatively still (consecutive gaze coordinates were located within one degree of visual angle of these AOIs) for a duration of two hundred milliseconds or more. We present example forms and their corresponding AOIs in Figures A and B.

Figure A.13

Figure B.14

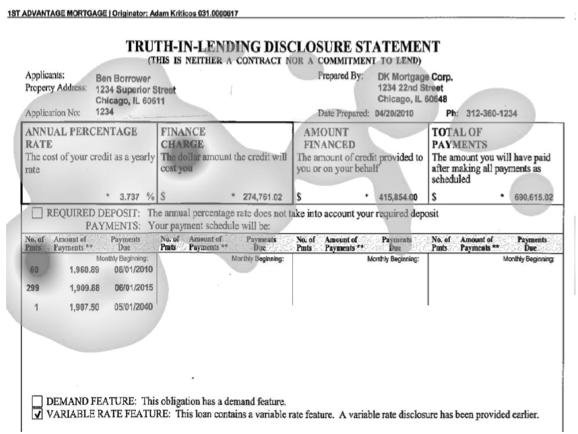

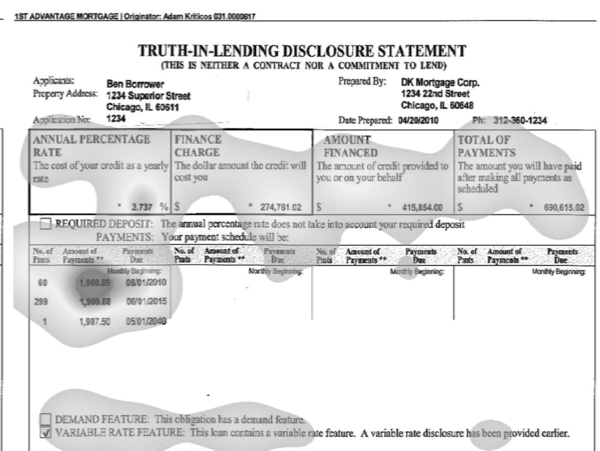

We present examples below of confirmatory and disconfirmatory fixation patterns from participants in eye-tracking “heat maps” that show distributions of eye movements. For the purposes of this study, we define a confirmatory pattern of fixation as at least one fixation in the AOI containing confirmatory information without an additional fixation in any of the AOIs containing disconfirmatory information. For example, on the 2010 HUD-1 form, if a participant made a fixation on the initial monthly payment term, but failed to fixate on at least one of the maximum monthly payment terms, we defined this pattern of fixation as a confirmatory search strategy. We define a disconfirmatory search strategy as at least one fixation in the AOIs containing disconfirmatory information. Figure C demonstrates confirmatory and disconfirmatory patterns for the TILA form used in Experiment 1. Figure D demonstrates confirmatory and disconfirmatory patterns for the 2010 HUD-1 form used in Experiments 2 and 3.

Figure C.15

Figure D.16

In Experiment 1, we excluded two participants (one of the twenty-five participants in the interest rate condition and one of the 25 participants in the monthly payment condition) from the fixation analysis because they did not fixate on either confirmatory or disconfirmatory information, leaving forty-eight participants for analysis. Of the remaining forty-eight participants, 29% of those in the interest rate condition (seven participants out of twenty-four) and 33% of those in the monthly payment condition (eight participants out of twenty-four) displayed a confirmatory fixation pattern.

In Experiment 2, we excluded one participant (one of the twenty-four participants in the monthly payment condition) from the fixation analysis because the participant did not fixate on either confirmatory or disconfirmatory information, leaving forty-seven participants for analysis. Of the remaining forty-seven participants, 4% of those in the interest rate condition (one participant out of twenty-four) and 35% of those in the monthly payment condition (eight participants out of twenty-three) displayed a confirmatory fixation pattern.

Comparing the results of Experiments 1 and 2 suggests that better designed forms may help some consumers avoid confirmation biases, but the results are equivocal. A statistical analysis combining the interest rate and monthly payment results failed to find a statistically significant advantage for the 2010 HUD-1 form over the pre-2010 HUD-1 form. While fewer participants (19%) in Experiment 2 displayed confirmatory fixation patterns than participants (31%) in Experiment 1, the difference was not statistically significant.17 When we analyzed the results by condition, we found no difference for the monthly payment condition (33% in Experiment 1 versus 35% in Experiment 2). We did find a statistically significant difference in the interest rate condition (29% in Experiment 1 versus 4% in Experiment 2).18 Thus, the improved 2010 HUD-1 disclosure form only helped participants avoid confirmation biases if the interest rate was the loan attribute they were primed to confirm.

There are several possible explanations for the disparate results between the interest rate and monthly payment conditions in Experiment 2. First, the distance between the confirmatory and disconfirmatory information on monthly payments on the 2010 HUD-1 form (rectangles B and E in Figure B) was greater than the distance between confirmatory and disconfirmatory information on interest rates (rectangles A and C in Figure B). Individuals may be more likely to notice contradictory information that is physically close than contradictory information that is physically far away.Second, it is possible that the media attention on adjustable interest rates during the recent mortgage crisis sensitized participants to the issue, but only the better-designed form allowed them to find the information they sought.19

In Experiment 3, we tested the effect of conversation on confirmation biases using the improved 2010 HUD-1 form. We excluded two participants (one of the twenty participants in the interest rate condition and one of the twenty-two participants in the monthly payment condition) from the fixation analysis because they did not fixate on either confirmatory or disconfirmatory information, leaving forty participants for analysis. Of the remaining forty participants, 42% of those in the interest rate condition (eight participants out of nineteen) and 48% of those in the monthly payment condition (ten participants out of twenty-one) displayed a confirmatory fixation pattern.

Comparing the results of Experiments 2 and 3 demonstrates that distracted participants were more likely to use a confirmatory test strategy than participants who were not distracted.20 Forty-five percent of the participants in Experiment 3 displayed a confirmatory fixation pattern, while only 19% of participants in Experiment 2 displayed such a pattern. These results suggest that better-designed disclosure forms are insufficient for protecting consumers from confirmation biases if distractions occur as consumers review home-loan disclosure forms. We have reason to believe that such distractions are commonplace.21

B. Recall of Critical Loan Attributes

Participants’ difficulties recalling information presented in the disclosure forms—even though they were paid one dollar for every correct answer—further underscores how problematic it is to rely on disclosure forms to protect consumers from predatory lending.

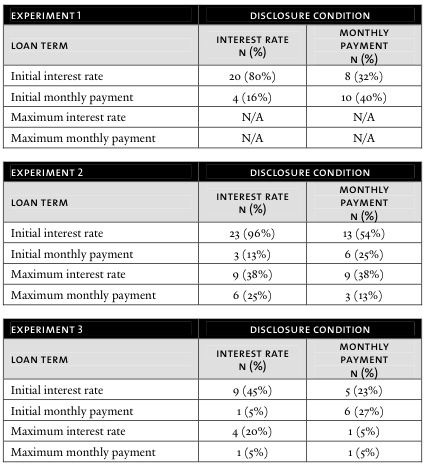

To analyze participants’ recall of critical loan terms, we focused on four attributes of the loan: the initial interest rate, the initial monthly payment, the maximum interest rate, and the maximum monthly payment. We asked participants to recall these attributes. Participants excluded from the fixation analyses in Experiment 1 (two participants), Experiment 2 (one participant), and Experiment 3 (two participants) were included in the recall analyses. We deemed an answer correct if the first two digits of the recalled value matched those of the term’s actual value. For example, if the initial interest rate was 3.875%, we counted as correct any value between 3.800% and 3.899%. Likewise, if the maximum interest rate was 8.875%, we counted as correct any recalled value between 8.800% and 8.899%.

Table 1 displays the number and percentage of participants within each experiment and condition who correctly recalled the essential loan terms.22 The results suggest that consumer recall was better using the 2010 HUD-1 form (Experiment 2), rather than using the pre-2010 form (Experiment 1). However, once we added conversation (Experiment 3), accurate recall dramatically declined even with the improved forms.

Combining the results of participants’ recall under both conditions in Experiments 2 and 3 shows that conversation inhibited recall for almost every term. Participants were less likely to recall the initial interest rate (33% versus 75% correct),23 maximum interest rate (12% versus 38% correct),24 and maximum monthly payment (5% versus 19% correct)25 while engaged in conversation. The only term for which the difference in recall was not statistically significant was the initial monthly payment (17% versus 19% correct).26 These findings suggest that conversation makes it very difficult for participants to encode and recall loan-related information.

Table 1.

Number of Participants Who Correctly Recalled Information in Each Condition

C. Estimation of Future Interest Rates and Monthly Payments in Experiment 1

In compliance with statutory requirements, the TILA disclosure used in Experiment 1 did state that the loan contained a variable-rate feature. However, neither the TILA forms nor the pre-2010 HUD-1 form presented the maximum interest rate or monthly payment possible under the loan. Moreover, the future monthly payment information on the TILA disclosure reflected an amount less than the initial interest rate and monthly payment amount.27 Although the TILA disclosure expressly noted that the loan was a floating-rate loan, the eye-fixation results presented above suggest that this statement was insufficient to alert consumers to this feature or the risk of the loan.

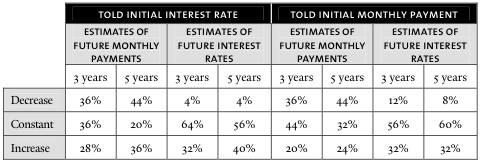

To further investigate this question, we asked participants in Experiment 1 to estimate the interest rate and the monthly payment on the loan in three years and again in five years. We classified estimates (1) below a 3% interest rate or a $1,900 monthly payment as projected decreases; (2) between a 3% and 4% interest rate or between a $1,900 and $2,000 monthly payment as constant projections; and (3) above a 4% interest rate or a $2,000 monthly payment as projected increases.

Table 2 shows the estimated values of future interest rates and monthly payments. The majority of participants projected that interest rates and monthly payments would remain constant or decrease. Only 32% and 36% of participants estimated that the interest rate would increase in three and five years, respectively. Only 24% and 30% thought the monthly payment amount would increase in three years and five years, respectively.28 Consistent with the misleading nature of the TILA statement, participants were particularly likely to project that monthly payments would decrease. These results demonstrate that the variable-rate statement included in the TILA disclosure was inadequate to inform consumers that the loan they were considering was adjustable and that the monthly payments could nearly double.

Table 2.

Experiment 1: Estimates of Future Interest Rates and Monthly Payments

D. Loan Quality Judgments

We asked participants to rate the quality of the loans they reviewed. Participants’ ability to rate loan quality is important because it goes to the very purpose of disclosure forms: to provide information on loan terms so that borrowers can make informed judgments about whether an offered loan is overpriced, unaffordable, or otherwise risky or unsuitable.

We asked participants to rate the quality of a hypothetical, variable-rate loan on a scale from one to seven. A score of one indicated a very bad loan, while a score of seven reflected a very good loan. We also asked participants to provide written comments on the quality of the loan by typing their responses on the computer screen. Participants should have rated the loan poorly and provided negative comments for the loan because it was an adjustable-rate loan (at a time when fixed-rate loans were available at historically low rates) and riskier than a fixed-rate loan.29 There were no significant differences on the loan ratings among the three experiments,30 but there were profound differences in participants’ comments.

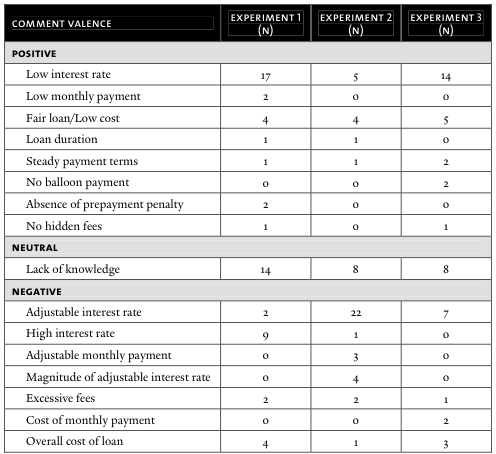

Table 3 presents these results. The comments were appropriately negative overall in Experiment 2, in which participants reviewed the better designed 2010 HUD-1 form without conversation; 64% of the comments were negative (thirty-three out of fifty-two) in Experiment 2, while only 21% were positive (eleven out of fifty-two).

By contrast, the comments were positive overall in the other two experiments. In Experiment 1, in which participants reviewed the pre-2010 HUD-1 and TILA forms, the comments were favorable overall; 48% of comments were positive (twenty-eight out of fifty-nine) while 29% were negative (seventeen out of fifty-nine). In Experiment 3, in which participants reviewed the better form but were engaged in conversation, the comments were favorable overall; 53% of comments were positive (twenty-four out of forty-five) while 29% were negative (thirteen out of forty-five).

Table 3.

Number of Participants Citing Each Explanation for Their Loan Ratings

The results from these experiments reflect a general inability of the participants to appropriately assess the adjustable-rate loan as very negative, regardless of the form used or presence or absence of distraction. A review of the narrative comments suggests that participants were more likely to recognize the possibility of a future rate increase or payment increase when they reviewed the 2010 HUD-1 form and were not intentionally distracted. From these results, we conclude that the improved disclosure forms better alert consumers to the fact they are receiving loans where the interest rate and monthly payment can increase greatly. More worrisome is the fact that none of the participants commented on the implications of the adjustable-rate loan feature for the future affordability of the loan. This suggests that consumers may need counseling to effectively judge the appropriateness of a loan.

III. Proposed Legal Reforms

The CFPB has recognized that home loans have become complicated products with terms that are often difficult for consumers to understand.31 The results of this study suggest that improving disclosure forms, without more, may be insufficient to educate consumers on the consequences of taking out home loans.

When consumers have questions regarding the information presented in home-loan disclosures, they often ask their lenders or mortgage brokers for guidance. Because those agents have a financial interest in having the borrower take out the loan, lenders and brokers may emphasize favorable rather than unfavorable loan terms or, in some cases, answer such questions in a deceptive or fraudulent way.32

That possibility, coupled with the results described in Part II, suggests that the combined disclosure forms recently proposed by the CFPB are unlikely to adequately protect consumers. Even if improved forms can successfully alert all home-loan mortgage consumers to the presence of adjustable rates, the forms fail to explain the risks from such adjustable rates. A home-mortgage loan may have other risky terms, such as a balloon-payment feature, that disclosure forms do not address.33 Confirmation biases and dual tasking, coupled with a basic lack of understanding about the meaning and significance of loan terms, make it difficult for consumers to notice or evaluate those features, even with improved forms.

To avoid overloading consumers with information, the CFPB decided not to include any educational information in the recently proposed disclosure forms.34 Yet if consumers do not understand loan features, such as “balloon payments,” and their associated problems, merely disclosing the presence of such features will not be adequate.

Even when consumers are familiar with loan features from other sources, significant cognitive and social-psychological barriers may still impede consumers’ judgments.35 For example, even if consumers are eligible for better terms, they may settle for less favorable loans if they have already sunk time, effort, and money into obtaining the loan.36 Consumers may also demonstrate inappropriate levels of trust in brokers or lenders, thinking they will provide properly priced and suitable home loans. Borrowers with less education or income may be particularly vulnerable.37 Consumers may also proceed with a loan even after spotting an unfavorable term, as long as they receive some minimal explanation. One experiment by the first two authors of this study found that the senseless explanation that the form contained a particular loan term “because it was drafted that way” was sufficient to induce consumers to proceed with a deal when they were orally promised one thing but the contract provided something different than what was promised.38

We believe that the best way to ensure that consumers understand a loan’s risks and costs is to provide “mortgage counseling interventions.”39 Under the counseling we propose, consumers would receive an explanation of the terms of the loan for which they have applied. Consumers would also receive a determination from an independent, specially trained mortgage counselor about whether the loan appears to be: (i) overpriced,40 (ii) unaffordable, (iii) risky (owing to the presence of an adjustable-rate or balloon-payment feature), or (iv) otherwise unsuitable (e.g., because the refinancing is likely to result in a net economic loss to the borrower if the borrower is refinancing an existing debt).41 Preventing consumers from entering into overpriced home loans is particularly important because a large percentage of homeowners during the housing bubble entered into overpriced loans. Current home-loan disclosures have been ineffective at helping consumers determine whether their loans are overpriced.42

Mortgage-counseling interventions could also help consumers overcome biases associated with information overload. Consumers often look for a single reason to make a decision (“reason-based decisionmaking”) and fail to perform a normative in-depth analysis when faced with too much information.43 The amount of relevant information that a counselor should review with a borrower in making a wise home-loan decision likely exceeds the amount of information that the consumer can process independently. We thus propose that counselors be required to make a simple recommendation to consumers whether or not the proposed loan appears to be the best the borrower can obtain.44

The robust form of counseling we recommend can mitigate many of the cognitive and social psychological factors that prevent home-loan disclosures from being effective, especially if, as we recommend, the counseling is tailored to address these phenomena.45 The mortgage counselors would be trained and licensed by HUD, and their determinations would be based on criteria set forth in regulations created by HUD or the CFPB.46 We recommend that the new counseling law clarify that any determinations and recommendations they make in good-faith compliance with these criteria would immunize the counselor from liability relating to them. We also recommend that attorneys train for this licensing so they can provide such counseling in addition to important legal counsel on the purchase transaction.47

Some consumer-advocacy groups have objected to counseling as the primary means of protection because they fear that it places too many burdens on consumers to protect themselves.48 But those critics assume a much weaker form of counseling than the kind we propose, where the counselor simply explains the terms of the offered loan but fails to advise the consumer on whether it is in fact a good loan.The counseling we propose, which goes beyond the counseling that the CFPB contemplates,49 would not place difficult burdens on consumers to protect themselves.

Lenders have objected to counseling, arguing that it would result in delays and add costs to the lending process.50 But counseling would be less time-consuming and costly than the process of appraising home values, a process that is already mandated. In addition, a mandatory counseling requirement could have prevented some of the billions of dollars that were lost in the foreclosure crisis as a result of unsophisticated consumers’ taking out overpriced and unaffordable adjustable-rate loans.51

In Dodd-Frank, Congress has already required counseling for certain “high-cost home loans” and for first-time homebuyers who apply for a home loan with negative amortization (i.e., where the principal amount increases rather than decreases).52 Typical home loans are not covered.53 We recommend that Congress require all home-loan borrowers to obtain counseling if they fail to pass a financial literacy test. The test would consist of a series of questions designed to gauge consumers’ understanding of real estate and financial terms and to test their ability to use disclosure forms to effectively evaluate an offered loan. Either HUD or the CFPB should create the test, and it should be available on an agency-controlled website. This will ensure that counseling be provided to those who need it most.

We also recommend that the CFPB modify its proposed regulations to better explain what information a mortgage counselor should review with the borrower. The regulations should expand on what counselors can do to make the counseling intervention more effective in addressing the problem of borrowers entering unsuitable home loans. In comments to the CFPB, we detail these recommendations further and suggest other changes to the CFPB’s proposed rules relating to the timing of counseling and the source and manner of payment of counseling fees.54 The changes we recommend are designed to enhance the effectiveness of counseling and address problems of sunk costs, temporal discounting, and reciprocity effects that exist under the procedures the CFPB proposed.55

Dodd-Frank requires lenders and mortgage brokers to provide a list of counselors to all borrowers at the time they apply for a home loan.56 In implementing this requirement, we recommend the CFPB also require that, in addition to this list, lenders and brokers provide a description of the services that counselors can provide and the fees typically charged for such services. We believe that that additional requirement will help borrowers recognize the value of counseling, which we believe exceeds the typical charge for such services.57

Finally, in preparing the list of HUD-approved counselors, we recommend that the CFPB prepare the list rather than leaving the job to the mortgage broker or lender, as the proposed rule currently provides. If lenders can select and order the list, they are likely to select those counselors who are most “lender friendly.” That will compromise the independence and integrity of the counseling that takes place and undermine the effectiveness of the counseling.

Conclusion

Results from three eye-tracking experiments demonstrate that better home-loan disclosure forms can reduce confirmation biases, improve recall of loan attributes, and improve loan evaluations. But the results also demonstrate that the advantages of better forms diminish when consumers are forced to engage in dual tasking, i.e., they are distracted by conversation while they review the disclosure forms.

In light of these findings, other psychological barriers to rational home-loan decisionmaking, and the consequences of poor decisionmaking, we propose expanding the counseling requirements in the Dodd-Frank Act to cover all home loans when the borrower has failed to pass a financial literacy test. We also recommend that the CFPB modify its current proposed rules to require more robust counseling that includes providing clear and direct advice to consumers concerning whether the offered loan is overpriced, unaffordable, risky, or otherwise unsuitable. When appropriate, counselors should also help consumers shop for loans with better terms. Disclosure forms alone are unlikely to adequately protect many borrowers, but they could be highly effective in preventing consumers from entering into unsuitable loans if supplemented with robust counseling from specially trained independent counselors.

Debra Pogrund Stark is a professor of law at the John Marshall Law School. Jessica M. Choplin is an associate professor of experimental psychology at DePaul University. Mark A. LeBoeuf is a graduate student at DePaul University. The experiments reported in this Essay were supported by a grant to Professors Choplin and Stark from the National Science Foundation’s Law and Social Science Program (SES-1024435).

Preferred citation: Debra Pogrund Stark, Jessica M. Choplin & Mark A. LeBoeuf, Ineffective in Any Form: How Confirmation Bias and Distractions Undermine Improved Home-Loan Disclosures, 122 Yale L.J. Online 377 (2013), http://yalelawjournal.org/forum/ineffective-in-any-form-how-confirmation-bias-and-distractions-undermine-improved-home-loan-disclosures.