The Evolution of Shareholder Voting Rights: Separation of Ownership and Consumption

abstract. The nineteenth century saw the standardization and rapid spread of the modern business corporation around the world. Yet those early corporations differed from their contemporary counterparts in important ways. Most obviously, they commonly deviated from the one-share-one-vote rule that is customary today, instead adopting restricted voting schemes that favored small over large shareholders. In recent years, both legal scholars and economists have sought to explain these schemes as a rough form of investor protection, shielding small shareholders from exploitation by controlling shareholders in an era when investor protection law was weak.

We argue, in contrast, that restricted voting rules generally served not to protect shareholders as investors, but to protect them as consumers. The firms adopting such rules were frequently local monopolies that provided vital infrastructural services such as transportation, banking, and insurance. The local merchants, farmers, and landholders who used these services were the firms’ principal shareholders. They commonly purchased shares not in the expectation of profit, but to finance collective goods. Restricted shareholder voting assured that control of the firms’ services would not fall into the hands of monopolists or competitors. In effect, the corporations had much the character of consumer cooperatives. This perspective also sheds light on the unusual importance given to the doctrine of ultra vires in the nineteenth century.

While current legal and economic scholarship has focused incessantly on the separation between ownership and control, the prior separation between ownership and consumption, accomplished by the late nineteenth century, was another fundamental but generally overlooked turning point in the history of the business corporation. Understanding this transformation throws light not just on historical practices, but also on contemporary debates over deviations from the rule of one-share-one-vote.

authors. Henry Hansmann is Oscar M. Ruebhausen Professor of Law, Yale Law School. Mariana Pargendler is Professor of Law at Fundação Getulio Vargas Law School in São Paulo (Direito GV). For helpfulcomments and suggestions on earlier drafts of this article we specially wish to thank Ian Ayres, Howard Bodenhorn, Ronald Gilson, Timothy Guinnane, Leslie Hannah, Eric Hilt, Daniel Ho, Naomi Lamoreaux, John Langbein, David Le Bris, Aldo Musacchio, Claire Priest, Richard Sylla, Andrew Verstein, Charles Whitehead, and Robert Wright, as well as participants at the American Law and Economics Association 2011 Annual Meeting at Columbia Law School, the Latin American and Iberian Law and Economics Association 2012 Annual Meeting in Lima, and the Comparative Law and Economics Forum in Rio de Janeiro, and at conferences and workshops at Columbia Law School, Fundação Getulio Vargas Law School in São Paulo, Tel Aviv University, Toulouse School of Economics, Vanderbilt Law School, and Yale Law School. For valuable research assistance, we are grateful to Allison Gorsuch, Ian Masias, Nicholas Walter, Julie Wang, and particularly Joanne Williams. David Louk and his colleagues at the Yale Law Journal provided excellent editing.

Introduction

Adam Smith, an early critic of business corporations, identified two principal shortcomings of that form of organization. The first was that corporations were commonly monopolies, to the disadvantage of their consumers.1 The second was what we would now label as agency costs.2 Today, the latter problem—the costs imposed by managers acting opportunistically toward shareholders, or by controlling shareholders acting opportunistically toward non-controlling shareholders—dominates discourse about corporate governance.3 Recently, scholarship in both economics and law has also come to view agency costs as the major element shaping the historical evolution of the corporate form, interpreting the peculiar features of corporate law and practice in earlier periods as means to protect small shareholders from exploitation by managers or controlling shareholders.4 This is particularly true of the nineteenth century—the era that established the principal forms of enterprise organization in their modern garb, including conspicuously, the business corporation.5 Some scholars have even suggested that corporate governance practices from the early nineteenth century might usefully be adopted today in developing economies that, like even the most advanced economies of the nineteenth century, lack strong legal institutions for shareholder protection.6

This approach, however, is anachronistic. In the late eighteenth and early nineteenth century, the main economic evil linked to the corporate form was not managerial or controlling-shareholder opportunism toward small shareholders, but rather Adam Smith’s first concern: monopoly. Prior to 1860, most corporate charters were granted by special acts of the state legislature, and as a consequence often had a degree of monopoly power conferred on them.7 More importantly, many corporations were natural monopolies due to economies of scale. The peculiar features of early corporate law and practice were frequently designed to minimize the abuse of that market power. They did not seek to protect the corporation’s shareholders as investors, as is conventionally assumed today, but rather to protect them as consumers.

To understand this, it is important to recognize a critical but underappreciated feature of corporate enterprise in the early Republic—namely, the lack of separation between ownership and consumption. In many corporations of the time, the principal shareholders were also the firm’s principal customers. These customers were the owners of businesses—farmers, merchants, and manufacturers. And the corporations were commonly providing infrastructural goods and services that were critical for the success of those local businesses.

There were two reasons for this pattern of ownership. First, for many corporations, local merchants and farmers were apparently the most effective source of capital at a time when capital markets were poorly developed and governmental financing was not generally available. Second, by controlling their service providers, the consumers protected themselves from monopolistic exploitation. Early American business corporations were often, in effect, consumer cooperatives. And, as is generally the case with cooperatives,8 they served to protect their consumer-owners from the exercise of monopoly power.

Appreciation of this ownership pattern illuminates important features of early business corporations that have recently attracted attention from scholars in both economics and law. Most prominent in this respect are the peculiar rules of shareholder voting in this era. In the late eighteenth century and much of the nineteenth century, U.S. corporations frequently had schemes of shareholder voting that deviated from the one-share-one-vote rule that subsequently became the norm.9 In particular, many nineteenth-century corporations restricted voting in ways that made it difficult for a single shareholder to obtain control of the firm. Such voting schemes were of three types: graduated voting, in which the number of votes exercisable by a single shareholder increased less than proportionately with the number of shares owned; capped voting, in which a ceiling was imposed upon the total number of votes that a single shareholder could exercise regardless of the amount of stock he or she held; and per capita voting, which is the rule of one shareholder, one vote.

These restricted voting rules first came clearly to the attention of legal scholars through the work of David Ratner10 and Colleen Dunlavy,11 both of whom documented the frequency of the phenomenon and offered a similar interpretation of it. That interpretation did not focus on economic factors such as agency costs and monopoly, but instead saw restricted corporate voting rights as driven by, as Dunlavy put it, a “social preference for particular types of governance.”12 In particular, they reflected a “social conception of the corporation” that was more “democratic” than the “plutocratic” approach to governance represented by the rule of one-share-one-vote.13 We will call this “the democracy theory.”

Subsequently, the reasons for the restricted voting rules have been taken up by a number of other scholars, all of whom have—in contrast to Ratner and Dunlavy—emphasized explanations rooted in economic considerations. Specifically, reflecting the contemporary emphasis on agency costs, these authors almost uniformly interpret restricted voting rules as “designed to attract the participation of small shareholders by offering them some measure of protection from dominance by large shareholders.”14 Under this view, restricted voting—which was usually imposed by the corporation’s own individual charter—was “the most important protection offered to early-nineteenth-century small investors,” thus compensating for the weakness of the corporate law of the time in affording adequate minority shareholder rights.15 We will call this “the investor protection theory.”

However, both the democracy theory and the investor protection theory have difficulty explaining two important elements of corporate voting patterns in the nineteenth century. First, why did restricted voting appear in certain industries—such as turnpikes, canals, railroads, banks, and insurance companies—while they were largely nonexistent in other industries, such as manufacturing? Second, why did restricted voting largely disappear from all types of corporations by roughly the end of the nineteenth century?16

We seek to shed light on these questions by offering an alternative explanation for the observed pattern of restricted voting in the nineteenth century. Our interpretation is essentially economic in character, attributing changes in shareholder voting schemes to the different economic purposes and problems associated with business corporations in the early nineteenth century compared to their present-day counterparts. In short, we argue that voting restrictions generally served as a consumer protection device in corporations that were, in a rough sense, consumer cooperatives.

This “consumer protection theory” goes far to explain the relative incidence across different industries and firm ownership structures. Nineteenth-century transportation companies (turnpikes, canals, and railroads), as well as banks and insurance companies, commonly had substantial market power; manufacturing firms, by contrast, did not. Moreover, the firms adopting voting restrictions were typically local monopolies that provided vital ancillary services to local merchants. With surprising frequency, those merchants were at the same time the principal customers and the principal shareholders of early business corporations, for two important reasons. First, local merchants had an interest in helping form and finance an element of economic infrastructure that would be important to the success of their businesses.17 Second, this ownership pattern served to ensure that control over such an infrastructure element did not fall into the hands of profit-oriented investors who would charge the merchant monopoly prices for its use, or into the hands of one of the merchant’s competitors, who would use their control to discriminate in favor of their own businesses and against others in terms of the price, quantity, or quality of services provided.

The consumer protection theory also helps explain why voting restrictions effectively disappeared from business corporations in the late nineteenth century. By then, local and state governments had taken on the primary responsibility for constructing and maintaining physical infrastructure such as roads and bridges. Railroads had become too long and capital intensive to be financed and controlled by essentially voluntary organizations, while capital markets developed to provide the necessary financing for private enterprise. Improvements in transportation and communication increased competition in banking and insurance, while governmental regulation made investor-owned firms increasingly viable. Exploitation of market power came to be managed by separate bodies of antitrust and rate regulation law rather than by corporate law. Separate statutes for cooperative corporations were adopted and used to organize, in a more viable form, the cooperatives that were employed in subsequent decades to deal with monopolies not well controlled by the state, as in agriculture. And restricted voting rules were easy to avoid over time, making them only a crude and temporary form of consumer protection, and one whose costs—in terms of weak governance and limited access to capital markets—did not need to be borne after superior substitutes were developed.

The consumer protection theory that we offer to explain nineteenth-century voting restrictions is strongly at odds with the investor protection theory. When a firm is a monopoly, there is a clear conflict of interest between the firm’s investors and the firm’s customers. The investors benefit most by having the firm charge monopoly prices, while the customers are best served by having the firm charge competitive prices—or, in fact, even prices that do no more than cover marginal cost, so that the firm effectively provides no return at all to the shareholders’ investment. Consequently, if the firm is controlled by shareholders who are also major customers of the firm, the shareholders may prefer to keep the firm’s prices low, and get the return on their investment in the form of low prices rather than high dividends. But this policy will not be attractive to shareholders who are not also customers of the firm. From the perspective of an investor in the corporation, the customer-shareholders of the firm are tunneling out its (potential) profits through their other transactions with the company.

In contrast to the substantial literature offering the investor protection theory of restricted voting rules, two authors, both writing in the legal literature, have suggested something analogous to the consumer protection theory. One is Donald Smythe, who, in a short but insightful comment on Dunlavy, proffers without further investigation the hypothesis that the restricted voting rules in corporations providing amenities such as bridges and turnpikes might be explained by their character as suppliers of local public goods.18 The other is Joseph Sommer, who, in a thoughtful article on the historical development of banking in the first decades of the American Republic, observes that the banks of that era frequently had the character of merchants’ “utilit[ies],” “clubs,” “credit union[s],” or “cooperatives.”19

It is a familiar notion that the twentieth century brought the separation of ownership and control in large U.S. business corporations. Less familiar, but surely as fundamental, was the prior separation of ownership and consumption that characterized the evolution of corporations in the nineteenth century. Appreciation of this separation and its causes helps us understand the differentiation of the corporate form, in the course of the nineteenth century, into the various distinct types that governed enterprise organization for most of the twentieth century: the business (joint-stock) corporation, the cooperative corporation, the nonprofit corporation, and the municipal corporation. The early chartered corporations that we focus on here, with restricted voting rules, in effect combined elements of each of these latter forms: formal ownership by virtue of capital investment as in a joint stock company, de facto consumer ownership as in a cooperative corporation, philanthropic funding as in a nonprofit corporation, and provision of local collective goods and services as in a municipal corporation.

After restricted voting gave way to one-share-one-vote, the latter rule dominated publicly held corporations in the United States for the following century, and in fact was a requirement for listing on the New York Stock Exchange from 1926 to 1985. In recent years, however, the consensus in favor of that rule in the United States has become frayed. Highly prominent firms, such as Google and Facebook, have adopted—via dual-class stock—voting allocations that are effectively the opposite of restricted voting, with substantially more votes per share allocated to the largest shareholders than to smaller shareholders—a pattern we might call “augmented voting.” If this trend continues, then shareholder voting rules in U.S. publicly-traded business corporations will have followed what appears to be a continuous shift, over two centuries, from restricted voting to pro rata voting to augmented voting. But there is no consensus on the reasons for the recent embrace of augmented voting—or on whether it will last or whether it might be beneficial for society in general.20 Moreover, a prominent proposal for a return to restricted voting has recently been made, advocating in particular a system of “square-root voting” for publicly traded corporations, under which votes would increase as the square root of the number of shares that a shareholder owns in a corporation (so that, for example, one share would bring one vote, one hundred shares would bring ten votes, etc.).21 And investor protection is the principal objective of the proposal.

We will not pursue these contemporary developments here. But, in seeking to understand the patterns of corporate control that might be appropriate in the twenty-first century, it is helpful to understand how and why other patterns developed in the nineteenth and twentieth centuries.

The remainder of this Article explores the potential of the consumer protection theory of restricted voting by examining more closely the economic properties of different voting schemes and the available data on shareholder voting rights in nineteenth-century corporations. Part I describes the schemes of shareholder voting rights adopted by U.S. corporations in the late eighteenth and early nineteenth centuries. We break down our analysis by industry and show that voting restrictions appeared with far greater frequency in firms that had market power and were owned by their principal customers. In Part II, we suggest that the consumer protection account sheds light on another feature of early corporation law for which conventional explanations seem unsatisfying: the doctrine of ultra vires. Part III then explores the reasons for the progressive abandonment of restricted voting schemes in the latter part of the nineteenth century. Part IV explores the potential of the consumer protection account to explain the foreign experience with restricted voting in early business corporations.

I. corporate ownership and voting rights in early u.s. history

We begin by examining the ownership structure and voting patterns of U.S. business corporations in the late eighteenth and early nineteenth century. For ease of exposition, we divide our analysis by industry sector, focusing first on corporations promoting physical infrastructure projects, second on financial firms, and finally on manufacturing corporations.

A. Physical Infrastructure

Today, much of society’s basic physical infrastructure, and particularly major elements of transportation networks such as roads and bridges, are financed—and commonly owned and operated—by one or another level of government. In the early decades of the American republic, however, the situation was quite different. Municipal corporations in the American colonies, like their English counterparts of the seventeenth and eighteenth centuries, were generally dominated by local tradesmen, and served largely to establish and protect the monopolistic guild-like powers of the various trades.22 Municipalities sometimes constructed and operated facilities such as market halls and wharves, though apparently in large part for the sake of reinforcing the market power of the various trades and of the municipalities themselves, for which the facilities provided a source of income through user charges.23

The American Revolution brought substantial democratization to local government,24 but, as we explain below, this did not result in broad expansion of local (or state or national) governmental provision of physical infrastructure. Not only was the historical precedent for much activity of this sort lacking, but so was the popular will. Strong suspicion of government and resistance to taxes—particularly conspicuous in the Jacksonian era—were accompanied by fierce regional rivalries that blocked agreement on governmental development projects.25

State governments of the early nineteenth century were, however, prepared to give corporate charters to groups of citizens who wished to finance and manage publicly beneficial improvement projects on their own. The result was the widespread resort to private organization and financing. And the internal governance structures given these corporations reflected their role as private producers of public goods.

1. Turnpikes

Turnpikes provide a paradigmatic example of the use of voting restrictions in firms that were principally owned by their customers. In the late eighteenth and early nineteenth centuries, turnpikes were almost invariably undertaken by business corporations.26 Turnpikes were in fact one of the most common forms of business corporation throughout this period. Over one-fifth of all corporate charters granted in the late eighteenth century concerned turnpike companies, which remained one of the leading forms of business corporation in the East Coast through the early nineteenth century.27 Turnpikes made up one-third of all New York incorporations between 1800 and 1830.28

Restricted voting schemes were particularly prevalent in turnpikes. Joseph Stancliffe Davis notes that voting caps were “well-nigh universal” in eighteenth-century turnpike companies.29 Other surveys of voting patterns in nineteenth-century business corporations find that turnpikes displayed the highest incidence of voting restrictions across all industries. In his study of early New York corporations, Eric Hilt finds that a striking 98% of turnpike charters included voting restrictions and only 1% of them specified a one-share-one-vote scheme.30 Hilt estimates that turnpikes had a significantly lower level of voting concentration than corporations in other industries (a score of 0.23 in his index, compared to the next lowest score of 0.70 for bridge companies).31 Similarly, John W. Cadman reports that, even though the “vast majority” of early New Jersey corporations granted one vote per share, a significant number of turnpikes adopted either voting caps or a graduated voting scale.32

To confirm and extend these statistics, and others we report below, we undertook our own analysis of a large database—assembled and generously made available to us by economic historians Richard Sylla and Robert Wright33—that contains the voting rules of nearly all (more than 22,000) business corporations that obtained a legislative charter in any of the states of the United States between 1790 and 1859. A more extensive description of that database, as well as tables with statistics we have derived from it, appears in the Appendix. To simplify interpretation, we focus only on corporations formed in the original thirteen states. Moreover, we exclude from our analysis the states of Massachusetts and South Carolina, for which there are indications that the original data contain systematic omissions or miscoding. This leaves us with a sample of 6,387 corporations. We will refer to our work with this sample as our “multistate analysis.”

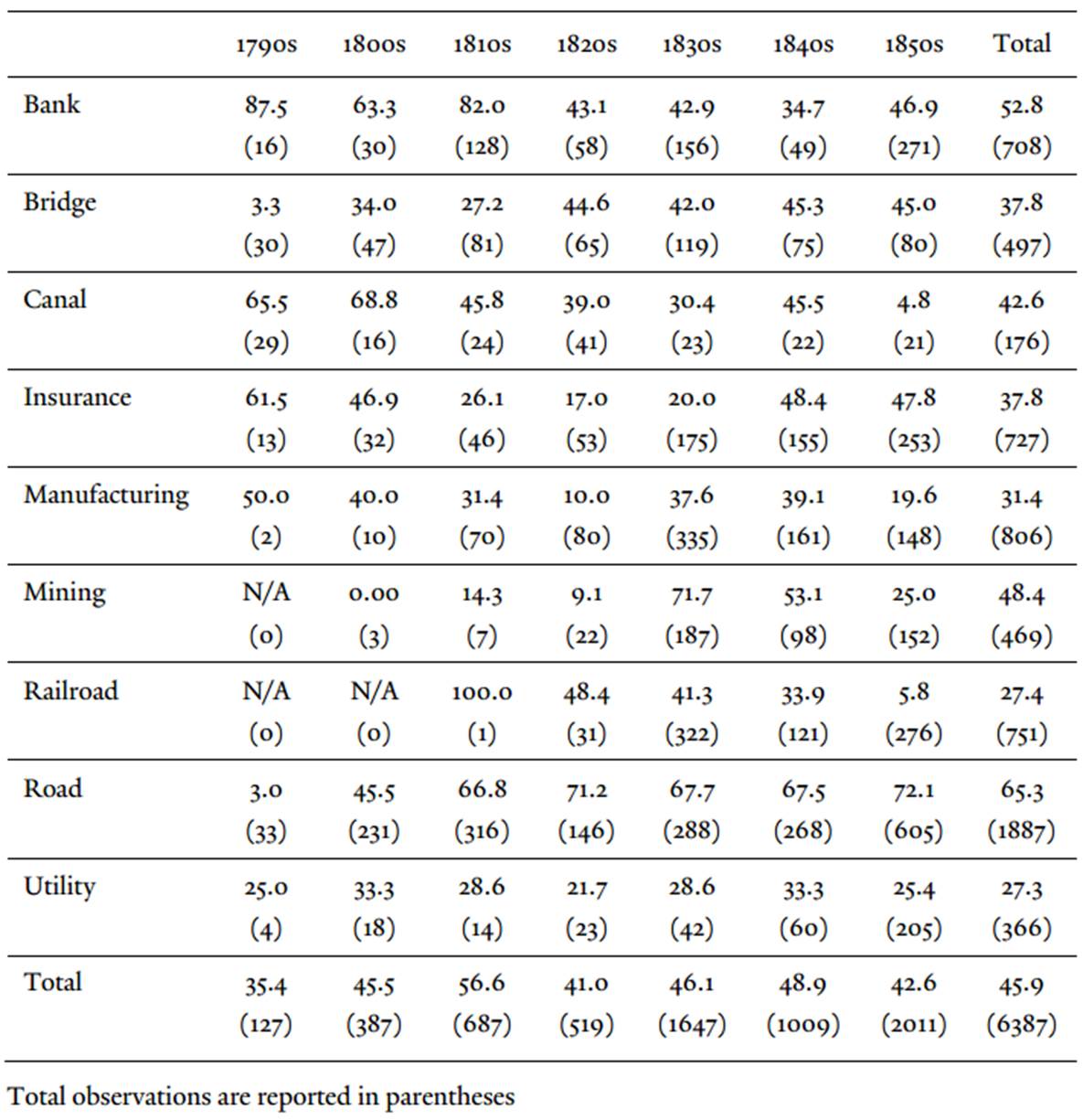

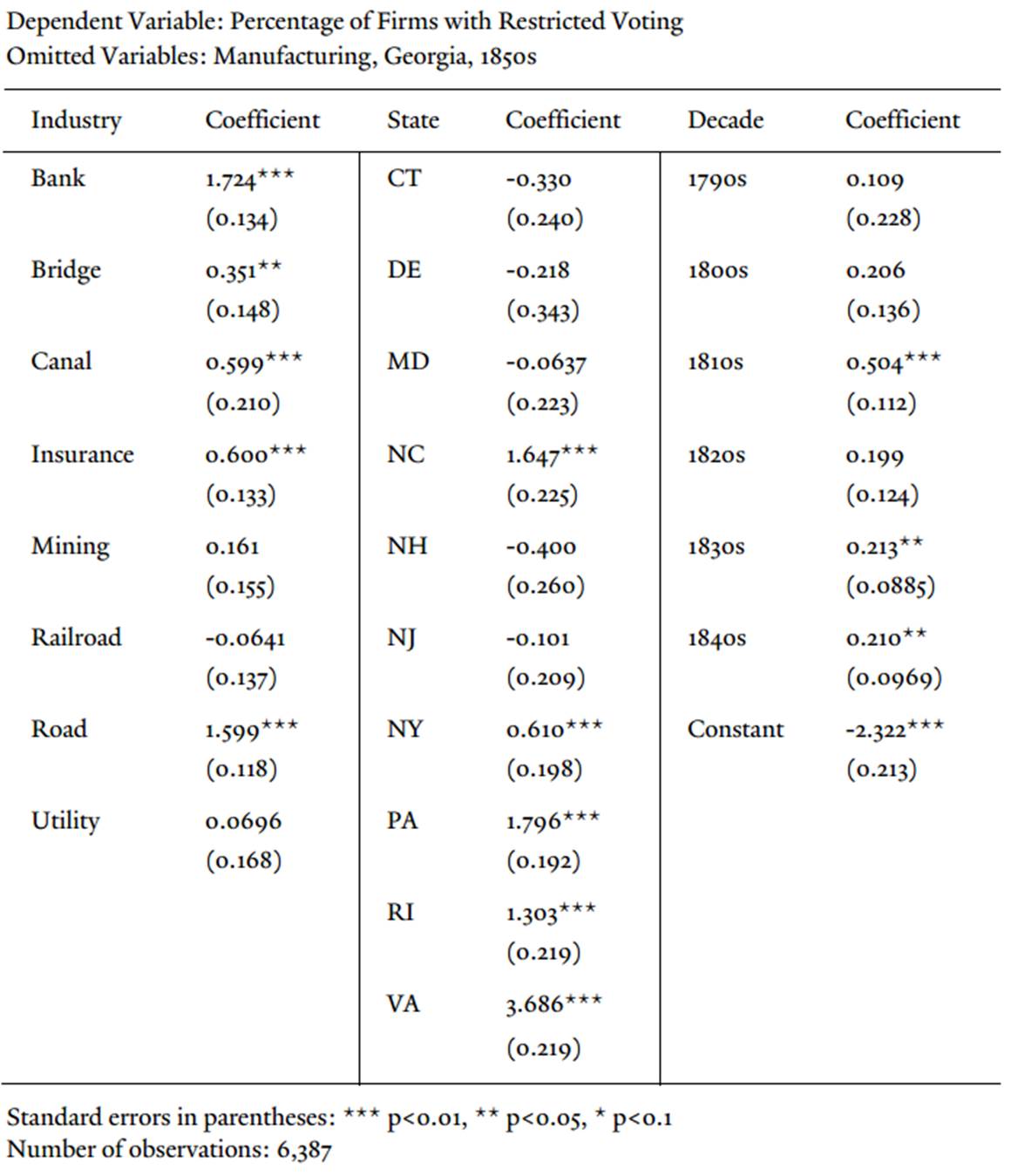

As shown in Table 1 in the Appendix, our multistate analysis reveals that 65% of corporations undertaking turnpikes or plank roads (which we combine under the heading of “roads” in the tables) had restricted voting regimes over the period 1790-1859. Confirmation that this percentage is significantly higher than those for manufacturing is provided in Table 2, which contains the results of a regression analysis showing that, controlling for state and decade of incorporation, turnpikes and roads were significantly more likely to have a restricted voting rule than were manufacturing corporations.

Consistent with the consumer protection account, turnpikes were the industry in which the interests of shareholders in the firm’s output (the road), rather than in the firm’s profits, were most conspicuous. Turnpike stockholders were commonly merchants and landowners who were located along the path of the turnpike and would benefit from its presence.34 As put by Ronald Seavoy, “[t]urnpikes were popular investments, not necessarily because they were expected to be profitable, but because they improved access to markets, raised local land values, and lowered the costs of goods that had to be teamed in. Shares were of low par value and were widely held.”35

In fact, turnpikes rarely paid dividends to their investors, and were not expected to.36 Purchasing a share resembled a voluntary payment of taxes toward a public good.37 Social pressure to contribute to this community improvement was an inducement to subscriptions, and the unlikely prospect of a financial return on the stock might have served as a form of “selective incentive[].”38 But the most effective marketing tool in attracting shareholders was the recurring emphasis on the expected financial benefits that the road would bestow upon them as local merchants and landowners.39

That the principal interests of turnpike shareholders lay in the firm’s output, not in its profits, was apparent from the turnpike litigation in the early nineteenth century. Indeed, some courts went as far as to allow shareholders to renege on their subscription commitments if a subsequent alteration of the turnpike’s route made the road less useful to them as prospective users. For example, in Middlesex Turnpike Corp. v. Locke,40 a shareholder successfully defended an action for payment of assessments made after his subscription precisely because a later act of the legislature had altered the planned course of the turnpike road. Defendant’s counsel successfully argued that his client

never consented to become a proprietor in the turnpike, as it was in fact located and made. He was induced to subscribe originally, on account of the particular convenience to him of the turnpike as originally directed. He would perceive no such convenience in the other route. He would have never subscribed to aid the latter . . . .41

The court agreed and let the shareholder off the hook.42

Even the courts that refused to invalidate subscription obligations due to later changes of route understood full well the nature of the interests of turnpike shareholders in the enterprise. In Irvin v. Susquehanna & Phillipsburg Turnpike Co.,43 counsel for the aggrieved shareholder contended that “it was not at all contemplated that the profits of the road would compensate the individuals for their money subscribed; it was the facilities and benefits which would result to their property: and it was upon this consideration that Ir[v]in entered into the engagement to pay.”44 The Court agreed that while the indirect benefits to owners provided a “very powerful incitement” to turnpike subscriptions, it refused to equate “the motive for entering into the contract, with the consideration of it.”45

In this context, restricted voting helped ensure that nobody—and, in particular, nobody who was not a major user of the turnpike—would accumulate enough shares to give him or her both the interest and the authority to set the tolls at a price much higher than marginal cost, much less to monopoly pricing levels.46 It was evidently understood that economic development would advance most rapidly and most advantageously toward all adjacent merchants and landowners if tolls on the turnpikes were kept low. Toll prices were kept very low indeed (almost to the point of undermining the firms’ viability) and underwent little change under the period. It is telling that, despite the well-known lack of profitability, petitions to the legislature for toll increases seemed to be very rare.47

The notion that voting restrictions favored the interests of consumers at the expense of investors was well understood at the time. This point is clear from the 1846 Report of the Revisors of the Civil Code of Virginia, a rare piece of evidence of legislative intent on the reasons for abandoning restricted voting schemes. This work noted that the financial interests of the state government as a shareholder in many public improvement corporations counseled in favor of the one-share-one-vote rule.48 The Revisors showed concern that excessively stringent voting restrictions were allowing shareholder-consumers to exercise disproportionate influence over corporate management so as to favor low prices to the detriment of profitability. According to the Report, “[t]he private stockholder who has a large amount invested will be apt, when he gives his vote, to consider the effect of that vote upon his investment, and go for such a course as seems best calculated to make his stock productive . . .”; by contrast, “the man who has but one or two shares will often be either indifferent as to the measures that are adopted, or be less alive to the interest of a stockholder looking for dividends, than to the interest of one using the work, that the tolls should be low.”49

2. Bridges

Voting restrictions were present in bridge companies incorporated in some states but not in others. Hilt finds that 42% of all bridge companies chartered in New York through 1825 adopted a restricted voting scheme.50 Voting restrictions also appeared in some early bridge companies in Massachusetts and in many bridge company charters in New Jersey.51 Conversely, bridge corporations chartered in Connecticut only rarely adopted restricted voting.52 In our own multistate analysis, 38% of bridge corporations formed between 1790 and 1859 had restricted voting.

Two of the most important nineteenth-century cases involving business corporations concerned bridge companies: the landmark Supreme Court decision in Charles River Bridge v. Warren Bridge,53 which held that a corporate charter does not imply a grant of monopoly privileges, and Taylor v. Griswold,54 the most cited case for the proposition that one-member, one-vote was the common law rule on shareholder voting rights in business corporations.55 These influential decisions notwithstanding, bridge corporations have received far less scholarly attention than their counterparts in other industries.

This dearth of historical studies translates into less information on the ownership patterns of early bridges and the driving forces behind their incorporation. Like turnpikes, bridges commonly have an important degree of monopoly power, which would naturally be expected to encourage consumer ownership. In describing the incorporation of Charles River Bridge, the first such company to be chartered in Massachusetts, Joseph Davis observes that “expectations of improvements in local business and in land values played a large part in the promotion, besides the prospects of revenue from tolls.”56 However, by the time the Charles River Bridge case was decided (more than fifty years after the establishment of the company), the Supreme Court consistently referred to the interests of its shareholders as those of investors.57

In Taylor v. Griswold, the question before the New Jersey Supreme Court was whether a bridge corporation could adopt bylaws permitting voting by proxy and providing for a one-share-one-vote rule in shareholder meetings when the company’s charter was silent on the issue. The court ruled in the negative, concluding that only the corporation’s charter, not the bylaws, could permit departures from the common law rule of one vote per member. In doing so, the court emphasized the “public nature” of corporations operating turnpikes, bridges, and railroads, as opposed to corporations it deemed to be “strictly private,” such as banks and insurance companies.58 Colleen Dunlavy pointed to the argument that “[e]very corporator, every individual member of a body politic, whether public or private, is, prima facie, entitled to equal rights”59 as paradigmatic of a different social conception of the corporation.60

Nonetheless, a closer reading of the Taylor opinion suggests that the adoption of restricted voting schemes in the nineteenth century was at least partially motivated by economic considerations. The New Jersey court’s decision, in particular, explicitly hints at a connection between voting restrictions and the interests of the consuming public in the face of a monopolistic firm. As put by Chief Justice Hornblower,

the apparent tendency, of the by-law in question [adopting a one-share-one-vote rule], is to encourage speculation and monopoly, to lessen the rights of the smaller stockholders, depreciate the value of their shares, and throw the whole property and government of the company, into the hands of a few capitalists; and it may be, to the utter neglect or disregard of the public convenience and interest. I do not say, that such was the design, or that such has been the effect; but only, that the natural or probable tendency of the by-law in question, is to produce such a result.61

The Court reasoned that because bridges “partake more of a public nature . . . the public have a more direct and immediate interest in their management,” an objective that would be arguably best achieved by a one-member-one-vote rule—a voting scheme that gives primacy to the interests of consumers and the public vis-à-vis those of providers of capital.62

3. Canals

The incidence of voting restrictions in canal corporations varied across time and place. Early canal charters in Massachusetts frequently provided for voting caps.63 Restricted voting schemes were also present in New Jersey canals, but were entirely absent from the corporate charters of the four canals incorporated in Connecticut through 1856.64 Our own multistate analysis indicates that 43% of canal corporations formed between 1790 and 1859 had restricted voting, with a peak of 66% having restricted voting in the 1790s.

The impetus behind the creation of the first canals in the United States was essentially the same as that for turnpikes. Local merchants and landowners whose business would benefit from improved means of transportation pooled resources and incorporated some of the early canals.65 Other eighteenth-century canals, however, attracted foreign investments from the beginning.66

The Middlesex Canal, one of the few early canals to be successfully constructed and operated, though unprofitable, provides an example of this type of locally owned and financed enterprise. Its founders were merchants, professional men, and landholders of Medford, the locality which, as the natural terminus of the canal, stood to benefit most from the new enterprise.67 Christopher Roberts attributes the significant stability of the canal’s shareholder base in its early years to “the function of coöperating owners uniting to establish a public utility.”68 The Middlesex Canal’s original charter of 1793 contained an elaborate graduated voting scale, a scheme that was streamlined by a charter amendment two years later granting voting by shares subject to a limit of twenty-five votes per shareholder.69 In the Delaware and Raritan canal, a restricted voting scheme was apparently instituted as a defensive mechanism against foreign (i.e., out-of-state) control of the enterprise, again presumably to protect shareholders as customers at the expense of their interest as investors.70

Ultimately, U.S. canals came to develop as government rather than private (either investor-owned or consumer-owned) enterprises, evidently for a variety of reasons.71 First, U.S. demographic patterns cut against private ownership of canals by investors.72 The most densely populated and commercially active areas in the United States were located either next to natural waterways or in the proximities of big East Coast centers that were accessible by roads, thus rendering canals uncompetitive.73 Second, private ownership by customers was surely impeded by the need for large amounts of capital, and by the heterogeneous group of merchants served by a long canal. Third, although the actors of the time would not have spoken in these terms, they presumably recognized that the high fixed costs and low variable cost of a canal required that, for efficiency, prices be set lower than the average cost, which required a substantial construction subsidy that was best injected through government ownership. Prior to the Erie Canal, only three of the existing canals in the country covered more than two miles; at twenty-eight miles in length, the Middlesex Canal was the longest of them, but struggled financially.74 In constructing and financing the trailblazing Erie Canal without the intermediation of the corporate form, the state government of New York inaugurated a new era of direct state involvement in canal development.75 Those public projects, in turn, would soon be threatened by the rise of railroads.

4. Railroads

Railroads came to dominate long-distance transportation in the nineteenth century, but they appeared later than the turnpikes and canals that they eventually replaced. While turnpikes and canals had been chartered since the eighteenth century, the first railroad corporations date from the late 1820s.76 As was the case with many canals, some railroad corporations received substantial government backing, but most of the early New England railroads formed in the 1830s were wholly private enterprises.77

Voting restrictions were common in the early stages of private railroad development. Massachusetts railroads established in the 1830s typically capped the voting power of large shareholders.78 A Massachusetts railroad statute of 1836 restricted the voting rights of individual shareholders to one-tenth of the number of outstanding shares,79 a rule also followed by five of the first ten railroads incorporated in Connecticut.80

Similar to turnpikes and canals, the formation of early railroad corporations was commonly animated by the prospect of indirect benefits stemming from improved means of communication. With minimal exceptions, domestic and foreign finance capital, which became important financing sources in later decades, did not play a major role in funding early railroad construction.81 As highlighted by Thelma Kistler, the first railroad promoters generally framed their appeals for subscriptions in terms of “incidental advantages” rather than profitability. Shareholders agreed to subscribe for the stock of the Western Railroad despite “a certainty of no direct profits.”82 Likewise, calls for contributions from residents along the route of the Amherst and Belchertown road stressed that subscriptions were not meant to be “an investment” for “financial return,” but rather “to secure the benefits for himself and community.”83

However, restricted voting gradually fell into disuse as the industry matured in its first decades. All Connecticut railroads chartered after 1841 granted one vote per share.84 New York’s general incorporation law for railroads of 1850 also specified a one-share-one-vote rule in director elections.85 In our multistate analysis, the percentage of railroad charters with restricted voting dropped precipitously from 48% of those chartered in the 1820s to 6% of those chartered in the 1850s. Consistent with these figures, Colleen Dunlavy shows that in the 1840s, support for restricted voting was already rapidly losing traction even in railroad corporations that initially limited the voting rights of large shareholders.86

We suggest that changes in voting rules parallel major transformations in the financing and ownership structure of railroad companies. Late nineteenth-century railroads came to be seen as the paradigm of the modern, large-scale business corporation requiring massive amounts of capital, specialized management, and dispersed ownership. Railroad securities ultimately became the darlings of Wall Street and the object of the most high-profile corporate scandals and control contests of the nineteenth century.87 But this shouldn’t obscure the fact that many of the earliest U.S. railroads closely resembled the type of cooperative enterprise that characterized other early transportation companies.

The geographical distribution of early railroad shareholdings corroborates the import of ancillary benefits as an inducement to stock subscriptions. The first railroad corporations in New England were eminently local businesses, covering an average distance of 36 miles as late as 1850.88 As many as 95% of Western Railroad’s Massachusetts shareholders (holding 96.6% of its total stock) resided along the route of the road.89 Most shareholders of the New London Railroad were also adjacent residents.90 All in all, the vast majority of early railroad promoters and shareholders were local merchants, manufacturers, or landowners who expected to benefit from the railroad’s operations.91

The interests of shareholder-consumers help explain the use of voting restrictions in early railroad companies. A key driver behind the first railroad incorporations, in particular, was “the desire to deflect trade from a rival commercial town.”92 In this light, voting restrictions helped assure that the corporation would not easily come under the control of capitalists having interests antagonistic to those of the railroad and its beneficiaries—a consideration that seems to have carried real weight at the time.

The experience of the Western Railroad, one of the first Massachusetts railroad companies, is illustrative of this concern. In 1834, when the Western faced great difficulty obtaining the requisite financing for construction, a group of New York capitalists offered to subscribe to the company’s entire capital in exchange for control of the business. Despite the firm’s urgent need for funds, its representative rebuffed the offer, pointing to the risk that the railroad would be “so managed as to defeat the purpose of its incorporators.”93 The voting restrictions specified in Western’s initial charter, which capped the voting rights of individual shareholders at one-tenth of the total shares,94 arguably fulfilled a similar function.95

By contrast, the little Mohawk and Hudson Railroad chartered by the New York legislature in 1826 was one of the few early railroads to be entirely investor owned.96 The Mohawk, which sought to connect the cities of Albany and Schenectady, was the first New York railroad designed to draw passenger traffic.97 Unlike its contemporary counterparts, it was not a local enterprise, being primarily sponsored by New York City capitalists.98 In 1830, only two months after the beginning of construction, it became the first railroad to be traded on the New York Stock Exchange.99 Consistent with its investor ownership, the Mohawk adopted a one-share-one-vote rule from the outset.100

The development of the railroad industry brought about changes in its financing and size. Once the first railroads were successfully constructed and turned out to be lucrative ventures, railroad promoters began to emphasize potential profit as well as indirect benefits when seeking new subscriptions.101 The structure of early railroads as “local ventures designed to serve local purposes” no longer seemed practical after 1847, and railroad expansion to more distant areas of the country became a priority.102

As the scale of railroad operations expanded, so did their financing sources. As noted by Winthrop Daniels, in the infancy of the industry, railroads “were chiefly financed by the savings of the localities they traversed.”103 Railroads resorted to the issuance of bonds beginning in the 1850s; meanwhile, railroad securities were becoming popular in eastern financial centers, and were increasingly held by speculators or magnates seeking control of the enterprise.104 By 1905, it appeared clear that “Wall Street is built on railway securities.”105

As the industry developed, and railroad ownership and control shifted away from local beneficiaries to investors, public dissatisfaction mounted over the railroads’ monopolistic pricing practices. Arthur Hadley’s classic study on railroad history viewed the separation between owners and customers as the source of discontent against railroad monopoly. “Serious conflicts of interests concerning a turnpike or bridge were almost impossible,” he argued, “because those who owned them and those who used them were to a large extent the same, or, at any rate, came in personal contact”; by contrast, “one set of men own a railroad and another set of men use it.”106

B. Financial Infrastructure

Restricted voting was not confined to firms providing society’s physical infrastructure. It was also frequently employed by firms that provided the financial infrastructure for business activity.

1. Banks

Voting restrictions were also common in early U.S. banking firms. Merrick Dodd finds that voting caps were a “uniform practice” in Massachusetts banks in the early nineteenth century.107 According to Dreier’s study of nineteenth-century Connecticut charters, banking corporations accounted for the highest incidence of voting restrictions across all industries, with precisely 50% of such firms specifying a graduated voting scale or, more often, an absolute cap on the number of votes per shareholder.108 Similarly, nearly one half of early New Jersey banks adopted a graduated voting scale.109 Voting restrictions were comparatively less frequent among New York banks. Hilt finds that 26% of New York banks in his sample adopted restricted voting, while 63% followed a one-share-one-vote rule.110 Our multistate analysis, in turn, shows 53% of banks adopting restricted voting between 1790 and 1859, with 82% doing so in the active decade from 1810 to 1820.

Like other early business corporations, the impetus for the creation of the first banks often came from parties who were more interested in the bank’s services than in its profits.111 In the words of Robert Morris, the Superintendent of Finance who promoted the creation of the first chartered bank in the United States, the Bank of North America, the bank’s profit rate “would never be sufficient inducement to hold stock, if there were no other consideration”112 and the majority of its shares “belong to citizens of Philadelphia, and principally to the commercial men, whose greatest inducement to continue [as] stockholders, is to support an institution which affords them accommodation and convenience, by means of discounts.”113

Local merchants were simultaneously the principal owners and the principal customers of most banks in the late eighteenth and early nineteenth centuries. In the words of a contemporary observer, “those who are not capitalists, but who are borrowers” were the main promoters of early Massachusetts banks.114 In their work on the history of New York’s Citibank, Harold Cleveland and Thomas Huertas noted that “like nearly all banks of the day,” the bank established in 1812 “was intended to be a kind of credit union for its merchant-owners.”115

These banks typically financed the purchase and sale of merchandise at wholesale, and steered away from serving other types of potential customers.116 In particular, banks provided much-needed liquidity for these merchants, who often had to advance credit at both ends of a given sale transaction.117 For example, merchants would pay sellers of merchandise with notes of obligation rather than with piles of coin. The sellers could then take those notes to the local bank to “discount” them—which is to say, exchange the company’s notes for short-term credit in the bank, with the bank taking a small fee (discount) for the transaction. The bank might itself give sellers notes of obligation—banknotes—issued by the bank, which these sellers, in turn, could hand over to other merchants as payment for consumption goods. Unlike modern commercial banks, which take deposits from the general public, early banks lent heavily out of their own capital stock.

Competition appears to have been limited in late eighteenth- and early nineteenth-century banking. Dreier reports, for example, that “[j]udging by the names of the banks and insurance companies chartered by special act in Connecticut between 1789 and 1856, which usually reflected where they were located, it was rare to find two banks, or two insurance companies insuring against the same risks, in the same town.”118 This initial shortage of bank charters was reinforced by state limitations on interstate and intrastate branching and by the legal restrictions on unincorporated banking in many states.119 While these legal restraints on bank competition were evidently in large part the product of ideology and political influence, early banks may also have enjoyed some monopoly power as a result of simple economies of scale. For example, prior to the establishment of a national currency in the 1860s, there were presumably important economies of scale in the issue of private banknotes.

The combination of a limited supply of bank charters and price regulation via usury laws led banks to favor insiders in allocating funds.120 Merchants unaffiliated with banking institutions had difficulty obtaining credit. Hence there was a good reason for local merchants, who needed the bank to discount their notes, to control the bank (and, before they did that, to pitch in together to finance its creation). That is, in this scenario, “[e]ach borrowing interest wanted a bank of its own.”121

Moreover, banks of the time were highly risky enterprises and failed at a substantial rate. Among the reasons for failure was the presence of moral hazard. Investor-owned banks were subject to the temptation to speculate with their creditors’ money (e.g., money received in exchange for private banknotes)—a practice now controlled by public regulation of banks’ capital reserves. If the banks’ principal customers collectively owned the bank, however, they had an incentive to manage it conservatively so it would be less likely to fail (and especially to fail while owing them money). This is the same reason why consumer savings banks were organized exclusively as nonprofit or mutual firms before 1845, only slowly becoming investor-owned after that as states began to regulate the banks’ reserves.122

Voting restrictions in consumer-owned banks helped prevent large shareholders from appropriating the banks’ credit to themselves to the detriment of other merchant owners. Yet the impetus for the adoption of voting restrictions in banks did not always come from the firm’s shareholders; it was sometimes externally imposed. The Bank of Massachusetts of 1784, one of the very first banks established in the United States,123 illustrates this point. Its charter mentioned the interests of merchants-consumers among the main justifications for the Bank’s creation.124 Many of the Bank’s initial shareholders were prospective customers, but its principal founder and stockholder, William Phillips, publicly displayed himself as a capitalist and a lender, not borrower, of the bank.125 The Bank’s initial charter provided for a one-share-one-vote rule.126

When elected president of the Massachusetts Bank in 1786, Phillips forced its shareholder-borrowers to sell their shares and withdraw from the corporation, in a move which was arguably designed to steer the bank away from the type of debtor cooperative that was prevalent at the time.127 He also imposed limits on the amounts any shareholder or person could borrow, a rule which was, however, later abandoned.128 Yet the Bank’s monopoly profits, combined with a perception of insider favoritism and arbitrary discount refusals, continued to trigger resentment among disgruntled borrowers.129

In order to appease critics and ensure “a more secure administration of the affairs of the Massachusetts Bank,”130 the state legislature eventually amended the bank’s corporate charter over its objections. Among the charter amendments, which ranged from prudential regulations to limitations on the bank’s scope of activity, the legislature imposed a cap of ten votes per shareholder—a rule that would persist as the norm for Massachusetts banks for nearly half a century.131

In 1790, two years before this incident, Alexander Hamilton had famously defended the adoption of a restricted voting scheme in the First Bank of the United States—a rule that he viewed as a “prudent mean” between the more extreme alternatives of one vote per member and one vote per share. In his words, “[a] vote for each share renders a combination between a few principal stockholders, to monopolize the power and benefits of the bank, too easy,” while “[a]n equal vote to each stockholder, however great or small his interest in the institution, allows not that degree of weight to large stockholders which it is reasonable they should have, and which, perhaps, their security and that of the bank require.”132

Hamilton’s statements do not sufficiently clarify his motives for advocating the adoption of voting restrictions in the Bank of the United States. But read in light of contemporary controversies and Hamilton’s overall concerns and objectives for the Bank, it seems more consistent with the consumer protection account of voting restrictions than with investor protection.133 The Bank of North America of 1781—the backdrop against which Hamilton formulated his proposals—had been arguably “‘all but crippled’ during the 1790s because a few powerful borrowers had monopolized its funds.”134

Throughout his “Report on a National Bank,” Hamilton sought to reconcile the interests of investors and those of the general public.135 He seemed particularly concerned with mitigating profit-maximizing behavior by the Bank’s shareholders to the detriment of consumers, as well as with preventing favoritism in lending decisions. He defended, for instance, the constitution of a bank with a large capital, because shareholders, fearing a decrease in profits, might resist subsequent capital increases that are beneficial to the Bank’s security and to its customers. “Banks are among the best expedients for lowering the rate of interest in a country,” he argued,

but, to have this effect, their capitals must be completely equal to all the demands of business, and such as will tend to remove the idea, that the accommodations they afford are in any degree favors—an idea very apt to accompany the parsimonious dispensation of contracted funds. In this, as in every other case, the plenty of commodity ought to beget a moderation of price.

Hamilton also proposed a mandatory rotation of directors, a rule that he deemed to reduce “the danger of combinations among the directors, to make the institution subservient to party views, or to the accommodation, preferably, of any particular set of men.”136

Ownership and control of banks by their merchant customers—and voting restrictions designed to reinforce that control—presumably served not just to constrain exploitation of monopoly power, but also to inhibit the banks from assuming an inefficient amount of risk, the costs of which would fall upon the banks’ customers. Clearly this was the reason for the dominance of mutual and nonprofit firms among savings banks—which in the nineteenth century were a distinct class of institutions from the commercial banks we are concerned with here—prior to the advent of effective governmental regulation of reserves beginning in the late 1840s.137 While the threat to customers of inefficient risk-taking was surely much higher in savings banks than in commercial banks, merchants whose notes were discounted by commercial banks clearly had a strong interest in the continuing creditworthiness of the banknotes or other credits issued by the banks in exchange.

Indeed, viewed in this latter respect, consumer ownership of commercial banks also helps explain other common charter provisions beyond shareholder voting rules. It was common for early bank charters to specifically prevent banks from engaging in trade or dealing in merchandise.138 Such provisions seem more likely to have been intended as consumer protection than as investor protection. In particular, they plausibly served to limit the riskiness of the banks, and perhaps also prevented the banks from competing with their local merchant-owners.

The early nineteenth-century commercial banks gradually transitioned from consumer ownership to investor ownership.139 What accounted for this transition? Increased competition seems a likely answer, as localities came to have more than a single bank and, beginning in the 1860s, bank entrepreneurs had the alternative of a federal charter as well as a state charter (though the widespread limitations on both interstate and intrastate branch banking continued to limit effective competition).140 Expanding state and federal regulation presumably also reduced the riskiness of banks, and was perhaps important as well in providing some assurance to merchants that their local bank would not discriminate against them in favor of their competitors.

2. Insurance

Voting restrictions also appeared among early property and casualty insurance companies.141 Maximum vote provisions were common, although not universal, in late eighteenth- and early nineteenth-century stock insurance companies in Pennsylvania and Massachusetts.142 Approximately one third of stock insurance corporations chartered by special act in Connecticut through 1856 adopted restricted voting schemes.143 By contrast, the overwhelming majority of New York finance and insurance companies144 and New Jersey insurance companies145 granted voting rights in direct proportion to share ownership. Our multi-state analysis shows 38% of insurance companies chartered between 1790 and 1859 adopting restricted voting.

A significant number of the early insurance corporations were, both in name and substance, mutual insurance companies. These firms were owned by their customers—the insured—and typically adopted one vote per member or another form of stringent voting restrictions. Early mutual insurance companies were particularly common in the fire insurance business.146 The economies of scale in building an insurance pool gave many of these companies substantial monopoly power, and created a strong incentive for collective ownership by their customers.147

While many consumer-owned insurance companies were organized formally as mutuals, a number of insurance companies formed as joint stock corporations were also effectively mutuals, serving principally to insure their shareholders. In this sense, the history of insurance companies is essentially akin to, and closely related with, that of banks.148 As described by Alfred Chandler in the context of marine insurance, “[b]y pooling resources in an incorporated insurance company, resident merchants, importers, exporters, and a growing number of specialized shipping enterprises were able to get cheaper insurance rates”; as a result, “[n]early all these companies handled only the business of local shippers and ship owners.”149 The local element of early insurance firms was made explicit in their charter provisions; state citizenship—or, in some cases, town residency—requirements for directors were common.150

Take, for example, the Insurance Company of North America, the first U.S. stock insurance company, which was chartered in Philadelphia in 1784. Historians attribute the decision to transform what was initially a failing tontine into a marine insurance company to John Maxwell Nesbitt, one of its founders and its future president who, as virtually all leading merchants at the time, had significant experience both as a policyholder and underwriter of marine insurance.151 The company came to insure the ventures of many of its shareholders and directors—a situation expressly contemplated and permitted by the corporation’s charter, provided that insiders did not receive special privileges.152 However, not all prospective customers were able to become shareholders in the company. In fact, the Pennsylvania legislature granted a charter to another marine insurance company, the Insurance Company of the State of Pennsylvania, signed into law just four days after the charter of its predecessor, with the justification that “a number of the ship owners and traders of Philadelphia, from local circumstance, have not been able to obtain shares in [the Insurance Company of North America].”153 Both insurance companies adopted a graduated voting scheme, subject to an absolute cap on the number of votes per shareholder.154

Leading merchants were also instrumental in establishing the first stock insurance corporation in Connecticut, the Hartford Fire Insurance Company, in 1810. According to P. Henry Woodward, “[a] sense of ever-present peril, a desire to avert the worst effects of calamity from the immediate sufferer by distributing the loss through the community, and a willingness to contribute fairly to the common fund, brought the company into existence”; even though its subscribers certainly intended to make a profit, “money-making was a secondary consideration.”155 Nevertheless, its shareholders and directors turned out not to be avid purchasers of insurance policies, and the company initially struggled for lack of a clientele.156 The corporation’s charter granted voting rights in proportion to share ownership.157

The inspiration for the establishment of another fire insurance company in Hartford came from merchants who were previously customers of the Hartford Fire Insurance Company. Interestingly, their main motivation for creating a competing business was allegedly not the firm’s monopoly prices, but rather its slack customer service. The story goes that the office of Walter Mitchell, the secretary and sole salesman of the Hartford Fire Insurance Company, had a highly inconvenient location, erratic hours of operation, and no regard for agreed-upon appointments. A disgruntled group of merchants then “pooled their discontent in a general protest” and incorporated the Aetna Insurance Company in 1819.158 Although originally a local endeavor, competition soon led the Aetna to expand to other localities and procure outside business through agents.159 The company’s original charter capped voting rights at fifty per shareholder, a rule that was, however, abandoned in favor of voting by shares in 1877.160

C. Manufacturing

In sharp contrast to the types of firms discussed above, one vote per share was from the outset the dominant voting rule in U.S. manufacturing corporations. Only one out of 135 manufacturing corporations chartered by special act in Connecticut through 1856 adopted voting restrictions.161 Similarly, restricted voting schemes were present in only 2% of the manufacturing corporations chartered in New York between 1790 and 1825 and 5% of such firms incorporated in New Jersey between 1790 and 1867.162 New York’s path-breaking general incorporation act for manufacturing firms of 1811 provided a one-share-one-vote rule—a pattern that prevailed in most such statutes subsequently enacted by other states.163

Our multistate analysis shows 31% of manufacturing firms chartered between 1790 and 1859 as having restricted voting, but this proportion is, almost certainly, misleadingly high. Manufacturing firms, in contrast to other types of firms, appear to have been formed under the period’s new free incorporation statutes in substantial numbers from an early stage.164 Indeed, the pioneering New York corporation statute of 1811 was limited to manufacturing firms. Consequently, manufacturing firms are probably underrepresented in these data, which exclude corporations chartered under free incorporation statutes. Moreover, there is good reason to believe that the omitted manufacturing corporations had a substantially higher ratio of one-share-one-vote rules than did the specially chartered manufacturing corporations included in the data. One reason is that the early statutes providing for free incorporation, such as the New York statute of 1811, were not only limited to manufacturing firms but also mandated a rule of one-share-one-vote.165 Thus our multistate analysis presumably understates the disparities between the voting rules adopted by manufacturing corporations and those adopted by corporations in other industries. Nonetheless, the regression reported in Table 2 shows that the frequency of restricted voting was significantly smaller in manufacturing corporations than in corporations organized to provide banking, bridges, canals, insurance, or roads.

The trend towards voting by shares in manufacturing firms was already apparent upon the incorporation of the pioneering Society for Establishing Useful Manufactures (S.U.M.) in New Jersey in 1791. The S.U.M. was a privately owned, but state-sponsored, corporation intended to foster the development of manufacturing in the United States. Even though the corporation was ultimately chartered and headquartered in New Jersey, most subscribers were New York capitalists and speculators. Unlike other contemporary corporations, which specified the object of the firm with considerable precision, the purposes clause of the S.U.M charter was exceedingly broad, providing that the corporation was to carry on “the Business of Manufactures in this State” and to employ its capital stock in “Manufacturing or making all such Commodities or Articles as shall not be prohibited by Law.”166 The S.U.M. charter granted one vote per share to private shareholders, while limiting the voting rights of the U.S. and state governments to one hundred votes each if they were to become shareholders in the firm.167 Interestingly, Alexander Hamilton, who vigorously defended the adoption of voting restrictions in the First Bank of the United States, was one of the chief promoters of the S.U.M.168

While many of the early corporations previously examined—such as bank, insurance, and transportation companies—were customer-owned local monopolies, shareholders of manufacturing corporations were almost always investors, not consumers. In contrast to the public utilities of the time, most manufacturing firms that required enough capital to employ the corporate form—which produced mostly textiles and, in smaller numbers, glass and metal169—were likely to be part of a reasonably broad market and thus face substantial competition. Moreover, the consumers of manufacturing firms were generally so dispersed, and purchased their products so sporadically, that they could not be efficiently organized to become owners of the enterprise. In this respect, they contrasted with the users of turnpikes, banks, and insurance companies, who would have continuously transacted with those service providers at a fairly constant rate of expenditure. Finally, as Donald Smythe observes, manufacturing firms required more active and innovative management than the early public utilities, and were therefore best served by active owners who faced and reacted to strong financial incentives, as compared to the broad cross-section of customers who presumably shared ownership of the monopolistic service industries.170

II. ultra vires as consumer protection

The recognition that a great number of early business corporations were owned by consumers rather than investors can shed light on other historical aspects of corporate law beyond shareholder voting rights. Another prominent feature of nineteenth-century corporation law that later fell into desuetude was a strong doctrine of “ultra vires” (literally, “beyond the powers”), which essentially prohibited corporate managers from deviating from the particular set of activities (or “purposes”) set forth in the corporation’s charter. Nineteenth-century business corporations typically listed in their charters a relatively narrow and specific set of corporate purposes. Corporate acts falling outside the scope of the specified purposes were subject to particularly stringent remedies, which ranged from shareholder and state lawsuits against corporate managers to the voiding of ultra vires contracts by the corporation or its counterparty.171

Since the late nineteenth century, this restrictive approach to corporate purposes has been progressively abandoned in both law and practice.172 Two conventional explanations have been offered for the rise and fall of the ultra vires doctrine. The first is that a narrow definition and construal of corporate powers made sense at a time in which incorporation conferred special privileges, a rationale that faded with the decline of the franchise view of the corporation, the spread of general incorporation statutes, and the gradual acceptance of general purpose clauses. The second is that the ultra vires doctrine served as a form of investor protection, assuring investors that their capital contributions to the firm would only be used in industries or activities in whose profitability they had some faith.173 The abandonment of the doctrine in more recent times is then explained on the grounds that it was ultimately ineffective and rendered unnecessary by the advent of the norm of shareholder supremacy and by the increasing liquidity of securities markets and the easy exit this permitted for shareholders unhappy with a corporation’s change of activities.174

We suggest that purpose restrictions might have served an additional important function in those early corporations—such as turnpikes, banks, and insurance companies—that were in essence consumer cooperatives. In consumer-owned firms, the nature and specifics of the business that the corporation engages in matter a great deal from a shareholder’s perspective. The early turnpike cases in which shareholders refused to pay for their subscriptions after a change in the proposed location of the road provide an illustrative example of this concern.175 A strong ultra vires doctrine not only assured firm members that their contributions would be channeled to the desired services, but also reduced the potential for using rents from the monopoly activity to cross-subsidize another activity that had a different distribution of benefits across the firm’s shareholders—a problem that haunts cooperatives up to this day.176 Moreover, the binding character of the proposed lines of business helped assure early shareholder-merchants that their corporate subscriptions would not be used to fund potential competitors. This concern was at the heart of the case of Colman v. Eastern Counties Railway Co., which contains what is arguably the first overt reference to ultra vires in English law.177

Nevertheless, as product market competition increased the prevalence of purely investor-owned firms, this early function of the ultra vires doctrine lost its raison d’être for most business corporations. If what a shareholder expects from the firm is not a specific product or service, but a profit—the fungible good par excellence—the precise purposes and activities specified in a corporate charter should be comparatively less important. Indeed, flexibility in switching lines of business in response to changing market conditions and technological advances is critical to maintaining profitability. It should therefore come as no surprise that, in parallel to the decline of the ultra vires doctrine, investor-owned business corporations came to take advantage of the law’s permission to craft exceedingly general purpose clauses that do not impose any meaningful limitation to their scope of action.178

Consequently, ultra vires was gradually abandoned as investor-owned firms came to dominate the corporate landscape. Consistent with this interpretation, (i) the ultra vires doctrine first started to lose its force as applied to manufacturing firms (which, as noted above, were overwhelmingly investor owned)179 and (ii) ultra vires has only subsisted (although in increasingly weakened form) in firms where the corporate purpose is not profit, such as nonprofit corporations in general and charities in particular.180 Although voting restrictions persisted as the norm in consumer cooperatives’ law and practice, the courts’ willingness to police ultra vires acts in cooperatives faded just as it did with respect to business corporations.181 But unlike business corporations, cooperatives continue to include purpose restrictions in their charters, as required under some statutes and encouraged by tax laws182 and, more importantly, because this avoids the strong conflicts of interest, and consequent governance problems, that arise when different groups of owners have conflicting interests in a firm’s activities.183

III. the decline of voting restrictions

Throughout this paper, we have sought to demonstrate the link between shareholder voting restrictions and consumer ownership of monopolistic corporations in the late eighteenth and early nineteenth century. Just as in the twentieth century,184 restricted voting schemes historically functioned as takeover defenses, albeit of a different kind. Unlike their modern counterparts, voting restrictions in early business corporations served not to shield corporate management and employees from a hostile acquisition, but rather to protect consumers by preventing the corporation from falling under the control of either a profit-maximizing investor or of a single merchant who would favor his own business over other local merchants in setting output allocation and pricing policies.

The consumer protection account predicts that the disappearance of voting restrictions would follow a shift from consumer to purely investor ownership of business corporations. We suggest that the nineteenth century witnessed precisely such a shift, for several reasons.

A. Governmental Provision of Infrastructure

By the late nineteenth century, general physical infrastructure, such as roads and bridges, were commonly financed and frequently owned and operated by government at one or another level, removing the need to fund such projects through quasi-philanthropic financing in which prospective beneficiaries purchased non-remunerative shares in private corporations. This expansion of the role of government paralleled more general changes in the structure of government in the first decades of the new nation, which saw the municipal corporation, in particular, evolve from its medieval role as a politically closed guild-like regulator of commerce to a new incarnation as a relatively democratic institution supported by general taxes rather than fees and flexibly organized to provide a variety of collective goods and services.185 In effect, the shift from provision by a private corporation with restricted voting to provision by local government involved the replacement of a makeshift type of cooperative with a much more durable one. Local governments are, after all, effectively territorial consumer cooperatives established in large part to provide services that would otherwise be local monopolies.186 And, of course, modern democratic governments have abandoned old practices of censitary suffrage in favor of the same highly restricted voting scheme that is the norm in consumer cooperatives—namely, the rule of one person, one vote.

B. Separation of Competition Law from Corporation Law

The scope of corporate law became increasingly narrow during the course of the nineteenth century, as the field progressively specialized in the respective rights and duties of a firm’s shareholders, managers, and creditors—the “internal affairs” of the corporation. Concerns about monopoly—which were initially addressed by limitations in charter provisions and in corporation statutes—became increasingly extraneous to this area of law.187 Early corporate charters and statutes contained several mechanisms that regulated monopoly pricing and dissuaded anticompetitive combinations—of which restricted voting is but one unappreciated instance.188 Over time, however, the regulation of monopoly (natural or otherwise) came to be the object of specialized areas of law—namely, antitrust law and utility regulation—that were much better focused, and less needlessly constraining, than were charter-based corporate voting restrictions.

C. Evolution and Differentiation of Standard Corporation Statutes

Over the course of the nineteenth century, the franchise view of the corporation was all but abandoned. Since the Supreme Court decision in Charles River Bridge in 1837, monopoly privileges were no longer implied by the mere grant of a corporate charter, and they became increasingly rare thereafter.189 Moreover, general incorporation laws, which allowed firms to incorporate without the need to obtain special legislative charters and conferred no exclusive privileges, gradually became dominant after the mid-nineteenth century; by the end of the century, they were the typical basis for incorporation, rendering the corporate form easily available to entrepreneurs seeking to raise outside capital.190

As this standardization and generalization of business corporation law proceeded, making that body of law particularly suited to investor-owned firms, separate statutes were adopted specifically to govern consumer-owned mutual and cooperative corporations. Maryland, for example, passed a special statute governing mutual savings and loan associations in 1843, and was followed by New Jersey in 1847, Pennsylvania in 1850, and subsequently other states as well.191 In 1857, New York adopted one of the first mutual insurance company acts.192 And, while early business corporations included many cooperatives in disguise, from the mid-nineteenth century onward cooperatives began to be recognized as a distinctive form of organization and to be expressly formed and labeled as such.193 Scholars typically view the establishment of the Rochdale Society of Equitable Pioneers, an English consumer cooperative, in 1844 as marking the birth of the cooperative movement and the first enunciation of cooperative principles, including the rule of one member, one vote.194 In 1865, Michigan enacted the first U.S. cooperative corporation statute,195 followed within a few years by Massachusetts, New York, Pennsylvania, Connecticut, and Minnesota.196 These cooperative statutes regularly imposed a mandatory rule of one member, one vote.197 The statutes for mutuals generally did not make such a voting rule mandatory, though the structure of their business would generally have rendered the number of shares held by customer-owners similar.198