The Case for Tax: A Comparative Approach to Innovation Policy

abstract. The federal government deploys a variety of institutions—patent, tax, and spending, among others—to encourage innovation. But legal scholars have given short shrift to how these institutions should be coordinated. In this Note, I argue that tax credits could be used to ameliorate a number of inefficiencies that arise from the failures of patent law. Deploying strong tax credits narrowly could improve incentives for small businesses and in emerging industries at a relatively low cost. I argue that this style of comparative institutional analysis should be part of every innovation scholar’s toolbox.

author. Yale Law School, J.D. 2013; University of California, San Diego, Ph.D. 2010; Vanderbilt University, B.A. 2005. I would like to thank Anne Alstott for her tireless supervision of this Note; Carlton Forbes and the staff of the Yale Law Journal for their superb editing assistance; and Amy Kapczynski, Alvin Klevorick, Mark Lemley, Daniel Hemel, Xiao Linda Liu, Can Sun, and Andrew Tutt for their insightful comments. Finally, thanks to my wife, Kate, for her love and support.

Introduction

How should the federal government encourage innovation in the United States? Policymakers have a menu of choices at their disposal. They can give cash grants, issue patents, offer prizes, or provide tax breaks. But when legal scholars set about answering the question, they tend to focus on their areas of expertise. Intellectual property scholars typically talk about patent scope or duration, the doctrine of equivalents, and disclosure requirements.1 Tax scholars argue that research tax credits should be larger, permanent, or more easily accessible.2 Sometimes these scholars acknowledge that their chosen institution should treat different technologies or industries differently.3 But how to deploy an institution—patent, tax, or spending—to encourage innovation should be the second question we ask. The initial, oft-overlooked4 question is the following: which institution (or mix of institutions) should we use in the first place?

This oversight is surprising for the simple reason that the stakes are so high. Federal research and development tax incentives total more than $10 billion annually;5 the rents that patent holders collect are hard to estimate, but they probably top $30 billion every year;6 and the National Institutes of Health (NIH) alone distributed over $30 billion for medical research in 2012.7 These cash and cash-equivalent distributions—which drive much of the research that fuels the U.S. economy—often have overlapping targets. Yet the subsidies themselves, the way they are allocated, and the institutions that distribute them are substantially different. These differences should inform our choice of how to encourage innovation.

To illustrate, consider the emerging technology of DNA computing.8 There are several potential advantages to using DNA to store data and conduct computations.9 The research is still mostly of the basic variety, although commercial entities have started to show some interest.10 How should the government encourage this nascent research as it becomes commercially viable? One of the arguments that I will make in this Note is that the patent system may be a poor fit for such a field. For instance, the patentability of a DNA computer—and the computer’s related interactions with human cells—seems presently uncertain.11 The eventual patentability determinations will lag the technology by decades and will not necessarily be motivated by sound policy rationales.12 Moreover, the patent system might underfund such early-stage research, as many of the developments—while critical to charting the field—will not themselves yield any commercially viable products. This decreases the value of patenting such discoveries.13 Other subsidy systems are not so limited; research tax credits, for example, are distributed ex ante regardless of commercial success. Moreover, the institution overseeing the tax system has the data-gathering tools to make informed decisions about qualifying research. As will be discussed throughout this Note, these advantages recommend using the tax system to fund emerging technologies like DNA computing.

The thesis of this Note is that tax may be a more effective driver of innovation than previously recognized. But my suggestion is not an across-the-board increase in tax credits. Rather, I will recommend that Congress should reallocate the $10 billion in annual research tax expenditures to more narrowly target those domains where tax is most effective. To get to this conclusion, I will compare the institutions of patent and tax, and argue that the strengths of tax complement the weaknesses of the patent system. My suggestion is that Congress should focus its tax expenditures on those areas of research where patents fail and tax excels.

While my analysis will hopefully demonstrate the value in a comparative institutional analysis, I admit that I am not taking on the choice-of-institution question in its entirety. I am focusing on tax’s strengths relative to patents—and largely ignoring grants and prizes—for a variety of reasons. First, patent and tax are the two institutions primarily focused on encouraging commercial research. Grants fill a different niche, as they tend to be directed at basic, university investigations. Second, neither patent nor tax requires that government officials decide ex ante whether or not any particular research qualifies for the subsidy. Federal grant programs involve scientist-officials approving promising research before it takes place. Traditional prizes require some upfront goal specifications. There are plausible arguments that this style of top-down directed research is inefficient.14 Third, the case for prizes, in particular, has already been made.15 Notwithstanding these cogent arguments, the federal government has shown little inclination to convert to a prize-oriented system of innovation subsidies.16 By contrast, the government is extremely comfortable distributing tax subsidies to promote favored types of research. Thus, by focusing on tax, I hope to make a series of suggestions that might actually be implemented by the federal government. Finally, as I hope to show in this Note, patent and tax are complementary in many respects. Comparing these institutions illustrates their advantages and limitations. I leave for another day the question of whether prizes and grants have similar strengths and weaknesses and how they could be added to the institutional mix.

Part I of this Note lays the groundwork necessary for my argument: first, by explaining the economic logic for government subsidies to innovation; and second, by describing how patent and tax affect social welfare by encouraging more optimal research decisionmaking.

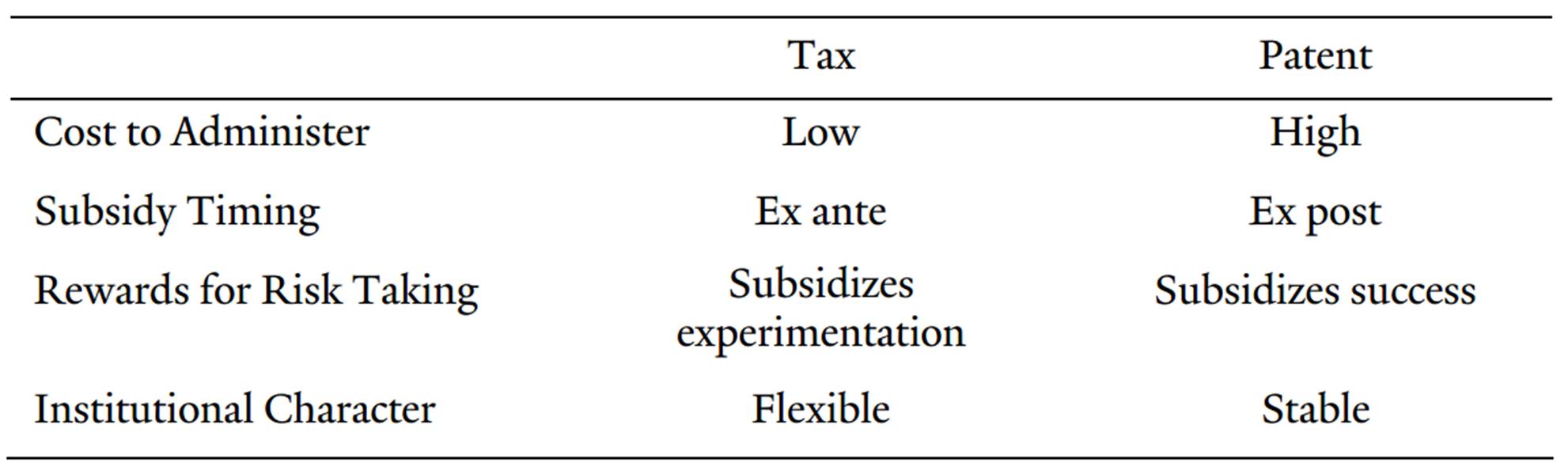

Part II analyzes several specific advantages of tax subsidies relative to the patent system. Along with exploring tax’s comparative benefits, I describe the innovation environments in which these advantages are particularly important. I identify four considerations that should inform a choice between patent and tax when the government’s goal is to foster socially beneficial research decisions. (Table 1 offers a summary.) The first important difference between tax and patent is tax’s relatively low administrative cost. When inventors are filing low-value or multiple patents, these lower administrative costs will make tax comparatively efficient in encouraging innovation. The second difference is subsidy timing. In situations where credit markets are imperfect, tax’s upfront payments ease the burden of research costs, which is particularly valuable for small inventors. The third difference is tax’s reward for risk taking. When failure is valuable, tax may be preferable. The fourth and final point is institutional: tax’s rewards are more flexible and immediate, while patent is perhaps more predictable over a longer time frame. These differences favor tax in situations of technological change and emerging industries. Implementing the changes that flow from these observations could dramatically improve the productivity of hitherto neglected research environments while simultaneously cutting the costs of duplicative subsidies.

Table 1.

four differences between

patent and tax

I. innovation subsidies and social welfare

A. Why Subsidize Research?

Innovations are slippery things. Sometimes they come unexpectedly and effortlessly, like a bolt in the night. But other times they are the product of systematic, careful investigation. This Note is concerned with how government policymakers should best stimulate such research-driven innovations. But first we must ask the prior question: why should we be encouraging research at all?

Even in a world without any government help, entrepreneurs would still investigate new technologies.17 Indeed, many of the most important inventions in history have sprung forth without much or any meddling from the government.18 Nevertheless, there are good arguments in favor of subsidizing research. Perhaps the best reason is that research can produce spillover benefits—positive externalities benefiting someone other than the inventor.19 These are benefits that the researcher herself cannot appropriate. Consider, for example, Ford Motor Company’s development of the moving assembly line in the early twentieth century. To be sure, Ford made a handsome profit from this innovation—it was able to make cars much more cheaply. However, the value of this innovation far exceeded the value to Ford Motor Company alone. Other manufacturers soon imitated Ford’s improved process, which allowed them to also use their capital and labor more efficiently.20 In the parlance of innovation theory, we can say that Ford was unable to appropriate the full value of its innovation.

As a general rule, individuals will engage in research when the research’s expected value—to the inventor—is greater than the research’s costs. But when researchers cannot appropriate the full value of their innovations, those innovations may be underproduced.21 This is a critical point that motivates most government expenditure on research. Imagine that an executive at Ford is deciding whether to spend money researching an assembly line. She estimates that the company could undertake a project costing $100,000 that would yield a 50% probability of producing a productivity-enhancing process that could earn the company $150,000. As a profit maximizer, she will reject this research plan because it yields an expected loss of $25,000. But what if the research, if successful, would also earn Ford’s competitors $150,000 worth of productivity enhancements? Then, society’s expected value from the research would total $150,000. Since that is more than the $100,000 cost of the research, society would prefer that Ford undertake the research. For the purposes of this Note, I will assume that research decisionmaking is “optimal” when inventors engage in research whenever the total research costs are less than or equal to the expected total social welfare produced by the research.22 The reason we subsidize research is to bridge the gap between an individual inventor’s expected value and society’s expected value: in the example above, society should be willing to spend up to $75,000 to encourage Ford to undertake the research.

There are many ways society could encourage Ford to engage in more optimal decisionmaking. The Constitution puts forward one solution in the Patent and Copyright Clause,23 and patents do present an elegant way of allowing Ford to appropriate much of the value of the assembly line. But Congress could also rebate some portion of Ford’s research costs—this is the basic approach of Congress’s research tax credit. Congress could also fund the research directly—this is the approach embodied in, for example, NIH grants to private researchers. Or Congress could award a prize to the first team to develop an assembly line. The basic point is this: there is an institutional choice Congress has to make about how best to encourage innovation.24 A full comparison of all these alternatives is desirable but beyond the scope of this Note. Here I focus on a pairing that has been largely overlooked in the innovation literature25: patent protection and the research tax credit. I will argue that various features of the patent and tax systems make tax particularly attractive under certain innovation conditions. We shall see that tax may be the most sensible legal vehicle for encouraging innovation when the research produces many inventions, has a long commercialization period, or is in an emerging field. Tax may also be the preferred approach for helping lone inventors and small businesses, or when the industry is diffuse and difficult to monitor.

B. Patents

The patent system attempts to spur innovation by granting researchers a right to exclude others from using their invention, which provides the researchers with a temporary monopoly on their discoveries.26 With this monopoly, a researcher can earn a “patent subsidy” by charging more for products that use the invention or by licensing the invention to her competitors.27 In effect, society is subsidizing the invention by way of higher prices. To be patentable, an invention must be novel, useful, and non-obvious.28 It must also be a process, machine, manufacture, or composition of matter.29 A patent holder can sue infringers30 to enjoin their use and to recover damages.31 The great benefit of the patent system is that it more closely aligns an inventor’s expected value in doing research with society’s total expected value from that research.32 Harkening back to the example in the previous Section, a patent would allow Ford to charge its competitors to use the assembly line. In a perfect market, Ford would earn an extra $150,000, which would equalize Ford’s expected value and the expected value to society. The patent system succeeds in aligning social welfare with research incentives when socially valuable ideas—with patent protection—command large profits or high licensing fees. To be sure, patent does not operate to maximize social welfare in all cases: some discoveries, like surgical checklists, are notoriously hard to monetize even with patent protection, and these goods will be systematically underproduced without other subsidies.33 Nevertheless, the patent system does succeed at providing significant subsidies for inventions of large social value that would otherwise be underproduced.

In exchange for these handsome rewards, the patent system demands a quid pro quo34: inventors seeking patents must disclose their invention publicly.35 Disclosure ensures that the invention can be easily reduced to practice by the public at the end of the patent term.

A final notable feature of the patent system is that it harnesses the inventor’s own knowledge about the value of the research.36 Government regulators do not need to vet the project ahead of time. Rather, the inventor decides what she thinks will be the most profitable course of research. This is an advantage because we assume that researchers are best situated to evaluate the probability of success and the commercial viability of their research agenda. By exploiting this privately held knowledge, the patent system avoids the costly and duplicative bureaucracy of direct government funding.

Through the mechanisms described above, the patent system aims to improve social welfare by producing innovations that would not otherwise have come about. However, the patent system also involves several drawbacks. It imposes deadweight loss via monopoly pricing: some consumers who would be willing to pay the competitive price of a good (i.e., the price without any patent protection) will not buy at the monopoly price; this missed exchange is a social welfare loss.37 Additionally, patents can hinder innovation by other researchers, who will have to pay licensing fees and may be excluded altogether from using patented ideas to further their own research.38 Because of these substantial costs—which are incurred even for inventions that would have emerged without patent—policymakers should only seek to distribute patent protection to the extent necessary to optimally stimulate research.

Two additional details are worth noting. First, implementing the patent system has administrative costs, which include filing fees and enforcement costs, among others. This is an oft-overlooked impediment to patent law achieving optimal efficiency to which we’ll return in Section II.A. Second, the patent system only operates on successful inventions. Patent does not allow any appropriation of experimental failures that benefit society. I will address this distortion in Section II.C.

C. Tax

The federal government also uses tax incentives to improve social welfare by stimulating research. These incentives reduce researchers’ tax bills proportionally to the amount they spend on qualified research. The intricacies of how these tax incentives are calculated are somewhat complex and not critical to my argument in this Note. Here I merely provide an overview.39

The two major federal tax incentives for research are a tax deduction40 and a tax credit.41 The research tax deduction allows taxpayers to treat research or experimental costs related to a trade or business as a current expense.42 Thus, if Ford spends $100,000 on research in 2013, it can immediately reduce its net income by $100,000, which, if Ford has a marginal tax rate of 35%, would reduce its tax bill by $35,000. The most significant restriction on the deduction is that it must be for expenditures that are “research and development costs in the experimental or laboratory sense,” which has been further interpreted to mean costs related to scientific research and analysis that is intended to mitigate the uncertainty surrounding the development of an innovative product.43

The second major federal tax subsidy for research is the research credit. Congress enacted this credit in 1981,44 a time when U.S. research expenditures were decreasing when measured against the growth of the broader U.S. economy.45 The credit equals twenty percent of the increase in a taxpayer’s qualified research expenses for the taxable year over a base amount.46 The base amount is the product of a fixed-base percentage—the percentage of the taxpayer’s total gross receipts spent on qualified research averaged over a set period during the 1980s—and the average annual gross receipts in the prior four taxable years.47 So if Ford’s gross income remains the same and it spends $100,000 more on research in 2013 than it had in the previous four years, the amount of taxes it owes would be decreased by $20,000.48

Research expenses that qualify for the tax credit include wages paid to an employee engaged in qualified research as well as the expenses for supplies used in that research.49 For the research to qualify for the credit, it must meet three criteria beyond the requirements for the deduction. First, the research must be undertaken for the “purpose of discovering information . . . which is technological in nature.”50 Second, the research activities must “constitute elements of a process of experimentation.”51 Third, the research must be intended to improve the function, performance, quality, or reliability of a business component.52 A “business component” is defined as a “product, process, computer software, technique, formula, or invention which is to be held for sale, lease, or license, or used by the taxpayer in a trade or business of the taxpayer.”53 These determinations are made by the taxpayer herself—she does not need to have the research approved in advance to claim the credit (or deduction), although she will have to provide sufficient documentation should she be audited.54

The scope of these research tax subsidies is larger than the scope of patent protection. IRS regulations have established a patent safe harbor: the issuance of a patent is “conclusive evidence that a taxpayer has discovered information that is technological in nature that is intended to eliminate uncertainty concerning the development or improvement of a business component.”55 This safe harbor does not cover every element of the three-part test described above.56 Thus, there may be a small class of inventions that can be patented but whose research expenditures would not qualify for the tax subsidies. For instance, one might imagine patentable inventions that wouldn’t qualify as a business component because they will not be used in the taxpayer’s trade or business. However, these will be unusual instances,57 and perhaps they are not the sort of discoveries that need to be subsidized at all. On the other hand, huge swaths of non-patentable research qualify for tax subsidies in any case. The IRS has noted that a patent is not a prerequisite for claiming the research tax credit.58 Of particular note, research need not be a success to qualify for the credit; moreover, the taxpayer need not be the first to make a discovery for the research to qualify.59

Much like the patent system, tax aims to improve social welfare by producing innovations that would not otherwise have been discovered. Instead of increasing appropriability directly, the tax system provides a cash rebate to the researcher by decreasing her tax bill. Ideally, this credit would equal the difference between the expected value of the research to the inventor and the expected value of the research to society. An important feature of tax—which is both a weakness and a strength—is that the size of the credit is easy to manipulate. This is a weakness because it creates the possibility a researcher could receive an inefficiently large or small credit. But it is a strength because it allows policymakers to tailor the tax credit to accommodate differences in innovation environments.

However, distributing research credits60 also has a social cost. The social welfare cost of the tax credit depends on the nature of the tax that is used to collect funds to pay for the credit. Highly distortionary taxes will impose greater social costs,61 and the larger the distributed credits, the greater those costs.62 Thus, much like for patent, we should only aim to distribute research tax credits to the extent that they are most likely to produce social welfare-improving research.

II. an institutional comparison

As the preceding Part suggests, patent and tax can both contribute to social welfare by encouraging innovation. But the two regimes are strikingly different. In this Part, I explore four important differences: administrative costs, subsidy timing, rewards for risk taking, and institutional character. These differences suggest that we could more optimally encourage innovation by reconfiguring the patent/tax balance of the status quo. Deploying stronger tax subsidies for innovation in a few particular research environments would yield better research decisions at low additional costs.

A. Administrative Costs

Administrative costs are costs borne by the inventor that are not related to actually doing the research. These are costs that only come about from the inventor trying to obtain the subsidy. The paradigmatic administrative cost is hiring a lawyer to write a patent application or an accountant to prepare a tax return. Other administrative costs include filing fees and litigation costs associated with defending the patent or tax return. Administrative costs are problematic because they deter socially desirable research that would otherwise be undertaken. This occurs when the expected value of the research is greater than the research’s costs—perhaps in part because of a government subsidy—but the administrative costs incurred in obtaining the subsidy flip this relationship such that total costs exceed expected value.

Both the patent and tax systems include many such costs. But in this Section I will argue that the expenses of filing and defending patents impose burdens on certain types of research that tax subsidies largely avoid. In particular, all else being equal, tax has a comparative advantage in subsidizing research that (1) yields many small inventions, (2) produces innovations that are costly to exclude competitors from using, or (3) has a low expected value. I will argue that we could promote more optimal research decisionmaking by using stronger tax credits for these research environments. Additionally, I will argue that the tax system is amenable to having its administrative costs reduced if policymakers see fit, which make it a strong choice in any domain where we think such costs are problematic.

1. Administrative Costs of Patent

There are, broadly, two sorts of administrative costs involved in using the patent system: prosecution costs and enforcement costs. Patent prosecution comprises the legal steps involved in initially obtaining the right to exclude. Typically this involves a lawyer searching for similar inventions that would invalidate the potential patent, a lawyer drafting the initial patent application to the Patent and Trademark Office (PTO) and responding to subsequent PTO actions, and the patentee paying the PTO’s filing fees. It can also involve appellate review63 and, with the passage of the America Invents Act, various forms of administrative litigation after the grant of the patent.64 And, of course, the patentee often needs to secure patent protection in many other countries—there is no such thing as an international patent.65

Prosecuting patents is expensive. Collecting figures from several studies, Mark Lemley estimates that it costs between $10,000 and $30,000 to prosecute a patent in the United States from start to finish (where “finish” means patent issuance).66 And these costs have little chance of decreasing. Indeed, most commentators argue that the PTO—which is notoriously slow and inaccurate in issuing patents—needs more funding, which would likely mean higher filing fees.67 The current filing fee structure does give a fifty percent discount to small entities.68 And the new America Invents Act—although it raises fees across the board by fifteen percent69—gives a further discount to “micro entities.”70 But these fee reductions do not diminish the impact of attorney fees.71 And even for small firms with simple patents, preparation costs are the lion’s share of patent prosecution expenses.72

For a patent to have any value, though, it must be enforced. Patents give the patentee the right to sue infringers. Patent enforcement consists of the myriad activities after patent issuance that are required to maintain monopoly rights. These activities require payments including monitoring costs, which the patentee uses to stay abreast of both the public and private uses of her patented technology; negotiation costs, if the patentee wishes to license out her technology; litigation costs, should the patentee detect infringement; and PTO maintenance fees.

Estimates for the cost of patent enforcement are harder to come by since it is discretionary—that is, patent holders may choose to enforce their property rights a lot or not at all. Commentators rightly assume that these enforcement costs are high, though.73 Costs related to monitoring vary based on industry size and composition. In industries with a few big players, or industries where sales and production are highly regulated, patent infringement should be fairly easy to observe. The canonical example is the pharmaceutical industry—because of the extensive monitoring by the FDA and the requirement for publicized studies validating treatments, a company like Merck would not need to spend much to find out if Pfizer is infringing one of its patents. On the other hand, in a diffuse industry such as computer programming, detecting patent infringement might require expensive investigation and constant vigilance.

While monitoring costs are significant but amorphous, litigation costs are simply significant. Very few patents ever get litigated after issuance,74 but the ones that do cost about $800,000 to take through discovery and $1.5 million to take through trial and appeal.75 Any patentee wishing to credibly threaten a patent infringement lawsuit must be ready to shoulder this burden.

These administrative costs are all multiplied if the patentee wants international protection. Monitoring is obviously more expensive when infringement can be occurring across the globe. International patent litigation is increasingly common and incredibly expensive, as evidenced by the Apple-Samsung litigation over the design of those companies’ smartphones, which, as of 2011, spanned nine countries.76 And prosecuting patents internationally is very expensive: the GAO has estimated that patenting in nine countries could cost up to $330,000.77

2. Administrative Costs of Tax

The administrative costs of tax are rather different. These costs are more accurately thought of as compliance costs—expenses for recordkeeping, filling out tax forms, and the like. The best evidence about compliance costs for research tax credits actually comes from surveys of Canadian companies.78 These surveys asked the companies how much they spent on research, how large a credit they received, and how much they spent on complying with the tax requirements. They found that compliance costs for the Canadian “scientific research and experimental development credit” were low overall but varied quite a lot based on the size of the firm. For instance, estimates of annual compliance costs have ranged between 0.7%79 and 14.5%80 of the total claimed credit. For Canadian taxpayers with the smallest claims (less than $25,000), compliance costs were over one third of the credit amount.81 This results from fixed costs, such as filling out the requisite paperwork, that the firms had to incur regardless of their claim.82 There is also, however, a fairly substantial variable component of the compliance costs: some large firms claiming the credit can spend over $100,000 to comply, much of that going to technical documentation of the research activities.83

I know of no comparable surveys of American firms’ compliance costs for the research tax credit.84 As a general matter, there is no obvious reason why recordkeeping requirements should be qualitatively different between Canada and the United States. If anything, the costs in the United States may be decreasing, as recent decisions have allowed taxpayers to use a fair estimate of their expenses in claiming the credit, which should ease contemporaneous recordkeeping burdens.85

Finally, it is important to take note of costs that are absent from the tax system. Since tax subsidies confer no property rights, there are no enforcement costs of tax.86 Additionally, there is no international component to the tax system. While it is surely true that foreign countries give credits for research, inventors need not (and typically cannot) claim those credits alongside U.S. federal tax credits.

3. Comparing the Administrative Costs of Patent and Tax

We are now in a position to compare the administrative costs of subsidizing research with the patent and tax systems. Before we actually compare the two systems, though, it is worth briefly pausing to define the scope of the problem. Administrative costs are trivial in some situations. If a pharmaceutical giant is considering whether to begin a billion-dollar research project for a breast cancer drug, the cost of patenting versus the cost of filing a tax return would be drops in the bucket. However, administrative costs are significant when the expected value of the invention is on par with the administrative costs themselves. In other words, the discussion below is mainly confined to smaller-stakes inventions, when an inventor might forgo research because the cost of patent prosecution or tax compliance makes the research not worth it.

Can we make a ballpark comparison of the costs of tax compliance and patent’s administrative costs? A first-pass look at the data suggests that, for some innovation environments, it is reasonable to estimate that costs for tax compliance and patent prosecution (not enforcement) are roughly equal. First, using the Canadian data, small- and medium-sized businesses claiming the research tax credit spend approximately 5% of their credit on compliance costs.87 Second, although there is significant variability across industries, these businesses generate approximately one patent application for every $1.8 million in R&D expenditures.88 Third, assuming that the entirety of the $1.8 million qualified for the research credit, that expenditure would yield a compliance cost of $18,000.89 Patent prosecution costs around $20,000.90 Thus, the tax compliance and patent prosecution costs of generating a single invention are (very roughly)91 equal. But this is not the end of the story. The administrative costs of both patent and tax are different in at least three important ways that could make tax the preferable choice for subsidies in particular research environments.

The first difference is that the administrative costs of patent accrue per invention, whereas the costs for subsidizing research with tax credits accrue across inventions. If a researcher is relying on the patent system, she will have to pay filing fees and attorney fees for every invention she wishes to patent. If, instead, she relies on the tax system, her compliance costs will not depend on the number of discoveries she makes. This difference suggests that, in situations where we expect a line of research to generate many discoveries that would need to be independently patented, the tax system may entail lower administrative costs. The consequence of this difference is that the tax system would deter fewer inventors from pursuing socially desirable lines of research.

What industries might exhibit such a pattern? One likely candidate is genetic research. The Federal Circuit has held that inventors may patent isolated genetic sequences.92 The human genome contains tens of thousands of protein-coding genes.93 Even more strikingly, the field of synthetic biology—in which inventors create new, artificial sequences—removes any upper limit on patentable sequences.94 Discovering one of these sequences is becoming increasingly routine as costs have come down.95 Thus, individual lines of genetic research often yield a multitude of inventions. Indeed, in the field of synthetic biology, the number of “parts” (functional proteins coded by man-made genetic sequences) has proliferated in recent years,96 but many, if not most, of these parts are unpatented, likely because of the high cost of a patent.97 In such a field, increased tax credits could function as a less distortionary subsidy by avoiding the high costs of patenting many small inventions.

A second difference between tax and patent is that tax subsidies are free from enforcement costs. This has several implications. In industries where use is difficult to detect, patent enforcement will be expensive, which will distort investment decisions. Amy Kapczynski and Talha Syed—in their article about the continuum of patent excludability—offer surgical checklists as an example of an invention that an inventor would have a hard time excluding doctors from using.98 They argue that such inventions are difficult to appropriate value from. But we can flip this argument on its head: if an inventor of a surgical checklist wanted to exclude competitors, she would need to engage in costly monitoring of the surgical practices in thousands of hospitals nationwide. Moreover, every time the inventor detected a violation, she would need to be able to credibly threaten litigation. These administrative costs might deter an inventor from pursuing a line of research. Thus, enforcement costs will be high in industries with many possible infringers. And if those infringers are not wealthy, the expected value of litigation against them would be low. Enforcement costs will also be higher in industries that are geographically dispersed—it is more costly to monitor and maintain a litigation presence nationwide. In such industries, policymakers should consider whether tax incentives might encourage more optimal research decisions.

A third and final difference between tax and patent is that the administrative costs of tax can be reduced more easily than the costs of patent. Why is this important? Because when we come across an industry or group—for instance, small, startup inventors—that might be especially deterred by administrative costs, a common move is to try to selectively reduce those costs. If one system is particularly amenable to this sort of reduction, it might be preferable in those situations where we think administrative costs are stymying research.

There are a few differences between tax and patent that make the administrative costs of patenting more difficult to reduce. The first is that we insist that every patent be examined with the same scrutiny. This is a sensible choice because a patent confers a powerful right to exclude. But this fundamental requirement spawns the significant legal costs of patent prosecution, costs which arguably cannot be reduced.99 In comparison, not every tax return is audited. This is also sensible. Mistakenly allowing a single taxpayer to claim an improper research tax credit is typically not especially costly.100 The corollary to this difference is that we could relax the compliance requirements for tax in particular situations where administrative costs are problematic. For instance, if we were concerned that small businesses faced high fixed compliance costs of claiming the research credit, we could reduce documentation requirements if their credit stayed under a certain dollar amount. By comparison, reducing patent prosecution requirements for a small business—for instance, by not requiring them to report prior art—would lead to improper grants of monopoly protection that could cause significant economic harm.101 Another reason administrative costs are more easily mitigated for tax is that the subsidy itself can be tailored to compensate for the administrative costs. For instance, we might worry that a business filing for the credit for the first time would face burdensome fixed startup costs. If so, we could simply double the allowable credit for that year. Since the tax subsidy and compliance costs are in the same units (dollars), they can easily make up for each other. In contrast, it is not clear how a patent could be made stronger to compensate for high administrative costs. The takeaway from this point is that the administrative costs of tax are much more flexible than the administrative costs of patent, and where administrative costs are distorting research decisions, policymakers should consider whether a reduced-compliance-cost tax regime might be optimal.

Finally, while my focus in this Note is largely on the either/or choice between patent and tax, I should note that there are likely viable hybrid approaches—that is, ways in which the tax and patent systems could be deployed together to compensate for each other’s weaknesses. A simple example would be a patent prosecution tax credit. The status quo already allows inventors to deduct the costs of patent prosecution.102 But the tax code could provide a stronger incentive. For example, we might give a tax credit of up to $20,000 for prosecution costs for any inventor with fewer than three patents. A promising avenue for future work would be to think of creative ways that patent and tax can be coordinated to spur innovation.

B. Subsidy Timing

In this Section, I explore how the difference in the timing of the patent and tax subsidy systems affects how they should be deployed. Whereas the subsidies from tax are paid out annually, patent subsidies (in the form of higher profits) can be delayed for many years. This difference has gone largely unnoticed in the academic literature. Several scholars have pointed out that inventions can take decades to commercialize, which might decrease or eliminate the usefulness of the patent system as a means to stimulate research.103 These scholars have suggested lengthening patent protection104 or granting new intellectual property rights focused on product development.105 What these solutions miss—likely because of their single-institution focus on the patent system—is that the payment lag in the patent system is itself quite costly. The tax system avoids this cost by reimbursing the taxpayer immediately.

Delay can undermine a subsidy system. This is so because there are implicit costs in an inventor tying up her own funds in research.106 Each dollar spent on research is a dollar that the inventor cannot put to other productive uses, such as growing her business.107 Every year that passes between the initial expenditure and the eventual subsidy, the inventor has to forgo the yield on that expenditure. These delay costs may undermine the efficacy of innovation subsidies: the researcher will only engage in research if current costs are less than the eventual expected value of the research plus the subsidy, discounted by the time delay of the subsidy. The “discount” the researcher assigns to the subsidy will be a function of two things: the length of the delay itself and the annual implicit costs of the delay. I treat each of these concerns in turn, and I conclude that long delays are most harmful to small inventors and to inventions with long time horizons. In such situations, I argue that tax may be a preferable choice.

1. Subsidy Timing in Patent and Tax

There are a number of ways to make money from a patent, but most of them require patience. When we think about subsidy timing and patent, it is helpful to divide the process into three phases: first, the inventor conducts the research; second, the inventor applies for a patent; and third, someone develops and commercializes products based on the patent. In the paradigm case, the inventor is the “someone” exploiting the patent. Since the inventor has an exclusive right to sell the invention, she can earn supracompetitive profits, which act as the subsidy of the patent system. But this subsidy is delayed in a few ways.

An inventor must first wait through the invention process, and she must spend whatever is necessary to uncover the patentable idea. For research that requires significant upfront investments, this delay can be costly.

Second, the inventor must wait for the PTO to evaluate and issue the patent. The median delay between patent application and patent issuance is three to four years,108 although now, under the America Invents Act, patent examination can be expedited for a fee of $2,000 for a small entity or $4,000 for a non-small entity.109

And third—assuming the patentee is exploiting the patent herself—she must wait until the product is developed and ready to commercialize before realizing any of the patent subsidy. It is difficult to generalize about how long it takes a firm to commercialize a new invention: the delay depends on the field of technology, the size of the firm, and, of course, the invention itself.110 Nevertheless, it is safe to say that commercializing an invention can take a while. The U.S. patent system encourages patents to be filed early in the product development cycle by setting low patentability requirements and by granting patent rights to the first to file.111 Indeed, examples abound of famous inventions that were not commercialized for decades, including television (35-year delay between patentable invention and product), radio (15 years), and penicillin (16 years).112 I’ll put to one side the worry—which has been explored by others113—that our 20-year patent term might not provide much incentive for inventions with these lag times, and I will assume that the patent system is providing the inventor a subsidy that would induce the research. My focus, rather, is on the costs of the delay itself. It is important to note that these delays are inherent in the patent system: until the inventor puts her invention into practice and sells her products, we have no way of knowing how big the subsidy should be. Delay is the price we pay for precision.

Of course, there are other ways to profit from patents, which could potentially make delay a nonissue. The main one is licensing. A patent license is a contract whereby the patent holder agrees to refrain from suing the licensee for infringement. Most licenses are granted in exchange for royalties, plus, oftentimes, a lump-sum payment.114 Inventors can also assign their patent rights, which grants all of the patentee’s rights to the assignee. These contractual relationships are often undertaken when the inventor lacks sufficient complementary assets—such as manufacturing, marketing, and distribution networks—to commercialize the invention.115

Royalty payments are subject to the same delay problems as direct commercialization. Selling one’s patent rights outright with an assignment might seem to circumvent the delay problem, but the inventor will typically be forced to take a discount if the invention is not likely to yield a profit for quite some time. Indeed, licensing regimes generally are characterized by a less-than-full subsidy for the inventor, who has to share the profits with the licensee or assignee with superior commercializing capabilities.116 Given a choice, firms opt for commercialization over licensing.117 Since licensing is generally a second-best approach to earning the patent subsidy, I will not consider it any further.

Timing for the tax system is quite a bit simpler. Since taxes are collected annually, a researcher should not have to wait much more than a year to earn her research tax credit. The tax system can distribute its subsidy so quickly because it is directed at expenditures. When claiming the tax credit, a researcher need not wait to see if her research is marketable. A small wrinkle is that, under the current tax system, the research tax credit is nonrefundable. That means that it is only useful to taxpayers who actually have a tax bill (which the credit reduces). For taxpayers who do not owe taxes, their research credit will be, in effect, delayed.118 Unused credits can be carried forward for up to twenty years.119

Thus far, I have argued that patents, as a general matter, subject the researcher to much longer delays than does the tax system. However, policymakers could delve deeper and ask: are there particular industries that are especially prone to long delays between expenditure and subsidy under the patent system? I would suggest focusing on industries where the commercialization process takes the longest. The research phase is variable both in how long it takes and when expenditures are required, even within industries. The patent prosecution phase is fairly consistent across industries. But the time it takes to commercialize inventions can be correlated within an industry. To illustrate, consider the science of materials. Thomas Eagar has lamented that commercializing a new material typically takes about two decades.120 This is so because it takes some time for manufacturers to understand the benefits of a new material and to effectively integrate it into their products.121 And many products are governed by manufacturing guidelines that make adopting a new material difficult.122 These and other factors make commercializing a new material a lengthy process. Industries with long commercialization delays would be good candidates for special tax treatment.

2. Identifying and Curing High Delay Costs

Delays are inherent in the patent system and are largely avoided in tax.123 But, setting aside the length of delay, when will delay be costly? Inventors sustain the largest implicit costs of delay when their research costs comprise a large share of their total assets. I hope this point is intuitive: if a startup firm has access to $1,000,000 of capital, then tying up $800,000 in research for a decade will be catastrophic. The impact of such a delay would be to halt the development of the business itself. Additionally, a company with limited assets risks bankruptcy in the near term by sinking a large chunk of its assets in research. Even if the research is highly promising and—in the sense described in Section I.A—optimal, an inventor might logically shy away from the research if it exposes her to a high risk of insolvency.124 These two implicit costs—stymied business development and bankruptcy risk—are most substantial when the research costs are on par with the total assets of the inventor. As such, delay will be most costly for lone inventors, small businesses, and startups.

The credit market can ameliorate the problem of high implicit costs of delay. If a startup has in mind a line of research that will likely lead to an extremely profitable invention, a creditor should be willing to finance that project. Of course, money is not free, and creditors will charge the researcher interest on the loan. But the capital-poor inventor should be willing to make modest interest payments, because her capital can be put toward highly productive activities like growing the business and maintaining a liquidity cushion to avoid bankruptcy. As such, access to credit should mitigate the cost of delay by providing the business with cash upfront in exchange for a small fee. However, if the credit market is not functioning “properly,” it might charge high interest rates even for safe bets, or it might not provide any additional financing for the research.

There is reason to think that the credit market for financing research is prone to just such failure. Creditors often cannot get perfect information about the commercial prospects of research, which deters them from lending money to the most deserving credit applicants. This information deficit exists for at least two reasons. First, it is difficult to accurately communicate a research plan; often, only the researcher himself truly understands the science and the prospects for success.125 Second, inventors have an incentive to keep their ideas private until after they get paid, and they may resist full disclosure to a creditor for fear of being scooped.126 Innovation scholars have understood information asymmetries for decades, but they have typically marshaled this point against the federal government as a direct funder of research in order to justify the patent system.127 But private-sector creditors are prone to similar mistakes. High-tech startups, for instance, have a difficult time acquiring debt financing.128 And outsiders are notoriously bad at pricing firms with predominantly intangible assets or high R&D expenditures.129 Finance scholars have attributed this to information asymmetries: “[M]anagement . . . will often have far better information about the future profitability of undeveloped products and untapped market niches.”130 Thus, we should not rely on the credit markets to ameliorate the costs of delay inherent in the patent system.

This problem is especially severe for lone inventors, small businesses, and startups, which, as I discussed earlier, are disadvantaged most by the costs of delay. These entities are likely to have difficulty securing credit, and thus are least able to cure their high delay costs. Robert Carpenter and Bruce Petersen conducted a survey of 2,400 high-tech firms that went public between 1981 and 1998. They found that after an IPO, small companies tended to have less debt—as a percentage of assets—than large companies.131 Even more importantly, small companies relied almost entirely on secured debt—debt that is backed by collateral, like buildings.132 In contrast, large companies relied mostly on unsecured debt.133 But secured debt does not ameliorate the delay costs of patent, since such debt does not depend on profitable ideas but rather on owning mortgageable property. Equity is also of little help: selling a portion of one’s future profits diminishes the incentive to capitalize on the patent.134 These data paint a bleak picture for small firms relying on patents: they face high implicit costs from sinking money into research and they are unable to sustain themselves with credit.

The previous discussion might be clarified by a quick illustration. Imagine a small business with an idea for a new photon torpedo. The business could pay for the research itself, but it would have to reduce its production of ray guns, which it could only do for a short period before going out of business. Instead, it goes to the bank for a loan. The bank is clueless about photon torpedoes, so it insists that the company mortgage its warehouse. But the company protests: mortgaging the warehouse was the backup plan in case the market weakened and bankruptcy threatened. If patent is the only option, the company abandons the research: it can’t afford the capital in the near term even if it thinks it could make money once it has commercialized the photon torpedo. But what about applying for a tax credit?

Policymakers could use the tax system to selectively bolster the domains of research where the patent system falters because of delay costs. For instance, tax credits could be targeted at the small businesses and lone inventors most likely to find the delay of the patent system unpalatable. In the previous example, the company might have researched the photon torpedoes if it could have been reimbursed with tax credits quickly. In order to target the credit at companies who truly need it, policymakers could increase the percentage of research expenditures reimbursed for companies with no more than a certain number of employees or amount of gross income. To minimize the distortionary effects of taxation, this small business R&D bump could be capped at a particular reimbursement amount to ensure that only the company’s top-priority research projects would be funded at this favorable rate. But the tax system is extremely flexible, and we could perhaps be even more creative. For example, if we were primarily concerned with startup companies’ access to capital, we might consider a very large credit for the first three years of the startup’s existence, which the startup would have to pay off through later rate hikes. If the problem is that startups lack access to credit, why not provide them with precisely that?

This could also be an opportunity to deploy a hybrid patent-tax approach. As we have seen, one of the longest delays in the patent system is that associated with commercialization. This delay cost could be alleviated with the tax system. The IRS already treats a patent as conclusive evidence that a line of research is technological in nature.135 This eases the burden on the inventor claiming the tax credit, but it does little to alleviate the costs of delay. Instead, we could provide a larger tax credit to inventors receiving a patent. This credit could apply retroactively to research that led to the discovery. The goal of this credit would be to target those inventors most likely to be experiencing delay costs in the near term. To even better effectuate this goal, we could impose a “commercialization” requirement: receiving the additional tax benefit could be contingent on producing evidence of a good faith effort to commercialize the product. Such a credit would be most beneficial to small entities, and could be so directed as described in the previous paragraph.

More favorable tax treatment could also be accorded to entities engaged in research in fields with long commercialization periods. Of course, this sort of “winner picking” is a dangerous game: the tax and patent systems are agnostic about subject matter precisely because we think the government is bad at choosing which research is worthy of help. That said, the tax system is littered with subsidies for favored types of research.136 In contrast to such existing subsidies—which are arguably not based on economic logic but on policy preferences—choosing to give favorable treatment to, for example, materials science research would be based on an identifiable market failure.

C. Rewarding Failure

The previous Section explored when the tax and patent systems distribute their subsidies. But there are also salient differences in what sorts of research these regimes subsidize. As a general rule, the tax subsidy is broader than the patent subsidy. If we can identify situations where the scope of the patent subsidy is inefficiently narrow, the tax system may be a good candidate to fill that gap. In this Section, I argue that one such area where tax could be valuable is in correcting patent’s inability to subsidize “valuable failure.”

I have already explained the difference between the patent and tax subsidy regimes.137 As relevant for our purposes here, patents are only awarded for new inventions, and the patent subsidy is only available through commercialization. Tax has no such requirement. The success or failure of a course of research does not affect the research’s qualification for the tax credit.

This difference will affect the decision to research. All else equal, the patent system should bias researchers to undertake projects with higher likelihoods of success and commercial applicability. Indeed, this is an intended effect of patent, as the traditional model of innovation assumes that research enhances social welfare by producing socially useful innovations.138 On the other hand, commentators have criticized the tax system’s lack of selectivity for success as failing to properly align research incentives with social welfare.139 They have recommend moving to a prize-like system where the credit is only available for successful discoveries140 or for projects approved by the government.141 I don’t disagree with these critiques, but I also think they paint an incomplete picture.

An oft-overlooked issue is the social welfare benefit of failed research. Sean Seymore’s recent article on the topic summarizes the concept nicely: “Failure is the basis of much scientific progress because it plays a key role in building knowledge.”142 A failed experiment always produces some data, if only that a particular technique is ineffective. But failure can be even more valuable as a way of exploring uncharted territory and constructing a knowledge base. Consider a few examples where researchers have found their own failures to be valuable.143 In her book on innovation, Dorothy Leonard-Barton recounts an incident concerning the development of a new metal alloy at Johnson & Johnson.144 To encourage experimentation, the vice president of operations required his chief metallurgist to discard two out of every three test batches of metal.145 The metallurgist went on to discover the alloy within a year, presumably because he was free to experiment with more risky mixtures. Failures are often literally stockpiled: pharmaceutical companies typically keep “chemical libraries” of the chemical compounds they synthesize, which can be screened for possible future treatments.146

In innovation environments where failures are valuable, and where these failures are communicated beyond the researcher herself, the patent system will systematically fail to subsidize some research that is socially beneficial. Patent law only operates on successful innovations. Even if patent law is maximally effective—in that the social value of the patented inventions is wholly appropriable by the inventor—it will fail to calibrate research decisions to the value generated by failed experiments. Any regime that rewards researchers solely based on their successful discoveries will be subject to this critique. The research tax credit is not such a regime. If we could know the expected social value of research failure, we could increase the credit to correct for this inefficiency. Of course, this would be a difficult value to ascertain. But the research tax credit, unlike the patent regime, at least provides a lever that is capable of capturing value from failed experiments, however roughly. The concern with implementing a credit of this sort—as with all tax credits—is that the subsidy would be too large and would encourage research with total costs higher than total expected social value. Thus, we should try to tailor the credit narrowly to compensate for situations where the patent system has failed most egregiously. This will occur when failure is the most socially valuable.

One area where failure will often be quite valuable is in emerging industries. The canonical illustration is perhaps the invention of the incandescent light bulb, which required Thomas Edison and his associates to conduct over one thousand tests before finding a material that could serve as the bulb’s filament.147 More relevant for our purposes is that inventors for decades before Edison had tried to make a commercially viable incandescent light bulb but failed, which produced insights—such as the necessity of a vacuum tube enclosure—that Edison’s team would build upon.148 The lesson of this anecdote has found support in systematic research. James Utterback describes three phases of an industry’s innovative progress: fluid, transitional, and specific.149 The fluid phase is characterized by significant “target” and “technical” uncertainty. According to Utterback, the hallmark of target uncertainty is “the fact that most early innovations do not enjoy an established market,” while technical uncertainty is caused by “the diffused focus of research and development.”150 During the fluid phase, firms “have no clear idea where to place their R&D bets” and they will often “concentrate on product technologies that ultimately will be ignored by the marketplace.”151 In other words, quite a lot of the early research in an emerging industry fails. A related line of scholarship concerns the pursuit of radical versus incremental innovation; unsurprisingly, radical innovation is more characterized by experimentation and failure.152 As an industry matures, the preferences of consumers become known, standards are established, and the knowledge base grows. This transition is associated with research becoming more focused and innovations more incremental.153

The above discussion gives rise to the following recommendation: emerging industries would be good candidates for a boosted research tax credit. While this proposition may be uncontroversial, I believe the logic is novel: the patent system does not sufficiently compensate this research because such research often produces valuable failures. These failures are “valuable” inasmuch as they map out uncharted territories and produce intermediate discoveries that are not themselves commercially viable. We could use tax credits to selectively boost these fields while they are in the fluid stage.

A reasonable objection to this proposal is that most failures are not socially valuable because they are not publicized. To the extent that a researcher’s failures only help herself, they are mere research costs, which should be properly calibrated by the patent system.154 However, there are several reasons to think that some failures are disseminated and thus are valuable not just to the researcher but to society at large.

The classic failed experiment in basic research is one that produces no effect and thus does not give rise to any patentable invention. While it is certainly true that academia disfavors failed experiments, especially in top-tier journals like Nature and Science, many run-of-the-mill journals accept well-conducted studies yielding negative results.155 Several journals are specifically dedicated to publishing such experiments.156 And, in at least some academic disciplines, it is common to share data of all sorts amongst one’s peers.157

Failed research initiatives may tend to remain more secretive in commercial settings, where there is more pressure to protect ideas and data. Nevertheless, there is reason to believe that some failure data leak out. First, a line of research may “fail” and still produce a marketable product. This is the case because—for our purposes—“failure” simply means that the line of research is not receiving much or any patent subsidy. A simple example is the video game industry in the 1970s and ’80s: dozens of innovative hardware systems competed for market share and influenced future design choices, but many of them were flops. Some of these failures were cautionary tales to future game designers;158 others provided important insights that paved the way for eventual success.159 These failed designs produced social value that went largely uncompensated by the patent system by dint of lack of sales but they were nonetheless shared publicly.

There is also reason to believe that data about failure leak out even absent any commercialization. In one classic study by Levin and colleagues, the researchers conducted a wide-ranging survey of high-level executives in various R&D-heavy industries.160 While not the focus of their study, many of their inquiries focused on the ways in which these industry insiders acquired knowledge about their competitors’ innovations. Unsurprisingly, patent disclosures and publications rated as moderately useful for most industries.161 Importantly for our purposes, however, there were a substantial number of industries where “conversations with employees of [the] innovating firm” and “hiring R&D employees from [the] innovating firm” were reported to be important ways of learning about competitors’ technologies.162 I would submit that these informal channels of communication must consist of information about failures, as I define them. An R&D executive can learn about a successful line of research by reading a patent or reverse engineering a product. Informal modes of communication are only valuable if they yield information about lines of research that don’t otherwise become public. The Levin study further found that there were clusters of industries where such “interpersonal channels of spillover were most important.”163 Examples abound of industries where competitors cooperate through both formal and informal networks to overcome common research problems.164 Tax incentives aimed at promoting socially valuable failure would be most useful in those industries where ideas are more freely exchanged.

Finally, we should consider measures that would be designed to promote the dissemination of valuable failure information. Professor Seymore has put forward one such idea, which he calls the “null patent.”165 This would provide inventors with centrally distributed incentives for disclosing their failed projects. Another possibility would be to tie disclosure to the receipt of the tax benefits themselves. This idea would need to overcome two significant limitations. First, such a system would be expensive for both the monitoring agency and the complying firm. Second, firms might be reluctant to accept tax funds if they had to forfeit the benefits of lead time and secrecy. We can envision some possible solutions, however. To lower the costs for the government, reporting could be monitored by random audit. To lower costs for firms, the reporting itself could consist of mere notice of the research. Curious competitors could be responsible for shouldering additional costs of transmitting data. To allay concerns about competitive advantage, the reporting could be delayed—after all, firms may not be sure what is a success or failure for quite some time. The system could give firms a several-year grace period before they would be required to report their failed experiments. These suggestions, of course, are mere rough sketches—much more work is required to explore how the research community can overcome the problem of underreporting valuable failures.

D. Institutional Competence

In this final Section, I will consider the relative strengths and weaknesses of the actual institutions that implement patent and tax. By “institutions,” I am referring collectively to the policymakers, agencies, adjudicators, and other individuals that are responsible for legislating and executing the tax and patent laws. I will argue that there are substantial differences between the institutions that oversee and implement patent and tax law. In particular, the institution governing tax law is more flexible and more capable of quickly responding to policy concerns than the institution that implements patent law, although these qualities make tax a more difficult regime for researchers to rely on. These differences recommend using tax in situations where policymakers may wish to adjust subsidy rules in response to changing circumstances, such as emerging industries.

1. Comparing Institutional Competences of Tax and Patent

The patent laws are, of course, passed by Congress. Congress doesn’t tinker with them very often,166 and when it does, as with the recent America Invents Act,167 the changes are typically procedural.168 Congress’s occasional tweaks of substantive patent law are usually unsuccessful. An illustrative example is the special protection afforded to semiconductor chips.169 This law provides manufacturers of semiconductor chips with the right to prevent others from producing chips with identical layouts.170 But the evolution of the semiconductor industry made this right irrelevant: small-time copyists cannot afford the expensive equipment required to manufacture modern chips.171 Thus, practically no litigation has been brought to enforce the statutory right.172 This illustrates a fundamental problem with congressional control of innovation policy: Congress is typically either unwilling or incapable of modifying the details of patent law in response to policy concerns.173

In most areas of law, Congress would delegate these complicated and controversial implementation details to an executive agency. The main executive agency responsible for implementing patent law is the PTO. Clarisa Long has described recent moves by the PTO to enhance its power. These include an aggressive campaign for more deference,174 a reorganization of the PTO that gave the agency more control over budget allocations,175 and a push by the PTO to get greater rulemaking authority.176 Notwithstanding these power grabs, the PTO is a comparatively weak agency. Critically, the Federal Circuit has held that the PTO does not have substantive rulemaking authority.177 A consequence of this holding is that courts do not defer to the PTO on substantive interpretations of the patent statutes.178 Without the power to make rules or to make substantive interpretations of the patent laws, it is not clear that the PTO is in a position to effect any significant changes to innovation policy.

With Congress uninterested and the PTO powerless, the task of patent policymaking has fallen to the courts, particularly the Federal Circuit. The Federal Circuit is a twelve-seat court with subject-matter jurisdiction over all appeals related to patents.179 Largely unchecked by the Supreme Court,180 the Federal Circuit is typically the last and loudest voice on all matters patent. Indeed, Ryan Vacca argues that the Federal Circuit’s en banc hearings are basically equivalent to agency rulemaking proceedings.181 But the Federal Circuit is a limited rulemaker for a number of reasons. First, Federal Circuit policymaking takes a long time. As we have seen, acquiring a patent takes years.182 Add to that delay the time it takes to bring a lawsuit, to litigate the case through trial and appeal, and for the Federal Circuit to issue a decision. To take just one example, in Marine Polymer Technologies, Inc. v. HemCon, Inc., an en banc decision issued in March 2012, the Federal Circuit affirmed a finding of patent infringement.183 The patent application was filed on July 11, 2003,184 and the litigation began in March 2006.185 Any policy coming out of the Federal Circuit will come slowly.186

Even when the Federal Circuit makes decisions, there is no guarantee its decisions will further laudable innovation policy. Federal Circuit judges do not necessarily have the know-how or the raw data to make informed, innovation-optimizing decisions. Senior Judge Plager has expressed frustration with the court’s inability to discern whether a particular law is sound policy: “How are the judges to make this assessment? Read newspaper and law review articles? Hold public hearings? . . . Shall the [Federal Circuit’s] rules now include a requirement that the appellant specify in what manner Congress got its policy wrong . . . ?”187 Another problem is that many judges on the Federal Circuit may be simply unwilling to set policy. Judge Plager, for example, objects strongly to the notion that the Federal Circuit should “see to it that the consequences of the policies and decisions of [Congress and the Supreme Court] properly reflect current needs and market conditions.”188 Indeed, most appellate judges may see their job as merely “[a]pplying the law”189 to “decide cases.”190

Despite—or perhaps because of—the Federal Circuit’s limitations as a policymaker, that court has frequently clashed with the executive branch over patent policy. For example, until recently the Federal Circuit had been stymying the executive branch’s efforts to tighten the patentability of isolated gene sequences. The DOJ opposes patentability of these sequences.191 While the DOJ has not explained its policy motivations, the ACLU—representing the party opposed to patentability—has.192 The ACLU argued that patents on isolated DNA would frustrate future research.193 Various amici focused almost exclusively on this point, warning of a “patent thicket that can inhibit future innovation.”194 But the Federal Circuit roundly rejected the DOJ’s position.195 The Supreme Court eventually stepped in, siding with the government and disallowing the patent on the isolated DNA.196 But even the Court did not explicitly consider the policy implications of patenting isolated DNA.197

The contours of tax policymaking are markedly different. Congress amends the research tax credit practically every year.198 These amendments are often substantive: examples range from changing the credit formula to correct unintentional disincentives199 to adding perks for preferred researchers200 and research areas.201

Courts play a more minor role for tax than for patent. To be sure, many of the critiques regarding the capacity and willingness of courts to make good patent policy apply with equal force to tax. Nevertheless, we need not dwell long on the role of the judiciary, because it occupies a much weaker position vis-à-vis the other branches. The Court has recently held that the Treasury Department is entitled to Chevron deference with respect to certain interpretive regulations, which diminishes the responsibility of courts while strengthening the agency.202 Additionally, standing doctrine usually denies third parties the opportunity to challenge tax assessments.203 As a consequence, courts will rarely have any opportunity to review decisions by the Treasury Department to let a taxpayer take a beneficial deduction or credit. If Treasury refuses to challenge an inventor making a bold interpretation in claiming the research tax credit, that interpretation is de facto law.

For these reasons, the Treasury Department exerts significant control over tax policy, especially in the administration of tax credits. As such, it is useful to contrast Treasury and the Federal Circuit as policymakers.204 As I discussed earlier, the three main deficits of the Federal Circuit are that it can only make ex post decisions, it lacks expertise, and it does not prioritize making sound economic policy. The Treasury Department differs in all three respects.

Perhaps the most important difference between the PTO and the Treasury Department is that Treasury can issue ex ante guidance. This includes private letter rulings, technical advice, revenue rulings, and Treasury regulations.205 Some of these are largely informative; private letter rulings, for example, apply the law to one taxpayer’s facts.206 Others are more legislative in character. Treasury regulations, which the agency typically puts through the notice-and-comment process,207 can be quite substantive. For our purposes, two types of substantive regulations are particularly important. First, the Treasury Department can declare that it will not challenge claimed tax credits that meet some lowered threshold. For example, as I described earlier, Treasury has recognized a patent safe harbor, whereby obtaining a patent is conclusive evidence of several of the requirements for claiming the credit.208 Second, Congress can allow Treasury to propound rules of conduct. For example, Congress explicitly invited Treasury’s help regarding internal-use software, which does not qualify for the research tax credit “[e]xcept to the extent provided in regulations.”209 Treasury issued regulations laying out a three-part test for qualifying internal-use software,210 which the agency has subsequently clarified in the face of public criticism.211 These forms of ex ante guidance are especially suitable for rapidly changing technological landscapes, a point I will return to in the next Subsection.

The Treasury Department also differs from the Federal Circuit in that it has the expertise to set policy. An important tool at Treasury’s disposal is the ability to solicit public feedback via notice-and-comment rulemaking. And the Treasury Department—which houses departments including the Office of Tax Analysis and the Office of Economic Policy—is well situated to evaluate the economic effects of innovation policy. Of course, we should not overestimate Treasury’s expertise. Tax lawyer Michael Rashkin has criticized Treasury’s capacity to administer the credit.212 He argues that the National Science Foundation would be a better agency to allocate the subsidy.213 I don’t disagree with Rashkin—the Treasury Department may lack the technical expertise that would be necessary to best implement the tax credit. However, compared to the Federal Circuit, the Treasury Department is the clearly superior policymaker. Treasury can hire expert staff, consult other agencies, and solicit public comments. None of my policy recommendations actually turn on Treasury itself having the final word; rather, they all turn on choosing the institution of tax—however implemented—over that of patent.

Finally, the Treasury Department, unlike the Federal Circuit, is a willing policymaker, especially when asked. I don’t think this point needs much elaboration. As discussed above, Treasury is quite capable of passing regulations to implement statutes. In passing those regulations, Treasury explicitly considers policy implications. To take just one example, Treasury decided to extend the credit to internal-use software that is developed in conjunction with hardware once it realized how prevalent such hardware-software combinations were.214

In sum, Treasury is an active, knowledgeable participant in setting tax policy, and it is able to issue ex ante substantive rules to guide conduct.

2. Policy Implications